Trinity (TRN) Stock Down on Lower Q3 Railcar Deliveries

Shares of Trinity Industries, Inc. (TRN) declined 5.10% in after-market trading on Oct 3. The downside followed Trinity’s unfavorable update pertaining to third-quarter 2023 railcar deliveries.

For the third quarter of 2023, TRN delivered 4,325 new railcars. However, the company failed to meet its third-quarter expectations by 685 units owing to the closing of the U.S.-Mexico border by the U.S. Customs and Border Protection Agency (CBP). On top of this border crisis, state vehicle inspections have increased. This has led to truck traffic congestion, which is hampering TRN’s supply chain.

Notably, CBP suspended the U.S.-bound cross-border rail traffic in Eagle Pass, TX, on Sep 20, 2023. This is a vital border for Trinity, which it uses for railcar deliveries from its manufacturing facilities in Sabinas and Monclova, Mexico. Per CBP, the suspension was done to put a check on the recent influx of migrants at the border. Though rail traffic operations have restarted on Sep 23, other substantial congestion remains. Moreover, rail traffic challenges are yet to be solved.

This prolonged rail and truck congestion at the border will unfavorably weigh on Trinity’s deliveries and supply chain until resolved. Trinity is closely monitoring both truck and rail traffic, trying to figure out better alternatives for rail and truck transportation between Mexico and the United States.

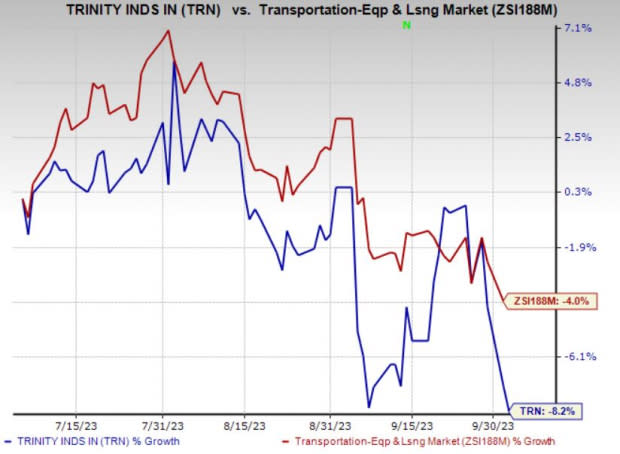

TRN will unveil the detailed impact of this traffic issue during its third-quarter 2023 results, which is scheduled to be released on Nov 2, 2023. Over the past three months, shares of TRN have declined 8.2% compared with the 4% loss of the industry it belongs to.

Image Source: Zacks Investment Research

Zacks Rank and Stocks to Consider

Currently, Trinity carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Zacks Transportation sector are GATX Corporation (GATX), Westinghouse Air Brake Technologies Corporation, operating as Wabtec Corporation (WAB) and SkyWest, Inc. (SKYW). Each of these companies presently carries a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

GATX has an expected earnings growth rate of 14.33% for the current year. GATX delivered a trailing four-quarter earnings surprise of 17.30%, on average.

The Zacks Consensus Estimate for GATX’s current-year earnings has improved 2.1% over the past 90 days. Shares of GATX have gained 6% year to date.

Wabtec has an expected earnings growth rate of 16.87% for the current year. WAB delivered a trailing four-quarter earnings surprise of 3.42%, on average.

The Zacks Consensus Estimate for WAB’s current-year earnings has improved 4.9% over the past 90 days. Shares of WAB have gained 5.9% year to date.

SkyWest's fleet-modernization efforts are commendable.A fall in operating expenses is a tailwind for SkyWest. In second-quarter 2023, the metric dipped 2.4% to $693.8 million due to a decline in operating costs. Low operating expenses boost bottom-line results. Shares of SKYW have surged 163.6% year to date.

SKYW delivered a trailing four-quarter earnings surprise of 31.51%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Trinity Industries, Inc. (TRN) : Free Stock Analysis Report

SkyWest, Inc. (SKYW) : Free Stock Analysis Report

Westinghouse Air Brake Technologies Corporation (WAB) : Free Stock Analysis Report

GATX Corporation (GATX) : Free Stock Analysis Report