Trump’s unintended gift to holiday shoppers

If you get a good holiday deal on a laptop or TV, you might have President Trump’s combative trade policies to thank.

That’s not because Trump’s tariffs and other protectionist measures have cut production costs or prices. Instead, retailers seem to have sharply boosted their orders of imported goods from China, to stock up before possible new tariffs go into effect. That surge in inventories might lead to unusual price wars or other discounts in order to move this mountain of merchandise.

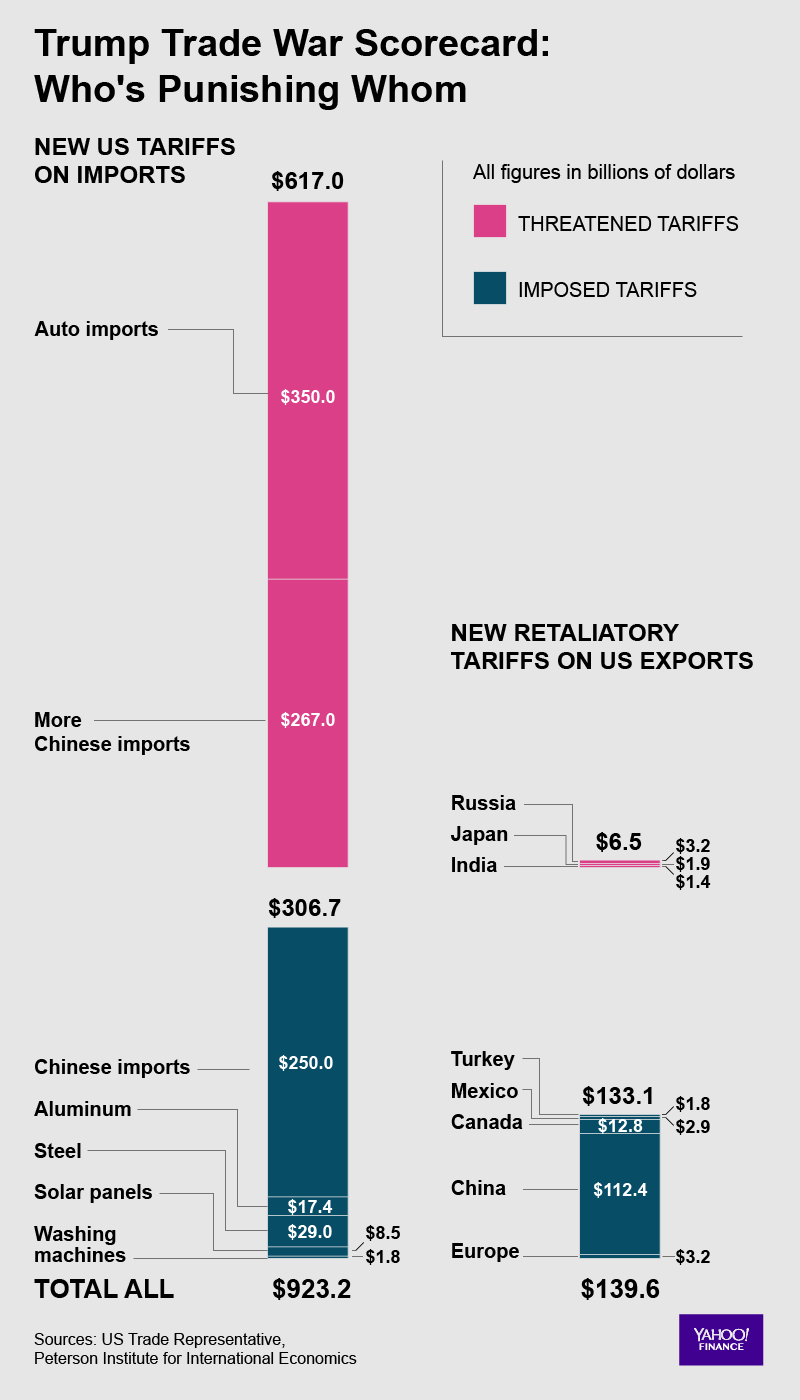

Trump has already put new 10% tariffs in place on about $250 billion worth of Chinese imports, or about half of everything China sends to the United States every year. But that mostly includes industrial goods and components used to build other things. Trump has left most finished consumer products off the list, to spare consumers the direct pain of price hikes that normally come with higher tariffs.

