Trupanion Inc (TRUP) Reports Accelerated Revenue Growth and Margin Expansion in Q4 and Full ...

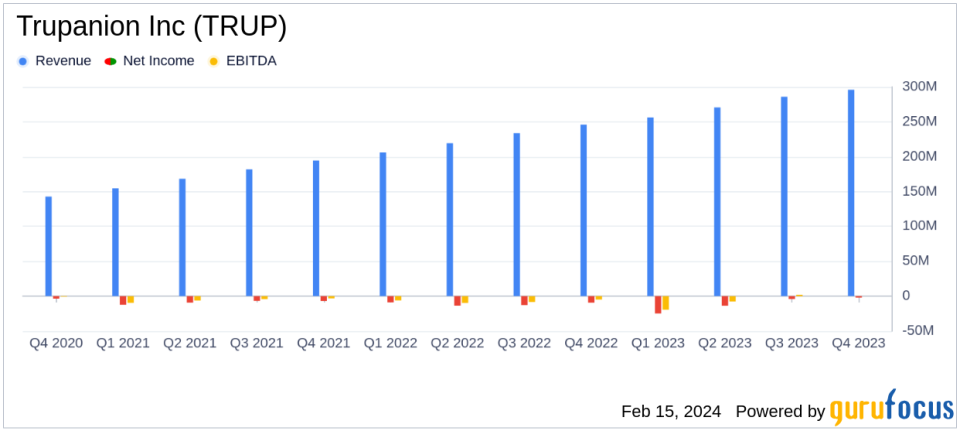

Total Revenue: Increased by 20% in Q4 and 22% for the full year, reaching $295.9 million and $1.1 billion respectively.

Subscription Business: Revenue up by 21% in Q4, with a 14% increase in subscription enrolled pets.

Net Loss: Decreased to $(2.2) million in Q4 from $(9.3) million in the same period last year.

Adjusted EBITDA: Improved to $8.5 million in Q4, a significant increase from $2.2 million in Q4 2022.

Free Cash Flow: Positive $13.5 million in Q4, a notable improvement from $(4.5) million in Q4 2022.

On February 15, 2024, Trupanion Inc (NASDAQ:TRUP), a leading provider of medical insurance for cats and dogs, released its 8-K filing, detailing its financial performance for the fourth quarter and full year ended December 31, 2023. The company, which operates primarily through its subscription business segment, has shown a robust increase in revenue and a significant reduction in net loss compared to the previous year.

Company Overview

Trupanion Inc is a specialty insurance provider focused on delivering tailor-made insurance products for pets, particularly cats and dogs. The company operates through two segments: the subscription business, which generates revenue from direct-to-consumer product subscription fees, and the other business segment, which includes revenue from third-party policy writing and other products and software solutions.

Financial Performance and Challenges

The company's financial results for the fourth quarter and full year of 2023 show a pattern of accelerated growth and margin expansion. Total revenue for the fourth quarter increased by 20% year-over-year to $295.9 million, while subscription business revenue grew by 21% to $191.5 million. This growth is significant as it reflects the company's ability to increase its market share in the pet insurance industry and the value of its subscription model.

Despite the positive trends, Trupanion reported a net loss of $(2.2) million, or $(0.05) per basic and diluted share, for the fourth quarter. However, this is an improvement from the net loss of $(9.3) million, or $(0.23) per basic and diluted share, in the same quarter of the previous year. The company's adjusted EBITDA also showed a strong increase to $8.5 million in the fourth quarter from $2.2 million in the prior year's quarter.

Trupanion's CEO, Darryl Rawlings, commented on the results:

I am pleased that Q4 showed continued improvement in our financial metrics. The combination of accelerated subscription revenue growth, continued margin expansion and efficient acquisition spend drove another quarter of positive free cash flow.

Financial Achievements and Importance

The company's financial achievements, particularly the positive free cash flow of $13.5 million in the fourth quarter, are important indicators of Trupanion's operational efficiency and financial health. Positive free cash flow allows the company to invest in growth initiatives without relying on external financing, which is crucial for sustaining long-term growth in the competitive insurance industry.

Key Financial Metrics

Trupanion's balance sheet as of December 31, 2023, shows $277.2 million in cash and short-term investments, providing a strong liquidity position. The company also maintained a capital surplus of $241.3 million at its insurance subsidiaries, which is $64.1 million more than the estimated risk-based capital requirement.

For the full year 2023, Trupanion achieved a total revenue of $1.1 billion, a 22% increase compared to 2022. The subscription business revenue was $712.9 million, up 19% from the previous year. The net loss remained flat at $(44.7) million, or $(1.08) per basic and diluted share, while adjusted EBITDA improved to $6.4 million from $0.7 million in 2022. Operating cash flow turned positive to $18.6 million, and free cash flow was $0.4 million, compared to negative cash flows in the previous year.

Analysis of Company's Performance

The company's performance in 2023 demonstrates its ability to grow its subscriber base and manage costs effectively. The increase in enrolled pets and subscription revenue highlights the demand for Trupanion's products and the success of its customer acquisition strategies. However, the reported material weaknesses in internal controls over financial reporting indicate areas that require attention and may pose challenges if not addressed promptly.

Trupanion's efforts to remediate these material weaknesses are underway, and the company expects to provide additional details in its Annual Report on Form 10-K. Investors and stakeholders will be closely monitoring these developments to ensure that the company maintains strong governance and risk management practices.

Overall, Trupanion's financial results for the fourth quarter and full year 2023 reflect a company that is successfully navigating the complexities of the insurance market, with a clear focus on growth and profitability.

For more detailed financial information and to join the conference call discussing these results, please visit Trupanion's Investor Relations website.

Explore the complete 8-K earnings release (here) from Trupanion Inc for further details.

This article first appeared on GuruFocus.