Trinity Capital Inc. (TRIN) Reports Record Net Investment Income for Q4 and Full Year 2023

Net Investment Income (NII): Record quarterly NII of $25.1 million in Q4, up 15.9% year-over-year.

Annual Performance: Record annual NII of $89.9 million, a 25.6% increase from the previous year.

Return on Equity: ROAE reached 16.9% in Q4, showcasing efficient capital utilization.

Asset Growth: Net Asset Value (NAV) per share increased to $13.19, with total assets under management growing to $1.5 billion.

Dividend Growth: 12th consecutive quarterly dividend increase, with a Q4 distribution of $0.50 per share.

On March 6, 2024, Trinity Capital Inc (NASDAQ:TRIN) released its 8-K filing, announcing a record-breaking quarter and full year for 2023. The company, a closed-end, non-diversified management investment company, specializes in providing debt and equipment financings to growth-stage companies, including those with venture capital backing.

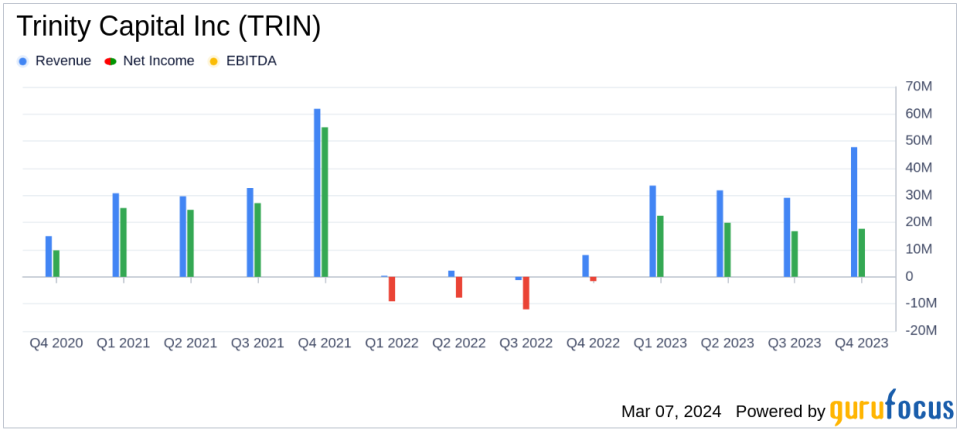

For Q4, Trinity Capital reported a significant 15.2% year-over-year increase in total investment income, reaching $47.8 million. The company's strategic focus on diversified financial solutions has led to a robust 25.0% increase in total investment income for the full year, amounting to $181.9 million. These impressive figures underscore the company's successful expansion and the high demand for its financial products within the growth-stage business sector.

Financial Highlights and Challenges

Trinity Capital's performance in the fourth quarter was marked by a record net investment income of $25.1 million, translating to $0.57 per basic share, a 15.9% increase compared to the same period last year. The company's Return on Average Equity (ROAE) was an impressive 16.9%, and the Return on Average Assets (ROAA) stood at 8.3%, reflecting the company's strong profitability and asset management efficiency.

Despite these achievements, the company faced challenges, including a slight increase in operating expenses, primarily due to higher compensation and amortization of restricted stock grants. Interest expenses also rose marginally due to an uptick in the weighted average interest rate on the credit facility. These challenges highlight the importance of maintaining cost control and managing interest rate exposure, which are critical for sustaining profitability.

Income Statement and Balance Sheet Summary

The year-end financials also revealed a net increase in net assets resulting from operations of $17.7 million, or $0.40 per basic share. Trinity Capital's balance sheet strengthened, with total net assets increasing to $611.2 million, up from $569.5 million at the end of the third quarter. The NAV per share saw a slight increase to $13.19 from $13.17 in the previous quarter.

Trinity's investment portfolio demonstrated significant growth, with a fair value of approximately $1.3 billion across 120 portfolio companies. The company's debt portfolio is well-structured, with 76.8% of loans backed by a first lien and 69.0% at floating rates, providing a hedge against interest rate fluctuations.

Portfolio and Investment Activity

The company's investment activity in Q4 was vigorous, with total gross investment commitments of $340.7 million and total gross investments funded reaching $267.4 million. Trinity's disciplined approach to investment, focusing on secured loans and equipment financings, has contributed to its strong performance. The company's investment risk rating system, with a weighted average score of 2.7, reflects a performing and robust portfolio.

Trinity's liquidity and capital resources remained solid, with approximately $141.8 million in available liquidity, including cash and available borrowing capacity under its credit facility. The company's leverage ratio increased to approximately 106%, primarily due to additional borrowings to fund portfolio growth.

In conclusion, Trinity Capital Inc (NASDAQ:TRIN) has delivered a record-setting performance for the fourth quarter and full year of 2023, with significant increases in net investment income and total assets under management. The company's strategic investments and prudent financial management have positioned it well for continued growth and shareholder value creation. As Trinity looks ahead to 2024, it remains committed to its rigorous underwriting standards and portfolio management practices, which are expected to drive further success.

For more detailed information on Trinity Capital Inc's financial results, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Trinity Capital Inc for further details.

This article first appeared on GuruFocus.