Is True Leaf Medicine International's (FRA:TLA) Share Price Gain Of 102% Well Earned?

True Leaf Medicine International Ltd. (FRA:TLA) shareholders might be concerned after seeing the share price drop 19% in the last month. But in three years the returns have been great. In fact, the share price is up a full 102% compared to three years ago. To some, the recent share price pullback wouldn't be surprising after such a good run. The thing to consider is whether the underlying business is doing well enough to support the current price.

View our latest analysis for True Leaf Medicine International

True Leaf Medicine International isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last three years True Leaf Medicine International has grown its revenue at 90% annually. That's much better than most loss-making companies. Along the way, the share price gained 26% per year, a solid pop by our standards. This suggests the market has recognized the progress the business has made, at least to a significant degree. That's not to say we think the share price is too high. In fact, it might be worth keeping an eye on this one.

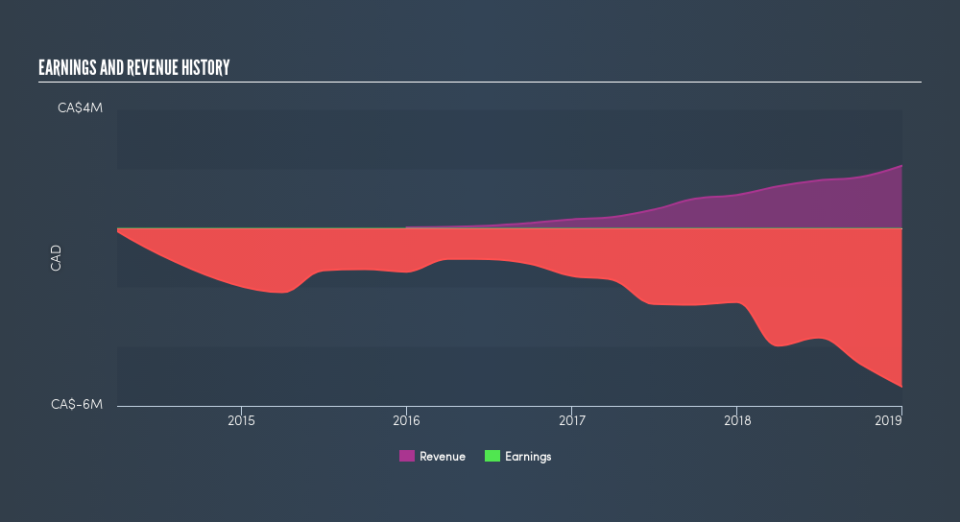

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

Balance sheet strength is crucual. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

True Leaf Medicine International shareholders are down 27% for the year, falling short of the market return. The market shed around 4.8%, no doubt weighing on the stock price. Fortunately the longer term story is brighter, with total returns averaging about 26% per year over three years. Sometimes when a good quality long term winner has a weak period, it's turns out to be an opportunity, but you really need to be sure that the quality is there. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.