Is Trinity Place Holdings a Hidden Value Trap? A Comprehensive Analysis

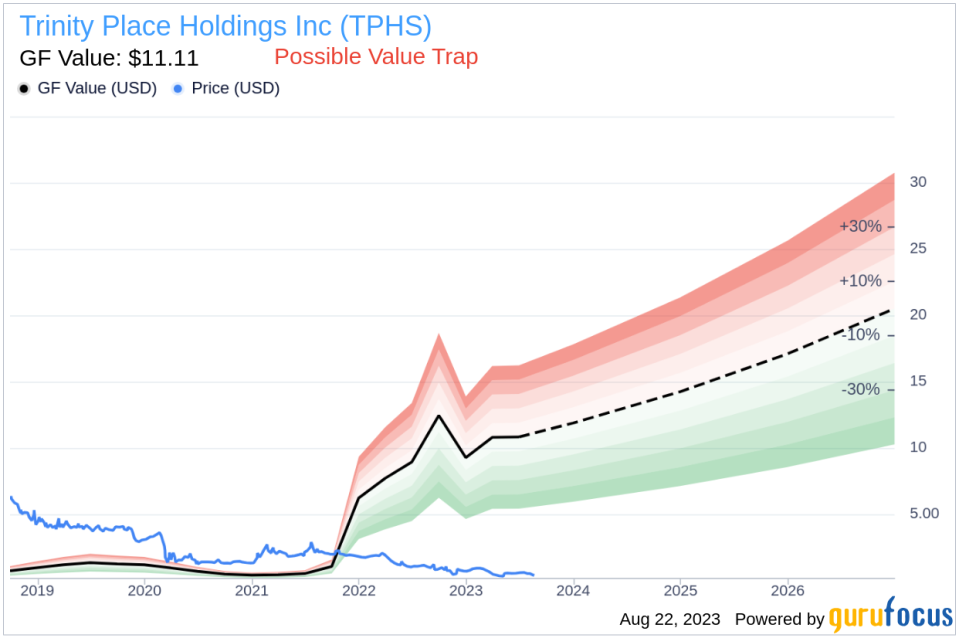

In the realm of value investing, the quest for undervalued stocks is perpetual. One such stock that has piqued interest is Trinity Place Holdings Inc (TPHS). The stock, currently priced at 0.45, recorded a day's gain of 26.51% and a 3-month decrease of 17.08%. According to its GF Value, the fair valuation of the stock is $11.11.

Understanding the GF Value

The GF Value is a unique valuation model that calculates the intrinsic value of a stock. This value is based on historical multiples, GuruFocus adjustment factor, and future business performance estimates. The GF Value Line on our summary page provides a snapshot of the stock's fair value. If the stock price significantly deviates from the GF Value Line, it could indicate overvaluation or undervaluation, impacting future returns.

However, a deeper analysis is required before making an investment decision. Despite Trinity Place Holdings' seemingly attractive valuation, certain risk factors cannot be overlooked. These risks are reflected in its low Altman Z-score of -0.49. These indicators suggest that Trinity Place Holdings, despite its apparent undervaluation, might be a potential value trap. This complexity underscores the importance of thorough due diligence in investment decision-making.

Deciphering the Altman Z-score

The Altman Z-score is a financial model that predicts the probability of a company entering bankruptcy within two years. It combines five different financial ratios, each weighted to create a final score. A score below 1.8 suggests a high likelihood of financial distress, while a score above 3 indicates a low risk.

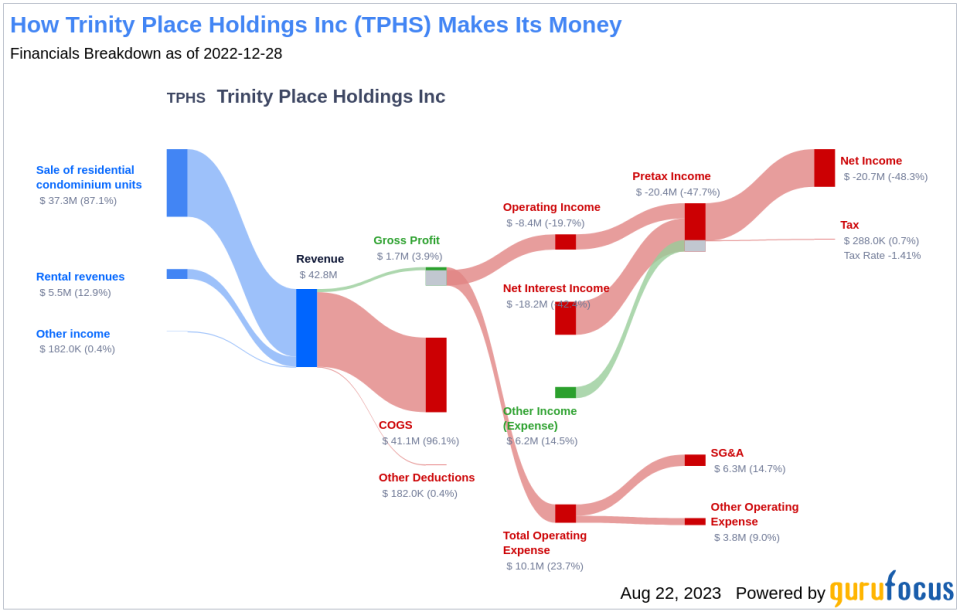

About Trinity Place Holdings Inc

Trinity Place Holdings Inc is a real estate holding, investment, and asset management company. It is primarily engaged in owning, investing in, managing, developing or redeveloping real estate assets and real estate-related securities. It also controls a range of intellectual property assets focused on the consumer sector.

Trinity Place Holdings's Low Altman Z-Score: A Breakdown of Key Drivers

A dissection of Trinity Place Holdings's Altman Z-score reveals potential financial distress. The Retained Earnings to Total Assets ratio, for instance, provides insights into a company's capability to reinvest its profits or manage debt. Evaluating Trinity Place Holdings's historical data, 2021: -0.06; 2022: -0.13; 2023: -0.26, we observe a declining trend in this ratio. This downward movement indicates Trinity Place Holdings's diminishing ability to reinvest in its business or effectively manage its debt, exerting a negative impact on its Z-Score.

Conclusion

In light of these findings, Trinity Place Holdings appears to be a potential value trap. Despite its seemingly attractive valuation, the company's low Altman Z-score and declining Retained Earnings to Total Assets ratio signal potential financial distress. This highlights the importance of comprehensive financial analysis in investment decision-making.

GuruFocus Premium members can find stocks with high Altman Z-Score using the following Screener: Walter Schloss Screen .

This article first appeared on GuruFocus.