Trustmark Corp (TRMK) Reports Solid Loan Growth and Increased Net Interest Income for FY 2023

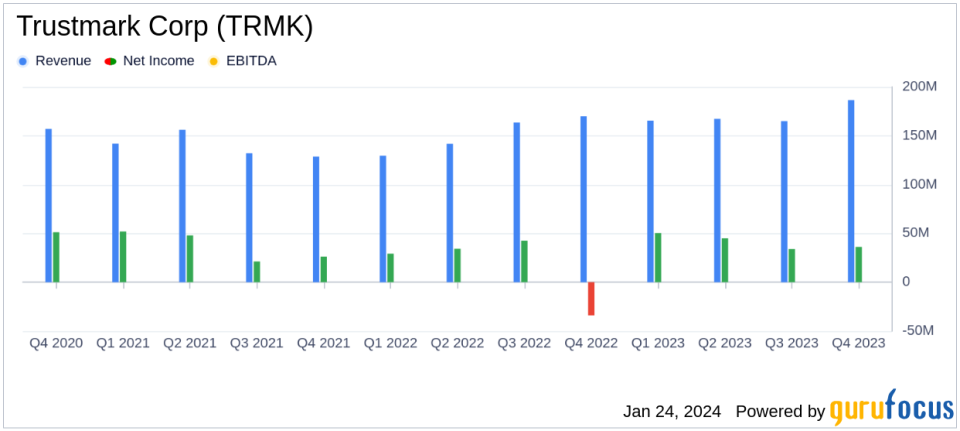

Net Income: $36.1 million for Q4 and $165.5 million for FY 2023.

Diluted Earnings Per Share (EPS): $0.59 for Q4 and $2.70 for FY 2023.

Loan Growth: Loans held for investment increased by $746.5 million, or 6.1%, in 2023.

Deposit Growth: Deposits increased by $1.1 billion, or 7.8%, in 2023.

Net Interest Income: Increased by 11.7% to $566.3 million in 2023, with a net interest margin of 3.32%.

Noninterest Income: Totaled $207.0 million, representing 27.2% of total revenue.

Dividend: Quarterly cash dividend declared at $0.23 per share.

On January 23, 2024, Trustmark Corp (NASDAQ:TRMK) released its 8-K filing, detailing the financial results for the fourth quarter and the fiscal year 2023. Trustmark Corp, a financial institution with over $12 billion in assets and more than 200 branches, reported a net income of $36.1 million for the fourth quarter, translating to diluted earnings per share of $0.59. For the full year, net income reached $165.5 million, or $2.70 per diluted share. The company's performance was marked by robust loan and deposit growth, solid credit quality, and a diversified revenue base.

Financial Performance and Challenges

Trustmark's financial achievements in 2023 reflect a strong competitive position in the market, with a 6.1% increase in loans held for investment and a 7.8% increase in deposits. The growth in net interest income by 11.7% to $566.3 million is particularly noteworthy, as it contributes significantly to the company's revenue, which is critical for banks that rely on lending as a primary income source. The net interest margin improved to 3.32%, up 15 basis points from 2022, indicating efficient asset utilization.

Despite these achievements, Trustmark faces challenges in an increasingly competitive marketplace, particularly in maintaining loan and deposit growth rates and managing interest rate risks. The company's continued technology investments aim to enhance efficiency and productivity, which are essential in a sector where digital transformation is rapidly changing customer expectations and operational processes.

Income Statement and Balance Sheet Highlights

Trustmark's income statement for 2023 shows a total revenue increase of $60.0 million, or 8.6%, to $759.8 million. Noninterest income, which includes insurance and wealth management services, totaled $207.0 million and represented 27.2% of total revenue. This diversification of income sources is important for the company's stability, especially in fluctuating interest rate environments.

On the balance sheet, loans held for investment (HFI) totaled $13.0 billion at the end of 2023, while total deposits stood at $15.6 billion. The company's capital position remained strong, with a Common Equity Tier 1 (CET1) ratio of 10.04% and a total risk-based capital ratio of 12.29%. Trustmark's tangible book value per share was $20.87, up 7.7% from the previous quarter and 15.2% from the prior year, reflecting the company's ability to generate shareholder value.

"We continued to make significant progress across the organization. Our performance reflected solid loan production and credit quality, and continued deposit growth in an increasingly competitive marketplace. We achieved double-digit growth in net interest income in 2023 while noninterest income continued to expand thanks in part to another record year in our insurance business and commendable results in our banking, mortgage banking and wealth management businesses," said Duane A. Dewey, President and CEO of Trustmark.

Analysis of Company's Performance

Trustmark's performance in 2023 demonstrates a resilient business model capable of delivering growth in core areas such as loans and deposits. The company's strategic focus on diversifying its revenue streams has paid off, with noninterest income contributing significantly to the total revenue. The increase in net interest income is a testament to the company's disciplined approach to asset and liability management.

The company's solid credit quality, as evidenced by net charge-offs representing only 0.06% of average loans in 2023, indicates effective risk management practices. Trustmark's commitment to technology investments and organizational restructuring to leverage these investments suggests a forward-looking approach to business operations, aiming to enhance customer experience and operational efficiency.

Overall, Trustmark Corp (NASDAQ:TRMK) has reported a strong financial performance for the fiscal year 2023, with significant growth in key areas and a strategic focus on maintaining a diversified and stable revenue base. The company's robust capital position and prudent management of assets and liabilities position it well for continued success in the competitive banking industry.

Explore the complete 8-K earnings release (here) from Trustmark Corp for further details.

This article first appeared on GuruFocus.