Trupanion, Inc.'s (NASDAQ:TRUP) Stock Retreats 37% But Revenues Haven't Escaped The Attention Of Investors

Trupanion, Inc. (NASDAQ:TRUP) shareholders that were waiting for something to happen have been dealt a blow with a 37% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 57% loss during that time.

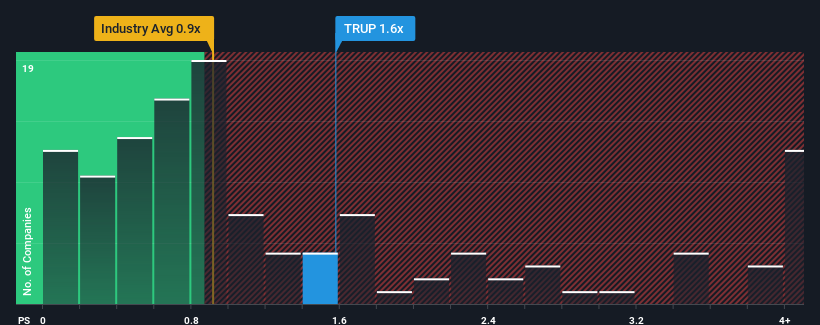

In spite of the heavy fall in price, given close to half the companies operating in the United States' Insurance industry have price-to-sales ratios (or "P/S") below 0.9x, you may still consider Trupanion as a stock to potentially avoid with its 1.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Trupanion

How Trupanion Has Been Performing

With revenue growth that's superior to most other companies of late, Trupanion has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying to much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Trupanion.

What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as high as Trupanion's is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that the company grew revenue by an impressive 29% last year. The latest three year period has also seen an excellent 136% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 14% per year over the next three years. With the industry only predicted to deliver 6.7% per year, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Trupanion's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Trupanion's P/S remain high even after its stock plunged. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Trupanion's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Trupanion that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here