Trinity (TRN) Q3 Earnings Miss Estimates, Revenues Up Y/Y

Trinity Industries, Inc. (TRN) third-quarter 2023 earnings per share (EPS) of 26 cents missed the Zacks Consensus Estimate of 35 cents and declined 23.5% year over year.

Total revenues of $821.3 million outpaced the Zacks Consensus Estimate of $652.4 million and grew 65.3% year over year. The top line was aided by a higher volume of external deliveries in the Rail Products Group.

Operating profit of $100.2 million grew 8.1% year over year. The uptick was backed by higher external deliveries in the Rail Products Group and improved lease rates in the Leasing Group, which was partially offset by lower lease portfolio sales volume and increased employee-related and other operating costs.

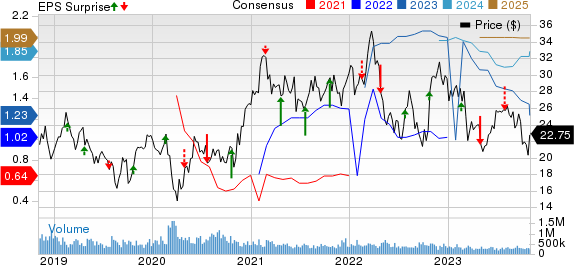

Trinity Industries, Inc. Price, Consensus and EPS Surprise

Trinity Industries, Inc. price-consensus-eps-surprise-chart | Trinity Industries, Inc. Quote

The Railcar Leasing and Management Services Group generated revenues of $222.6 million, up 14.2% year over year. Segmental revenues were boosted by higher utilization, improved lease rates and acquisition-related revenues. Segmental operating profit was $85.5 million, up 16.2%, owing to improved lease rates and higher utilization, partially offset by higher maintenance costs.

Revenues in the Rail Products Group totaled $682.2 million, up 14.2% year over year on the back of higher delivery volumes and a favorable mix of railcars sold. Segmental operating profit was $39.2 million compared with $26 million in the year-ago period. The uptick was due to higher volume of deliveries, partially offset by foreign currency fluctuations. The operating profit margin grew to 5.7% from 4.4% in the year-ago reported quarter.

Trinity exited the third quarter with cash and cash equivalents of $114 million compared with $91.7 million at the end of the prior quarter. Debt totaled $5,782.4 million as of Sep 30, 2023, compared with $5,832.6 million at the second-quarter end.

During the reported quarter, TRN generated $75.5 million of net cash from operating activities.

Trinity rewarded its shareholders with $21.4 million in the reported quarter.

For 2023, TRN expects EPS in the range of $1.20-$1.35 (prior view: $1.35-$1.45)

Trinity carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performances of Other Transportation Companies

J.B. Hunt Transport Services, Inc.’s JBHT third-quarter 2023 EPS of $1.80 missed the Zacks Consensus Estimate of $1.85 and declined 30% year over year.

JBHT’s total operating revenues of $3,163.8 million also lagged the Zacks Consensus Estimate of $3,224 million and fell 18% year over year. Total operating revenues, excluding fuel surcharges, decreased 15% year over year.

Delta Air Lines, Inc. (DAL) reported third-quarter 2023 EPS (excluding 31 cents from nonrecurring items) of $2.03, which comfortably beat the Zacks Consensus Estimate of $1.92 and improved 35% on a year-over-year basis.

DAL’s revenues of $15,488 million beat the Zacks Consensus Estimate of $15,290.4 million and increased 11% on a year-over-year basis, driven by higher air-travel demand.

Alaska Air Group, Inc. ALK reported third-quarter 2023 EPS of $1.83, which missed the Zacks Consensus Estimate of $1.88 and declined 28% year over year.

Operating revenues of $2,839 million missed the Zacks Consensus Estimate of $2,876.1 million. The top line jumped 0.4% year over year, with passenger revenues accounting for 92.2% of the top line and increasing 0.1% owing to continued recovery in air-travel demand.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

J.B. Hunt Transport Services, Inc. (JBHT) : Free Stock Analysis Report

Alaska Air Group, Inc. (ALK) : Free Stock Analysis Report

Trinity Industries, Inc. (TRN) : Free Stock Analysis Report