A Trio of Capital-Intensive Stocks to Consider

- By Alberto Abaterusso

When screening the market for value opportunities among capital-intensive businesses, investors may want to look at stocks whose price-to-tangible-book-value ratios are more appealing than their industry medians.

The price-to-tangible-book-value ratio is preferred to the price-book ratio for these publicly traded companies, as the assessment of their businesses primarily derives from tangible assets.

China Yuchai International Ltd

The first stock that meets the criteria is China Yuchai International Ltd (NYSE:CYD), a Singapore-based manufacturer and assembler of diesel and natural gas engines for the markets in the People's Republic of China and internationally.

China Yuchai has a price-to-tangible-book-value ratio of 0.53, which is more compelling than the industry median of 2.10 and ranks higher than 91% of the 2,408 competitors that operate in the industrial products industry.

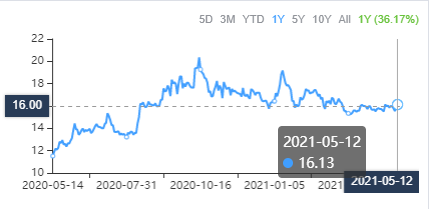

The share price was $16.13 as of May 12. The tangible book value per share was approximately $30.64 as of the June 2020 quarter.

The stock price has risen by 36.2% over the past year for a market capitalization of $659.04 million and a 52-week range of $11.03 to $20.49.

GuruFocus assigned a score of 5 out of 10 for the financial strength rating and 7 out of 10 for the profitability rating of the company.

On Wall Street, the stock has a median recommendation rating of buy and an average target price of approximately $22.50 per share.

Anhui Conch Cement Co Ltd

The second stock that investors may want to consider is Anhui Conch Cement Co Ltd (AHCHY), a Wuhu, China-based manufacturer of clinker and cement products in the People's Republic of China and internationally.

Anhui Conch Cement's price-to-tangible-book-value ratio of 1.34 appeals more than the industry median of 1.58, ranking higher than 165 companies out of a total of 979 competitors that operate in the building materials industry.

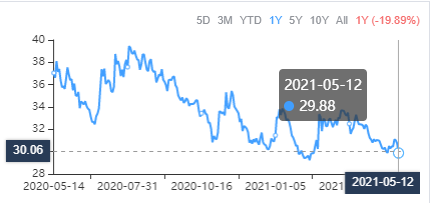

As of May 12, the stock price was $29.88, while the tangible book value per share was $22.22 as of the March 2021 quarter.

The stock price has fallen by nearly 20% over the past year for a market capitalization of $30.74 billion and a 52-week range of $29 to $40.04.

GuruFocus assigned a score of 8 out of 10 for the financial strength rating and 9 out of 10 for the profitability rating of the company.

On Wall Street, the stock has a median recommendation rating of overweight.

PetroChina Co Ltd

The third stock that meets the criteria is PetroChina Co Ltd (NYSE:PTR), a Beijing, China-based oil and gas corporation.

PetroChina's price-to-tangible-book-value ratio of 0.41 is more appealing than the industry median of 1.28 and ranks higher than 74% of 958 companies that operate in the oil and gas industry.

The stock price was trading at $40.75 as of May 12, while the tangible book value per share was $98.14 for the March 2021 quarter.

The stock price has risen by 20.5% over the past year, determining a market capitalization of $73.50 billion and a 52-week range of $27.675 to $41.60.

GuruFocus assigned a score of 5 out of 10 for the financial strength rating and 6 out of 10 for the profitability rating of the company.

On Wall Street, the stock has a median recommendation rating of overweight and an average target price of $53.23 per share.

Disclosure: I have no position in any security mentioned.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.