Trump’s tax bill is one tough sell

There are some worthy elements to the $1.5 trillion tax-cut bill House Republicans have finally released after months of secretive drafting. It would lower the corporate tax rate to a level competitive with the rates in other developed nations. It would reign in tax breaks that favor the wealthy. It would modestly expand tax credits targeted at low-income filers.

But it also has one glaring flaw: While it’s obvious how businesses would benefit from the cuts, it’s not at all clear how individual taxpayers would fare. Most taxpayers, in fact, will have a hard time figuring out if they’ll end up better off or worse off under the proposal. “It’s complicated,” says Martin Sullivan, chief economist at publisher Tax Analysts. “It depends on what tax bracket you’re in, and your individual circumstances. It looks like the bulk of that money is going to corporations.”

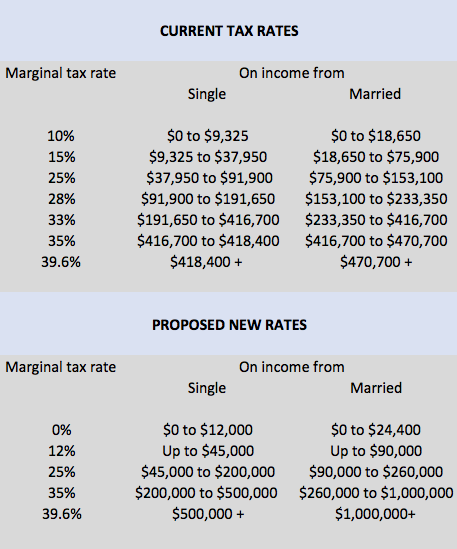

Here’s how the GOP bill would change individual taxes: Seven brackets currently would convert to five, with new thresholds for the income levels that apply to those brackets. Here’s a breakdown:

Other important factors would change, too. The size of the standard deduction would double, to $12,000 for individuals and $24,000 for married couples filing jointly. That’s generally good news for middle-income families. But the personal exemption would disappear, which could harm people with more kids, since they can generally claim an exemption for each. The bill would lower the limit on the tax deductibility of mortgage interest and state and local taxes, which would mostly affect wealthier families but could hit the upper-middle class as well. It would repeal the federal estate tax, which would benefit a small number of wealthy families.

So any family trying to figure out how they’ll fare under the plan will have to determine their prospects amid a complex matrix of possibilities. It’s simpler on the corporate side, where the cut in rates would be so large as to more than offset proposed reductions in tax breaks for most big companies. As every politician knows, complexity generates demagoguery, because it’s easier to bash something that’s hard to understand than something that’s intuitive.

Tax cut skews toward helping corporations, not individuals

Republicans backing the plan essentially say, trust us, this is great for the middle class. House Republicans claim the plan will save a median-income family of four $1,182 per year. But Americans are understandably skeptical. Americans like the idea of tax cuts in general, but polls show they consistently think individual taxpayers should benefit the most, not business or corporations. Early analysis of the GOP approach to tax cuts showed it heavily skewed toward corporate cuts, a political problem Republicans have been trying to address.

Kevin Hassett, chairman of Trump’s Council of Economic Advisers, recently oversaw a paper that argued cutting the corporate rate to 20% would boost the take-home pay of ordinary families by $4,000 to $9,000 per year. But he also acknowledged it could take three to 10 years for those benefits to trickle down, even though corporations and their shareholders would feel the effects almost right away.

Further complicating the delicate politics of tax-cut legislation is the reality that the corporate side of the tax code is the most broken and in need of repair. The U.S. corporate rate of 35% is the highest in the developed world, largely because competing nations have been cutting business taxes aggressively. That’s a big reason U.S. companies hold trillions in profits overseas, and some companies even try to move their U.S. headquarters out of the country.

That doesn’t make it easier to sell a sharp cut in business taxes in a populist political environment. Trump, of course, campaigned on helping coal miners, displaced manufacturing workers and the “forgotten men and women” of America. He’s now trying to persuade those voters that business tax cuts that would boost profits and stock values are the way to go. If Trump can pull it off, he truly has a magic touch.

Read more:

Rick Newman is the author of four books, including Rebounders: How Winners Pivot from Setback to Success. Follow him on Twitter: @rickjnewman