TripAdvisor Inc (TRIP) Posts Record Revenue in 2023, Despite Mixed Segment Performance

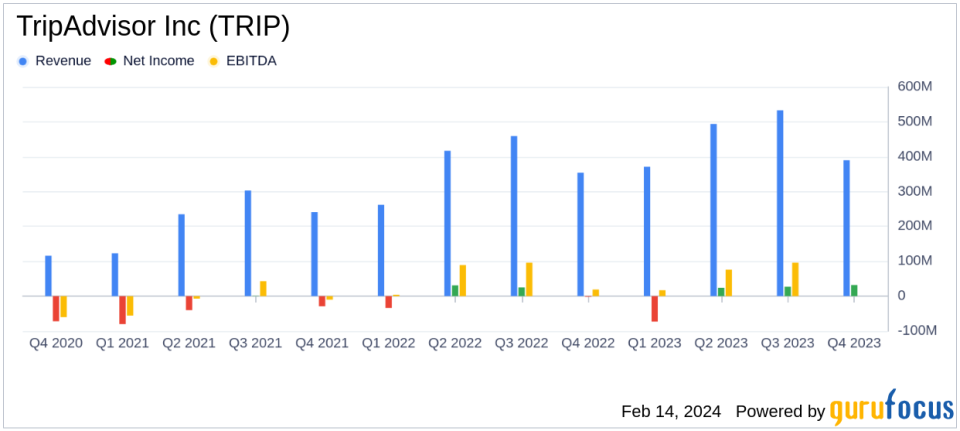

Revenue Growth: TripAdvisor Inc (NASDAQ:TRIP) reported a 20% year-over-year increase in annual revenue, reaching an all-time high of $1.788 billion.

Net Income: Full-year net income stood at $10 million, with diluted EPS of $0.08, marking a 50% decline from the previous year.

Adjusted EBITDA: The company achieved $334 million in adjusted EBITDA for the year, representing 19% of revenue.

Segment Performance: Viator led with a 49% revenue surge, while Brand Tripadvisor remained flat year-over-year.

Free Cash Flow: Free cash flow for the year was $172 million, a decrease of 50% compared to the prior year.

TripAdvisor Inc (NASDAQ:TRIP) released its 8-K filing on February 14, 2024, unveiling its financial results for the fourth quarter and full year ended December 31, 2023. The company, known for its travel metasearch platform with over 1 billion reviews and information on approximately 8 million accommodations, restaurants, experiences, airlines, and cruises, has reported a record revenue for the fiscal year 2023.

Financial Highlights and Challenges

The company's revenue for the fourth quarter was $390 million, a 10% increase from the same period in the previous year. Full-year revenue reached $1,788 million, a significant 20% growth. However, net income for the year was relatively modest at $10 million, translating to diluted earnings per share (EPS) of $0.08, which is a stark 50% decline from the previous year. The non-GAAP net income for the full year was more robust at $186 million, or $1.29 diluted EPS, indicating a 71% increase year-over-year.

Adjusted EBITDA for the fourth quarter was $84 million, or 22% of revenue, while the full-year adjusted EBITDA stood at $334 million, or 19% of revenue. Despite these strong figures, the company faced challenges, particularly in its Brand Tripadvisor segment, which remained flat year-over-year, and a significant 50% reduction in free cash flow compared to the previous year.

Segment Analysis and Strategic Focus

Viator, TripAdvisor's experiences brand, was a standout performer with a 49% increase in annual revenue, now representing more than 40% of the company's revenue. TheFork, TripAdvisor's dining brand, also saw a healthy 22% growth in revenue for the year. The company's strategic focus on diversifying its portfolio and transforming its core offerings has been instrumental in driving growth, despite the flat performance of the Brand Tripadvisor segment.

Cost performance was a mixed bag, with total costs and expenses for the year increasing by 19% to approximately $1.7 billion. Selling and marketing costs rose by 20% year-over-year, while technology and content costs increased by 23%. General and administrative costs saw an 11% increase for the year.

Liquidity and Share Repurchase Program

As of December 31, 2023, TripAdvisor had approximately $1.1 billion in cash and cash equivalents, marking a $46 million increase from the previous year. The company also actively engaged in a share repurchase program, buying back 6,049,253 shares at an average price of $16.51 per share for a total of $100 million.

Outlook and Management Commentary

CEO Matt Goldberg expressed satisfaction with the fiscal 2023 results, highlighting the revenue growth and diversification of the company's portfolio. CFO Mike Noonan emphasized the better-than-expected adjusted EBITDA due to favorable channel mix and disciplined marketing spend. Looking ahead to 2024, the company plans to continue prioritizing segment strategies focused on long-term growth and profitability.

For value investors and potential GuruFocus.com members, TripAdvisor's latest earnings report presents a company with strong revenue growth and strategic diversification, albeit with some challenges in net income and cash flow. The company's focus on experiences and dining segments, coupled with a disciplined approach to marketing and cost management, positions it as a potentially attractive investment in the travel and leisure industry.

For a detailed analysis of TripAdvisor Inc (NASDAQ:TRIP)'s financials, please refer to the full 8-K filing.

Investors and interested parties can look forward to the company's conference call on February 15, 2024, for further insights into the financial results and forward-looking information about TripAdvisor's business.

Explore the complete 8-K earnings release (here) from TripAdvisor Inc for further details.

This article first appeared on GuruFocus.