Truist Financial Corp Reports Mixed Q4 Results Amidst Goodwill Impairment

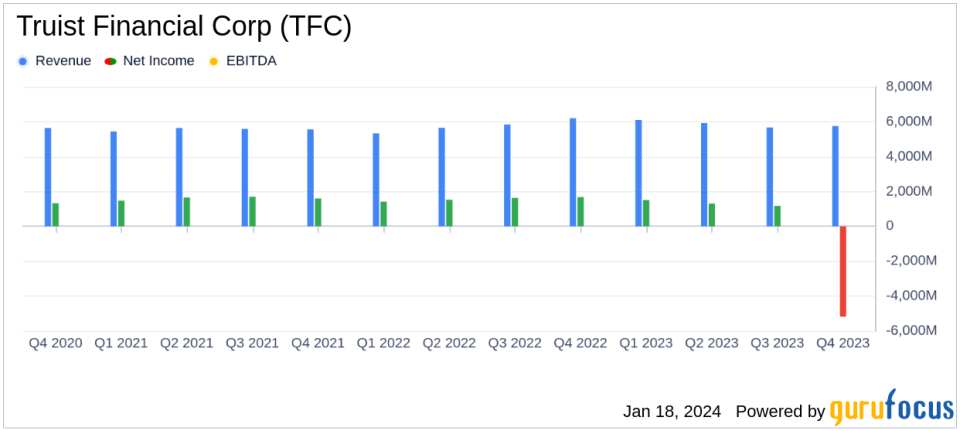

Net Loss: Truist Financial Corp (NYSE:TFC) reported a GAAP net loss of $5.2 billion, or $3.85 per diluted share.

Adjusted Net Income: Excluding significant items, adjusted net income was $1.1 billion, or $0.81 per diluted share.

Revenue: Total revenue on a taxable-equivalent basis (TE) slightly increased by 0.5% from the previous quarter.

Noninterest Expense: Noninterest expense surged by $6.5 billion, primarily due to a non-cash goodwill impairment charge.

Capital and Liquidity: CET1 ratio improved to 10.1%, and the average consolidated LCR was 112%.

Asset Quality: Asset quality remains solid with nonperforming assets declining by 6.0%.

On January 18, 2024, Truist Financial Corp (NYSE:TFC) released its 8-K filing, detailing the financial outcomes for the fourth quarter of 2023. The Charlotte-based financial institution, formed from the merger of BB&T and SunTrust, operates a significant regional banking network in the Southeastern United States, offering a suite of services including commercial, retail, and investment banking, as well as insurance brokerage.

Truist's fourth quarter was marked by a substantial GAAP net loss, primarily due to a non-cash goodwill impairment charge of $6.1 billion. However, when adjusted for this and other discrete items, the bank's net income remained resilient at $1.1 billion. This adjusted figure is indicative of Truist's underlying financial health and its ability to weather significant one-time charges.

Despite the net loss, Truist's total revenue on a taxable-equivalent basis saw a marginal increase from the third quarter, with noninterest income rising due to higher service charges and lending-related fees. However, net interest income experienced a slight decline, attributed to lower earning assets and increased funding costs, although the net interest margin saw a slight improvement.

The bank's noninterest expense witnessed a dramatic increase due to the goodwill impairment, but adjusted noninterest expenses actually decreased by 4.5%, reflecting ongoing efforts to transform into a more efficient organization. This was achieved through reduced personnel expenses and other cost-saving measures.

Truist's capital and liquidity levels showed signs of strength, with the CET1 ratio rising to 10.1% and the average consolidated LCR standing at 112%, well above the regulatory minimum. Asset quality also remained solid, with a decrease in nonperforming assets and an increase in the allowance for loan and lease losses (ALLL) ratio.

"While reported results included several discrete items, we earned $1.1 billion on an adjusted basis during the fourth quarter, which excludes a non-cash goodwill impairment charge that has no impact on our regulatory capital ratios, liquidity, our ability to pay the common dividend, or service our clients," said Bill Rogers, Truist Chairman & CEO. "Underlying results were positive as our transformation into a simpler, more efficient, and profitable company is well underway."

Looking ahead, Truist's focus remains on enhancing its core franchise and risk management infrastructure, with a strategic emphasis on efficiency and growth to drive increased value for both the franchise and its shareholders.

Investors and media seeking further details can reach out to Brad Milsaps for investor inquiries or Hannah Longmore for media-related questions.

Explore the complete 8-K earnings release (here) from Truist Financial Corp for further details.

This article first appeared on GuruFocus.