But that may not last. Trump has said he plans to extend new tariffs to all Chinese imports—including electronics, clothes, toys, furniture and thousands of every-day purchases—if China doesn’t agree to his demands on trade. There’s no strict timetable, but Trump has indicated Jan. 1, 2019, is his next deadline. If there’s no progress in talks with China by then, Trump could escalate further, by slapping tariffs on all Chinese imports, and raising the 10% tariff already in place to 25%.

Retailers seem to be planning for the worst. New data from research firm Panjiva show that imports of TVs from China surged 37%, year over year, in the four-month period that ended Oct. 31. That’s normally the window when retailers stock up for the critical holiday season that begins Thanksgiving week. Other increases in imports from China during that four-month period: 46% for laptops, 30% for audio products, 20% for microwaves and 57% for freezers and refrigerators.

Retail sales are up 4.6% during the last year, a healthy pace that’s likely to continue through the holiday shopping season. But retailers have obviously ordered far more Chinese imports than they expect to sell through the end of the year. “We’ve had a significant ramp-up in imports from China,” says Panjiva analyst Chris Rogers. “That would suggest lower pricing. The question is the timing—will it be lower pricing for Black Friday? Or lower pricing in the new year?”

There’s no price data yet for anything that might constitute holiday spending, but the Trump tariffs on Chinese imports has so far produced a somewhat counterintuitive outcome. Tariffs are a tax that directly add to the cost of an import at the point of entry into the United States. So all else equal, tariffs add to costs and prices. Yet Labor Department data shows that the price of Chinese imports rose just 0.3% during the last year, which is the second-lowest change among major U.S. trading partners. The average price change for imports from industrialized countries was 3.7%. That probably indicates wholesale discounting taking place to minimize disruption to global supply lines.

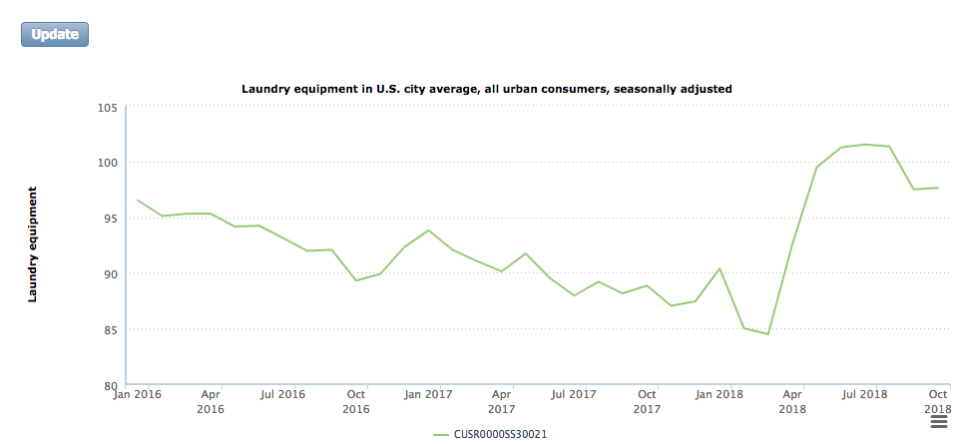

But if the Trump tariffs remain in place or intensify, discounting won’t last, and consumer prices will almost certainly go up. The real-world case study for this is washing machines. Early this year, Trump imposed tariffs of 15% to 60% on imported washing machines. Imports surged before the move, as U.S. retailers stocked up, in anticipation of tariffs. But imports fell after the tariffs went into effect, and prices rose at least 20%, according to investing firm UBS.

Part of the price hike was from the cost of the tariff itself. But domestic manufacturers whose products weren’t subject to the tariffs also raised prices, since the competition was now more expensive. “Domestic producers appear to have used the tariffs as an opportunity to raise prices,” analysts at UBS wrote in August. “Likewise, the industry seems to have boosted the prices of dryers in sync with the price of washing machines.” There were no new tariffs on dryers, yet prices went up anyway. The price of laundry equipment is still 16% higher than it was before Trump’s tariffs hit.

That suggests any discounts on consumer products from China during the few weeks might actually be as good as retailers try to make them sound. If Trump intensifies his trade war with China, as promised, the next blowout sale you encounter could be the last one for a while.

Confidential tip line: rickjnewman@yahoo.com. Click here to get Rick’s stories by email.

Read more:

Rick Newman is the author of four books, including “Rebounders: How Winners Pivot from Setback to Success.” Follow him on Twitter: @rickjnewman