Triumph Group Inc (TGI) Posts Mixed Q3 Fiscal 2024 Results; Updates Full-Year Guidance

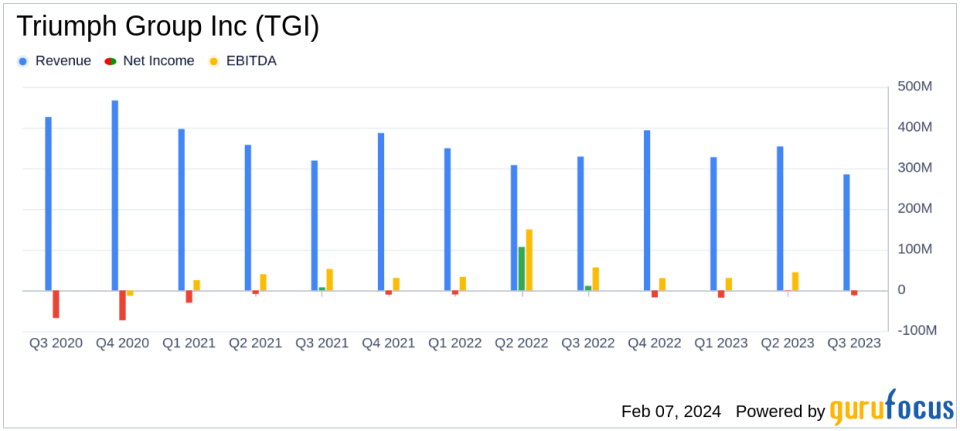

Net Sales: Reported $285.0 million, with a 13% organic sales growth.

Operating Income: $19.7 million, with an operating margin of 6.9%.

Net Loss: From continuing operations was ($11.9) million, or ($0.15) per share.

Adjusted EBITDAP: $27.7 million, with an Adjusted EBITDAP margin of 9.8%.

Free Cash Flow: Positive at $22.4 million.

Backlog: Increased 18% from the prior fiscal year end to $1.87 billion.

Updated Fiscal 2024 Guidance: Net sales expected to be between $1.17 billion to $1.20 billion.

On February 7, 2024, Triumph Group Inc (NYSE:TGI) released its third-quarter fiscal 2024 results, revealing a mix of growth and challenges. The company, known for its broad portfolio of aerostructures, aircraft components, and systems, reported net sales of $285.0 million, marking an organic sales growth of 13%. Despite this, TGI experienced a net loss from continuing operations of ($11.9) million, or ($0.15) per share. Triumph Group Inc operates under two segments: Systems and Support, and Interiors, serving a global customer base in commercial, business, and military markets. The full details of the earnings can be found in the company's 8-K filing.

Performance Highlights and Challenges

Triumph Group Inc's third-quarter performance was marked by a significant organic sales growth, particularly in the Commercial OEM sector, which saw a 27.5% increase due to higher production volumes on Boeing 737 and 787 programs. However, the company faced a net loss from continuing operations, which was attributed to industry-wide supply chain constraints impacting deliveries. Adjusted EBITDAP stood at $27.7 million, with a margin of 9.8%, reflecting the company's ability to maintain profitability in a challenging environment.

Financial Achievements and Industry Relevance

The positive free cash flow of $22.4 million is a testament to Triumph's operational efficiency and its focus on cash generation. The strong backlog, which has reached the highest level since March 2020, is particularly important for the Aerospace & Defense industry as it indicates potential future revenue and stability. This backlog growth is driven by a year-to-date book to bill rate of 1.34, lifting the backlog by 20% year over year.

Updated Fiscal 2024 Guidance

Triumph Group Inc has updated its fiscal 2024 guidance, now expecting net sales to range between $1.17 billion to $1.20 billion, reflecting 11 - 14% organic growth. Operating income is projected to be between $100.0 million to $110.0 million, with an operating margin of 9%. Adjusted EBITDAP is anticipated to be between $157.0 million to $167.0 million, with a margin of 13-14%. The company has reaffirmed its cash flow from operations to be between $65.0 million to $85.0 million and free cash flow between $40.0 million to $55.0 million, subject to the timing of the sale of Product Support.

"The announced sale of our Product Support business will be transformative for our balance sheet and is on track for closure this quarter which will meaningfully accelerate our deleveraging progress," said Dan Crowley, TRIUMPH's chairman, president, and chief executive officer. "Following the divestiture, we are right-sizing our cost structure to achieve our multi-year profit margin and cash flow targets. By strengthening our balance sheet and focusing on our OEM component, spares, and IP-based aftermarket business, TRIUMPH will further improve its capacity to win and profitably grow in the expanding markets we serve."

Triumph Group Inc's third-quarter fiscal 2024 results reflect a company navigating through industry challenges while positioning itself for future growth. The updated guidance and strong backlog suggest confidence in the company's strategic direction and market opportunities. Value investors and potential GuruFocus.com members interested in the Aerospace & Defense sector may find Triumph Group Inc's ongoing transformation and growth prospects worth further examination.

Explore the complete 8-K earnings release (here) from Triumph Group Inc for further details.

This article first appeared on GuruFocus.