The Trump economy might be peaking

President Trump is likely to get some much-needed good news on July 27, when the Commerce Department releases GDP numbers for the second quarter.

Economists think GDP grew by at least 4% in the quarter that ended June 30, with some estimates coming close to 5%. The actual numbers don’t always track forecasts, but many forces are lining up to make second and perhaps third-quarter growth numbers this year the strongest since 2014. If GDP growth exceeds 5.2% – the growth rate for the third quarter of 2014 — it will be the strongest pace since 2003.

The good times may not last, however. The tax cuts that went into effect earlier this year, along with about $250 billion in additional government spending for 2018, are creating a stimulus effect that could crest this year, then dissipate. The protectionist tariffs Trump is implementing will further harm growth later this year, and next, if they remain in place or intensify.

[See Trump’s grade on the Yahoo Finance Trumponomics Report Card]

Forecasting firm IHS Markit predicts real GDP growth, adjusted for inflation, will hit an annualized rate of 4.8% for the second quarter, and 3% for all of 2018. Growth will then fall to 2.7% in 2019 and an anemic 1.7% in 2020, the firm predicts. “The timing of the trade war could not be worse,” IHS economists wrote in their latest monthly update. “It is occurring as monetary stimulus is beginning to wear off, oil prices are elevated and political risks are on the rise.”

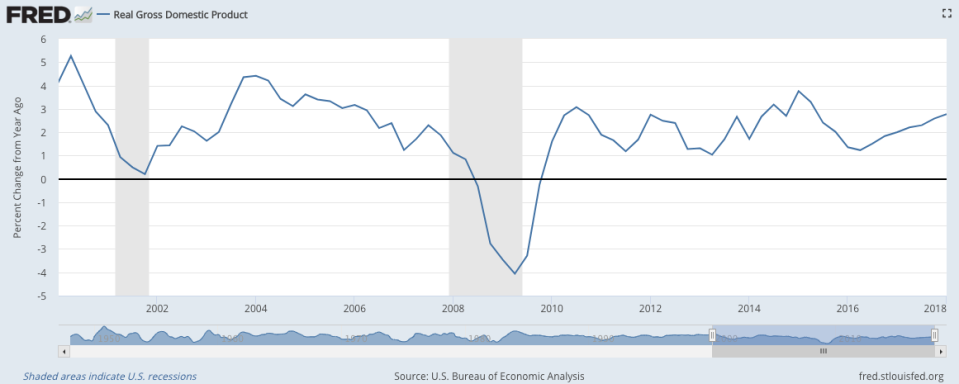

GDP growth plunged during the Great Recession, then sputtered under President Obama, averaging just 1.5% per year during his eight years in office. Excluding 2009, when the recession Obama inherited bottomed out, growth still averaged just 2.1%.

Trump has insisted he can push growth to 3% or even 4% per year on a sustained basis, but he hasn’t hit such levels yet. During the last 12 months (the first quarter of 2018 compared with the first quarter of 2017), GDP grew at 2.8% annualized rate. Growth in the first quarter was unusually weak, in part due to a slowdown in consumer spending and lousy weather. Some statistical anomalies may also be at play. Here’s the trend in annualized GDP growth rates since 2000:

Consumer spending picked up in the second quarter, especially on cars. A hiring surge continues, with some companies unable to find all the workers they need. Consumer and business confidence is strong, and the Trump tax cuts have sent corporate profits soaring.

The economy is one of the few things going right for Trump, who is mired in controversy over his coddling of Russian dictator Vladimir Putin and the sprawling investigation into Russia’s role in his 2016 election victory. That makes it all the more puzzling that Trump risks unnerving businesses and investors with tariffs, both threatened and imposed, that could disrupt global supply lines, raise prices and depress growth everywhere.

The strong economy, in fact, may be masking the damage tariffs and other protectionist measures could cause. And there are other risks, beyond the next couple of quarters. IHS points out that many other parts of the world economy are slowing, even as the U.S. economy heats up. Rising interest rates are causing outflows in emerging markets, and the flattening yield curve in the U.S. market suggests a recession could be coming.

Trump, however, isn’t one to worry about what’s around the corner. So watch his Twitter feed on July 27 for exaltations about the booming economy. He’ll be right, for now.

Confidential tip line: rickjnewman@yahoo.com. Click here to get Rick’s stories by email.

Read more:

Rick Newman is the author of four books, including “Rebounders: How Winners Pivot from Setback to Success.” Follow him on Twitter: @rickjnewman

Follow Yahoo Finance on Facebook, Twitter, Instagram, and LinkedIn