Triumph Group (TGI) to Sell Product-Support Business for $725M

Triumph Group Inc. TGI announced that it has signed an agreement with AAR Corp. AIR to divest its Product Support business. The transaction, valued at $725 million, is expected to be closed in the first quarter of 2024, subject to regulatory approvals.

Rationale Behind the Sale

Triumph Group's decision to divest its interest in the Product Support business underscores its commitment to focus on its core original equipment manufacturer (OEM) and intellectual property-based aftermarket (AM) businesses. The sale proceeds from this divestment should further strengthen TGI’s balance sheet.

For fiscal 2023, OEM and AM contributed a total of 99% to Triumph’s relative profit. Triumph Group’s military segment OEM is driven by a strong U.S. defense budget, while the commercial segment benefits from the increasing orders for 737, A320, 787 and A350 programs. As far as aftermarket services are concerned, growing air passenger demand has been boosting air travel significantly over the past year, which, in turn, has been bolstering the aerospace aftermarket demand.

Therefore, to reap the benefits of these demand trends, Triumph Group seems to have divested its Product Support business to focus more on aerospace parts and aftermarket space.

Peer Moves

Defense companies often engage in acquisitions, mergers as well as divestments for improving economies of scale as consolidations tend to expand and strengthen the product portfolio, while divestments help focus on their core business structure and improve capital allocation. A few such companies have been discussed below.

L3Harris Technologies LHX: On Nov 27, 2023, L3Harris signed a definitive agreement to divest its Commercial Aviation Solutions business to an affiliate of TJC L.P. for $800 million. The company plans to use the proceeds to repay debt, which will accelerate the timeline to reach its debt leverage objective.

The stock boasts a long-term earnings growth rate of 3.6%. The Zacks Consensus Estimate for LHX’s 2023 sales implies a 12% improvement from the 2022 reported figure.

AeroVironment AVAV: On Sep 18, 2023, AeroVironment completed the acquisition of Tomahawk Robotics, a leader in AI-enabled robotic control and integrated communications systems for $120 million. The acquisition will enable it to integrate both companies’ technologies and expand the unmanned systems segment.

The Zacks Consensus Estimate for AVAV’s fiscal 2024 sales implies a 30% improvement from the previous year’s reported figure. The stock boasts a four-quarter earnings surprise of 47.23%, on average.

Price Performance

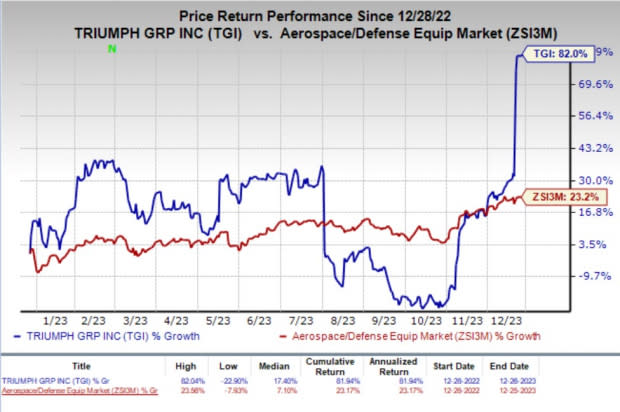

Over the past year, shares of TGI have rallied 82% compared with the industry’s 23.2% growth.

Image Source: Zacks Investment Research

Zacks Rank

Triumph Group currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Triumph Group, Inc. (TGI) : Free Stock Analysis Report

AAR Corp. (AIR) : Free Stock Analysis Report

AeroVironment, Inc. (AVAV) : Free Stock Analysis Report

L3Harris Technologies Inc (LHX) : Free Stock Analysis Report