Trulieve Cannabis Corp (TCNNF) Reports Strong Cash Flow Amidst Revenue Dip in 2023

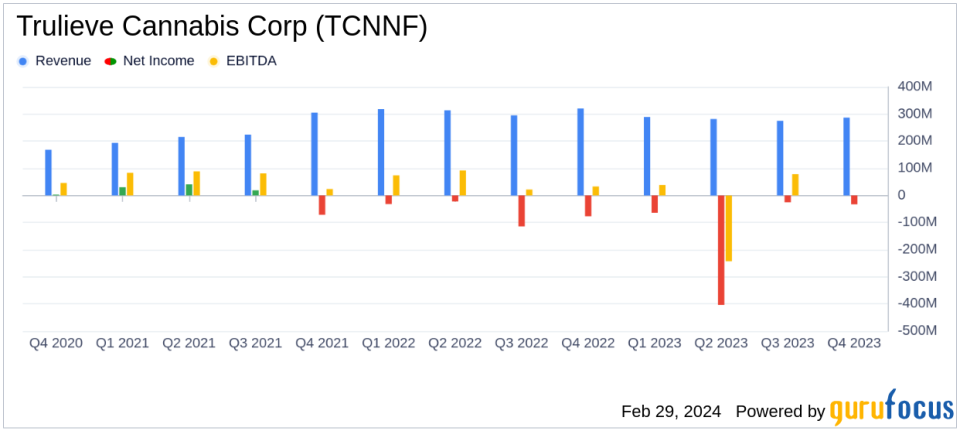

Revenue: Reported a 7% year-over-year decline to $1.13 billion in 2023.

Gross Margin: Achieved a GAAP gross margin of 52%, with gross profit of $589 million.

Net Loss: Reported a net loss of $527 million, with an adjusted net loss of $70 million after exclusions.

Cash Flow: Generated $202 million in cash flow from operations and $161 million in free cash flow.

Adjusted EBITDA: Achieved $322 million, representing 29% of revenue.

Retail Expansion: Increased retail footprint to 192 locations nationwide.

Strategic Exits: Exited retail assets in California and operations in Massachusetts as part of cash preservation.

On February 29, 2024, Trulieve Cannabis Corp (TCNNF) released its 8-K filing, revealing its financial results for the fourth quarter and full year ended December 31, 2023. The company, a vertically integrated seed to sale and fully licensed medical marijuana company, reported a year marked by strategic growth and strong cash generation, despite a decrease in annual revenue.

Financial Performance and Challenges

Trulieve Cannabis Corp (TCNNF) experienced a 7% decline in revenue year-over-year, totaling $1.13 billion, with the majority stemming from retail sales. The company faced a net loss of $527 million, which includes significant non-recurring charges and asset impairments. However, when adjusted for these factors, the net loss stands at $70 million. The adjusted net loss and the challenges it presents are significant as they reflect the company's underlying operational performance, excluding one-time events that may not be indicative of future performance.

The company's financial achievements, particularly in generating cash flow from operations of $202 million and free cash flow of $161 million, underscore its operational efficiency and ability to generate liquidity. These metrics are crucial for Trulieve's sustainability and future investments, especially in the capital-intensive cannabis industry.

Key Financial Metrics

Trulieve Cannabis Corp (TCNNF) reported a GAAP gross margin of 52% for the full year, with a gross profit of $589 million. Selling, General, and Administrative (SG&A) expenses were reduced by $61 million from the previous year to $386 million. The company's EBITDA for the year was $73 million, or 25% of revenue, with an adjusted EBITDA of $322 million, or 29% of revenue. These metrics are important as they provide insight into the company's profitability and operational efficiency.

"Last year we successfully executed on our plan to bolster our business resilience with a focus on cash generation and preservation while making investments to support future growth," said Kim Rivers, Trulieve CEO. "Fourth quarter momentum was underpinned by improved consumer trends. We entered 2024 in a position of significant strength just as the outlook for industry growth and reform brightened. With strong cash generation and a clearly defined strategy, Trulieve is best positioned for the coming wave of meaningful growth catalysts."

Analysis of Company's Performance

Trulieve's strategic decisions, including the exit from California retail assets and operations in Massachusetts, were part of a broader plan to preserve cash and strengthen business resilience. The company's focus on cash generation has positioned it well for future growth opportunities, particularly as it expands its retail footprint and enters new markets with adult-use sales in Connecticut and Maryland, as well as medical dispensaries in Georgia and Ohio.

The company's balance sheet remains robust with cash and cash equivalents of approximately $208 million as of December 31, 2023. This financial stability, combined with the company's operational achievements, positions Trulieve Cannabis Corp (TCNNF) favorably in the competitive cannabis industry.

For more detailed information on Trulieve's financials and strategic initiatives, investors and interested parties are encouraged to review the full 8-K filing and join the conference call and live audio webcast scheduled for February 29, 2024, at 8:30 A.M. Eastern time.

Explore the complete 8-K earnings release (here) from Trulieve Cannabis Corp for further details.

This article first appeared on GuruFocus.