TTM Technologies Inc (TTMI) Reports Dip in Annual Sales Amidst Strong Q4 Non-GAAP Performance

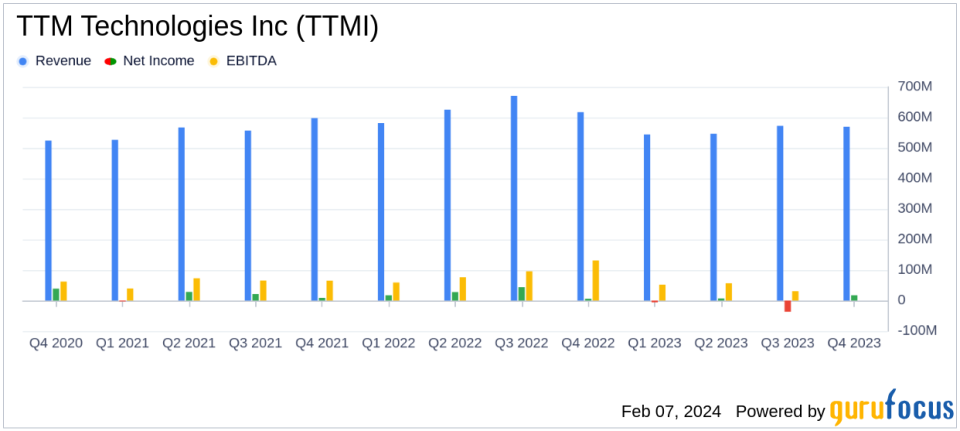

Revenue: Q4 sales reached $569.0 million, a decrease from $617.2 million in the same quarter last year.

Net Income: GAAP net income for Q4 was $17.3 million, up from $6.0 million in Q4 of the previous year.

Earnings Per Share (EPS): Non-GAAP EPS for Q4 remained stable at $0.41, matching the prior year's result.

Adjusted EBITDA: Q4 Adjusted EBITDA marginally declined to $80.9 million from $81.6 million year-over-year.

Full Year Performance: 2023 annual sales decreased by 11% to $2.2 billion from $2.5 billion in 2022.

Balance Sheet: Cash and equivalents increased to $450.2 million, up from $402.7 million at the end of 2022.

Outlook: Q1 2024 revenue is estimated to be between $530 million and $570 million, with non-GAAP net income per diluted share projected at $0.24 to $0.30.

On February 7, 2024, TTM Technologies Inc (NASDAQ:TTMI), a leading global manufacturer of technology solutions including mission systems and advanced printed circuit boards, released its 8-K filing, detailing the financial results for the fourth quarter and full year of 2023. The company, which plays a critical role in various high-tech sectors such as aerospace, computing, and telecommunications, faced a challenging year with a notable decline in annual sales. However, TTM Technologies managed to maintain a steady non-GAAP earnings per share in the fourth quarter, reflecting resilience in its operational performance.

Fourth Quarter and Full Year 2023 Financial Highlights

TTM Technologies reported a decrease in net sales for the fourth quarter of 2023, amounting to $569.0 million compared to $617.2 million in the fourth quarter of the previous year. Despite this, the company's GAAP operating income for the fourth quarter was $34.6 million, and the GAAP net income stood at $17.3 million, or $0.17 per diluted share. This represents an improvement over the fourth quarter of 2022, which saw a GAAP net income of $6.0 million, or $0.06 per diluted share.

On a non-GAAP basis, net income for the fourth quarter of 2023 remained consistent at $43.0 million, or $0.41 per diluted share, mirroring the performance of the same period in the prior year. Adjusted EBITDA for the quarter was slightly down at $80.9 million, or 14.2% of sales, compared to $81.6 million, or 13.2% of sales in the fourth quarter of 2022.

For the full year of 2023, TTM Technologies saw a decrease in net sales to $2.2 billion from $2.5 billion in 2022, marking an 11% year-over-year decline. The GAAP operating income for 2023 was significantly impacted by a $44.1 million goodwill impairment charge related to the RF&S Components segment, resulting in a decrease to $42.3 million from $210.4 million in 2022. The GAAP net loss for 2023 was $18.7 million, or ($0.18) per diluted share, compared to a GAAP net income of $94.6 million, or $0.91 per diluted share, in the previous year.

Non-GAAP net income for the full year was $139.5 million, or $1.33 per diluted share, down from $181.2 million, or $1.74 per diluted share in 2022. Adjusted EBITDA for 2023 was $298.2 million, or 13.4% of net sales, compared to $343.1 million, or 13.8% of net sales, for 2022.

Management Commentary and Outlook

Tom Edman, CEO of TTM, commented on the company's performance, stating,

TTM executed a strong finish to the year registering a Non-GAAP EPS that was above the high end of the guided range due to excellent operating performance and favorable product mix."

He also noted the challenges faced in the Automotive and Medical, Industrial, and Instrumentation end markets, which were offset by growth in the Aerospace and Defense and Data Center Computing sectors.

Looking ahead, TTM Technologies anticipates revenues for the first quarter of 2024 to be in the range of $530 million to $570 million, with non-GAAP net income per diluted share estimated between $0.24 and $0.30. The company's forward-looking statements are based on current expectations and are subject to various risks and uncertainties that could cause actual results to differ materially.

Value investors and potential GuruFocus.com members interested in the hardware industry and TTM Technologies' financial journey can find more detailed information and analysis on GuruFocus.com.

Explore the complete 8-K earnings release (here) from TTM Technologies Inc for further details.

This article first appeared on GuruFocus.