A Trio of Potential Opportunities for the Value Investor

Value investors may want to take a look at the following stocks, as they represent companies that meet the following characteristics:

They have a price-earnings ratio of less than 20.

They have a consistent history of earnings and sales generation, having grown both over the past five years with no net losses.

They have received positive recommendation ratings from sell-side analysts on Wall Street.

PPG Industries Inc

The first stock to have a look at is PPG Industries Inc (NYSE:PPG).

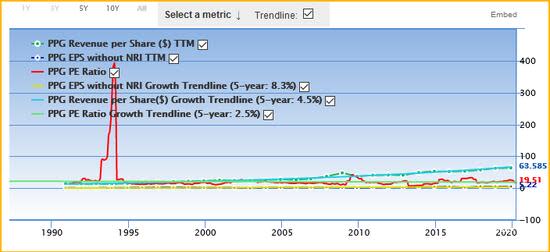

The Pittsburgh, Pennsylvania-based global distributor of specialty chemicals saw its trailing 12-month revenue per share increase by 4.5% and its earnings per share (EPS) without non-recurring items (NRI) grow by 8.3% on average every year over the past five years. The price-earnings ratio (19.51 as of Wednesday) has gained 2.5% over the period in question but is still below 20.

The stock price was trading at $95.99 per share at close on Wednesday for a market capitalization of $22.65 billion and a dividend yield of 2.13%.

GuruFocus assigned the company a moderate financial strength rating of 5 out of 10 and a high profitability rating of 8 out of 10.

As of May, the stock has four strong buy ratings, nine buy ratings and ten hold ratings on Wall Street. Sell-side analysts have issued an average target price of $105.50 per share.

Collectors Universe Inc

The second stock to have a look at is Collectors Universe Inc (NASDAQ:CLCT).

The Santa Ana, California-based provider of authentication services for coins and various collectibles saw its trailing 12-month revenue per share rise by 2.4% and its trailing 12-month EPS without NRI grow by 1.5% on average every year over the past five years. The price-earnings ratio (17.24 as of Wednesday) increased by 1.3% over the observed years but still stands below 20.

The stock price was trading at $20.86 per share at close on Wednesday for a market capitalization of $193.38 million and a dividend yield of 3.35%.

GuruFocus assigned a positive score of 6 out of 10 to the company's financial strength and a high score of 8 out of 10 to its profitability.

As of May, the stock has one hold rating on Wall Street.

EnerSys

The third stock to have a look at is EnerSys (NYSE:ENS).

The Reading, Pennsylvania-based manufacturer and distributor of industrial batteries and related equipment saw its trailing 12-month revenue per share grow by 5.4% per year and the EPS without NRI increase slightly by 0.9% per year over the past five years. The price-earnings ratio (16.76 as of Wednesday) rose by 2.5% over the observed years but is still less than 20.

The stock price was trading at $61.33 per share at close on Wednesday for a market capitalization of $2.59 billion and a dividend yield of 1.15%.

GuruFocus assigned the company a moderate rating of 5 out of 10 for its financial strength and a high rating of 9 out of 10 for its profitability.

As of May, the stock has two strong buys and two hold ratings from Wall Street. The average target price is $74.33 per share.

Disclosure: I have no positions in any security mentioned.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.