This Trio Is Growing Earnings Fast

- By Alberto Abaterusso

The S&P 500 saw its trailing 12-month earnings per share (EPS) grow by nearly 4% on average every year over the past five years. The index's share price ($3,446.83 as of Thursday) increased by about 71% over the past five years through Oct. 8.

Thus, investors may be interested in Taiwan Semiconductor Manufacturing Co Ltd (NYSE:TSM), Microsoft Corp (NASDAQ:MSFT) and Sirius XM Holdings Inc (NASDAQ:SIRI), as these holdings have grown their EPS at an average yearly rate of more than 4% over the years in question.

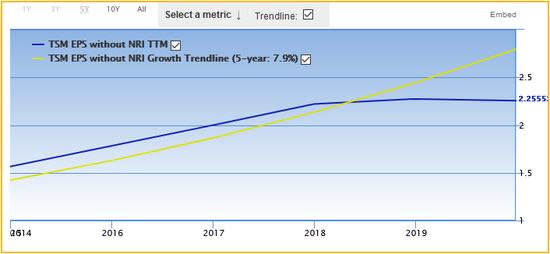

Taiwan Semiconductor Manufacturing Co Ltd

The Taiwanese global distributor of integrated circuits saw its trailing 12-month EPS without non-recurring items (NRI) increase by 7.9% on average every year over the past five full fiscal years.

The stock price soared 297.5% over the past five years to trade at $87.80 per share at close on Thursday for a market capitalization of $455.34 billion, a 52-week range of $42.70 to $88.86 and a price-earnings ratio of 25.83.

Among the top fund holders of the company, JPMORGAN CHASE & CO is the leader with 1.42% of shares outstanding. It is followed by MASSACHUSETTS FINANCIAL SERVICES CO /MA/ with 0.85% of shares outstanding and Sanders Capital, LLC with 0.79% of shares outstanding.

The stock holds a buy recommendation rating with an average target price of $69.22 per share on Wall Street.

Microsoft Corp

The Redmond, Washington-based developer, manufacturer, licensor and seller of computer software, personal computers and consumer electronics saw its trailing 12-month EPS without NRI increase by 27.2% on average every year over the past five full fiscal years.

The stock price skyrocketed over the past five years, increasing 348% up to $210.58 per share at close on Thursday for a market capitalization of $1.59 trillion, a 52-week range of $132.52 to $232.86 and a price-earnings ratio of 36.62.

VANGUARD GROUP INC leads the group of top fund holders, owning 8.35% of shares outstanding. It is followed by BlackRock Inc. with 6.90% and STATE STREET CORP with 4.16% of shares outstanding.

On Wall Street, the stock has a buy recommendation rating with an average target price of $233.68 per share.

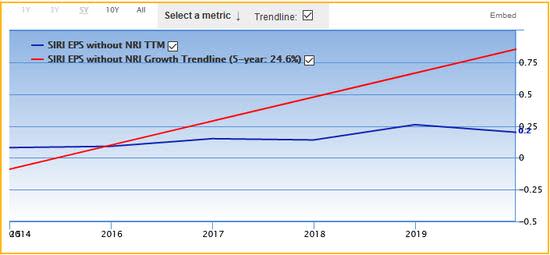

Sirius XM Holdings Inc

The New York-based provider of satellite radio services in the U.S. saw its trailing 12-month EPS without NRI increase by 24.6% on average every year over the past five full fiscal years.

The stock price has risen by more than 50% over the past five years to trade at $5.96 per share at close on Thursday for a market capitalization of $25.87 billion, a 52-week range of $4.11 to $7.40 and a price-earnings ratio of 27.09.

BlackRock Inc. dominates the group of top fund holders, owning 2.93% of shares outstanding. It is followed by VANGUARD GROUP INC with 1.54% and Warren Buffett with 1.15%.

On Wall Street, the stock holds an overweight recommendation rating with an average target price of $6.92 per share.

Disclosure: I have no positions in any securities mentioned in this article.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.