TriNet Group Inc (TNET) Reports Modest Revenue Growth and Significant EPS Increase in Q4 and FY 2023

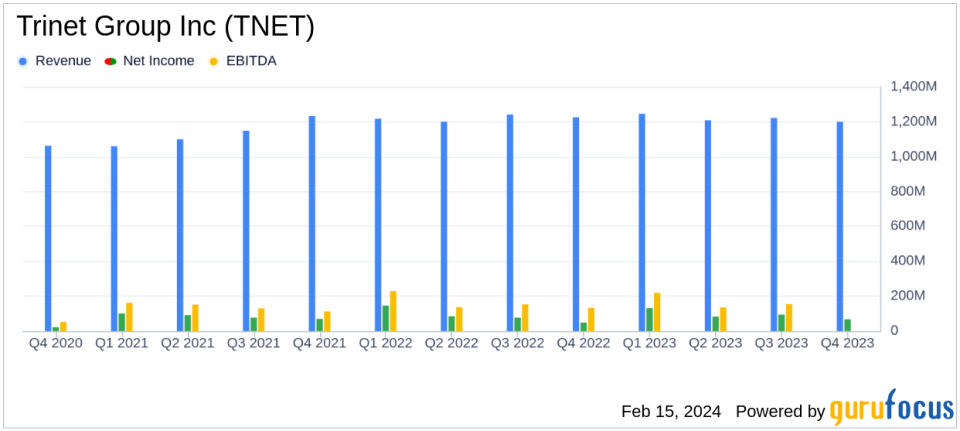

Total Revenues: Increased by 2% to $1.2 billion in Q4 and by 1% to $4.9 billion for FY 2023.

Earnings per Share (EPS): Grew by 68% to $1.31 in Q4 and by 17% to $6.56 for FY 2023.

Adjusted EBITDA Margin: Improved to 11.2% in Q4 and remained stable at 14.2% for FY 2023.

Dividend: Announced inaugural quarterly dividend of $0.25 per share.

Leadership Change: CEO Burton M. Goldfield to retire, with Mike Simonds set to lead.

On February 15, 2024, Trinet Group Inc (NYSE:TNET), a leading provider of comprehensive human capital management solutions for small and medium-size businesses, released its 8-K filing, announcing its financial results for the fourth quarter and fiscal year ended December 31, 2023. The company reported a modest increase in total revenues and a significant growth in earnings per share for both the quarter and the fiscal year.

Company Overview

TriNet provides outsourced payroll and human capital management solutions through a professional employer organization model. The company acts as the employer of record for regulatory purposes for its clients' employees, offering access to competitive employee benefits, compliance support, and HR functions such as payroll and tax administration. Following acquisitions in 2022, TriNet also offers self-service HCM software and R&D tax credit services.

Financial Performance and Challenges

For the fourth quarter, Trinet Group Inc (NYSE:TNET) reported a 2% increase in total revenues, reaching $1.2 billion, while professional service revenues remained flat at $189 million. The company's net income for the quarter was $67 million, translating to $1.31 per diluted share, a notable increase from $49 million, or $0.78 per diluted share, in the same period last year. Adjusted Net Income also saw an uptick to $82 million, or $1.60 per diluted share, compared to $71 million, or $1.11 per diluted share, in the prior year's quarter.

For the fiscal year, total revenues edged up by 1% to $4.9 billion, with professional service revenues approximately flat at $756 million. The annual net income rose to $375 million, or $6.56 per diluted share, from $355 million, or $5.61 per diluted share, in 2022. Adjusted Net Income for the year was slightly down at $446 million, or $7.81 per diluted share, compared to $448 million, or $7.07 per diluted share, in the previous year.

Despite these gains, the company faced challenges, including a 3% decrease in Average Worksite Employees (WSEs) for the quarter and a 5% decrease for the year. Additionally, HRIS Cloud Services Revenues decreased by 14% to $12 million for the quarter, with Average HRIS Users also down by 14%.

Financial Achievements and Importance

The improved Adjusted EBITDA Margin, which stood at 11.2% for the quarter and 14.2% for the year, reflects Trinet Group Inc (NYSE:TNET)'s ability to manage its operations efficiently, a critical aspect for companies in the Business Services industry. The initiation of a quarterly dividend at $0.25 per share demonstrates confidence in the company's cash flow generation and commitment to returning value to shareholders.

Key Financial Metrics

Important metrics from the financial statements include the Adjusted EBITDA of $140 million for the quarter and $697 million for the year, indicating the company's operational profitability. The balance sheet shows a solid financial position, while the cash flow statement highlights the company's ability to generate cash from operations, which supports the newly announced dividend.

"Throughout 2023 in what proved to be a challenging economic environment, TriNet focused its execution on the areas within our control," said Burton M. Goldfield, TriNets President and CEO. "We benefited from strong customer retention as we kept our customers at the center of everything we do. Finally, we launched our inaugural dividend completing an extraordinary year of capital allocation."

Analysis of Company's Performance

The company's performance in 2023, marked by revenue growth and significant EPS increases, suggests resilience in its business model despite economic headwinds. The leadership transition, with the retirement of CEO Burton M. Goldfield and the appointment of Mike Simonds, marks a new chapter for the company, potentially bringing fresh perspectives and strategies for continued growth.

Trinet Group Inc (NYSE:TNET) also provided guidance for the first quarter and full-year 2024, projecting total revenue growth between (1)% and 4% for the full year. The company's focus on sales acceleration and customer retention, coupled with prudent expense management, positions it to navigate the challenges ahead and capitalize on market opportunities.

Value investors and potential GuruFocus.com members may find Trinet Group Inc (NYSE:TNET)'s steady performance, dividend initiation, and strategic focus areas appealing for long-term investment considerations.

Explore the complete 8-K earnings release (here) from Trinet Group Inc for further details.

This article first appeared on GuruFocus.