Tuesday’s market meltdown was an ‘overreaction.’ Here’s why the rally can continue.

A previous version of this report gave incorrect information on the number of Amazon shares sold by founder Jeff Bezos. The story has been corrected.

Most Read from MarketWatch

Super Micro’s stock has surged 900% in a year. Why BofA is making a ‘buy’ call.

Nvidia discloses positions in SoundHound AI, Arm — and these other stocks

The Valentine’s Day massacre came a day early — was it a big overreaction? Early stock action shows bargain hunters are on the prowl this morning.

“What we’ve seen is a market caught offside with limited hedges in place and a max long position in risk,” explains Chris Weston, head of research at Pepperstone, of Tuesday’s rout. “It’s worth pointing out that sell-offs like this have been incredibly frustrating for those short risk, as there has been limited follow-through.” Also, the Fed’s preferred PCE inflation numbers are still to come — Feb. 29.

The selloff is going nowhere, is our call of the day from one of the Street’s biggest bulls, Fundstrat’s head of research Tom Lee, who calls Tuesday’s equity meltdown an “overreaction.

“Is this the peak for equities in the first half of 2024? In our view, this is not likely and we think this pullback will soon get bought (aka “buy the dip”),” says Lee, who also maintains it will could be a tough first half for investors.

Why listen to Lee? He swung bullish in 2023 when most went the other way, almost nailing his predicting for the S&P 500 to finish at 4,750. He also has one of the highest S&P 500 targets for this year —- 5,200, which he has already deemed too conservative .

Breaking down his rationale for why stocks have further to rise in a note to clients, Lee firstly points out that a “sure sign of a near-term peak” is when equities sell off on good news, which wasn’t the case with Tuesday’s CPI data. That said, he doesn’t think the downward inflation trajectory has ground to a halt.

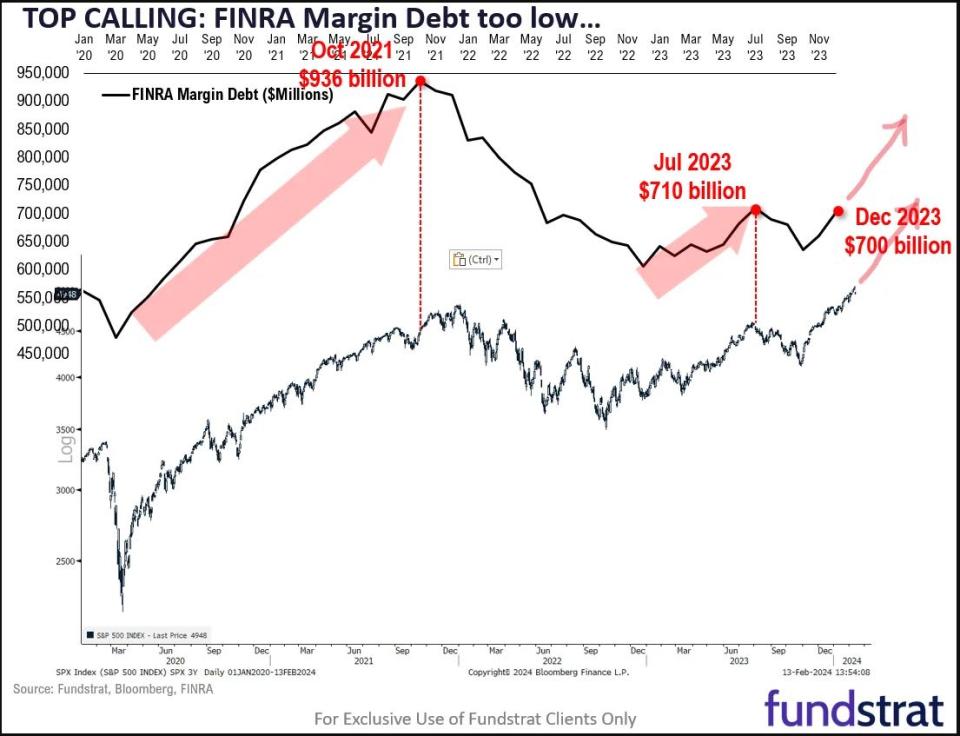

Second, he sees too much “dry powder” on the sidelines. “Buying power needs to be exhausted. This was behind the July 2023 top. By comparison, there is still low level of NYSE margin debt. These figures need to surge to mark a near-term top,” said the strategist.

Margin debt refers to money borrowed by traders to buy stock. When those debt level get too high, traders are pushed to sell, which in turn puts stocks at risk. Lee says margin debt stood at $700 billion at end December, and the most recent peak was $710 billion in July, with an 11% stock pullback coming on the heels of that.

The idea that lots of cash is still sitting may not seem far off base. Recall last November, a BlackRock executive spoke of roughly $4 trillion in cash hanging around the sidelines, looking for a home .

Another reason stocks probably haven’t peaked is because sentiment is still skeptical, says Lee. “Skeptics of inflation, economy and stock market have been vocal today. This is not what makes a near-term top.”

What will bring on that peak? Those scanning the horizons should be on the lookout for “good news” —- “meaning we get a great macro data point, and stock sell off,” he says.

Meanwhile, Lee is sticking to small-cap stocks, via the iShares Russell 2000 ETF IWM, and sees that group likely to “rebound as markets stabilize.” The Russell RUT, incidentally, fared the worst of all indexes on Tuesday, losing nearly 4% for its biggest one-day rout since June 2022. Its performance has also lagged behind other major indexes.

Read: Interest rates have bottomed due to surging government spending, Gundlach says

The markets

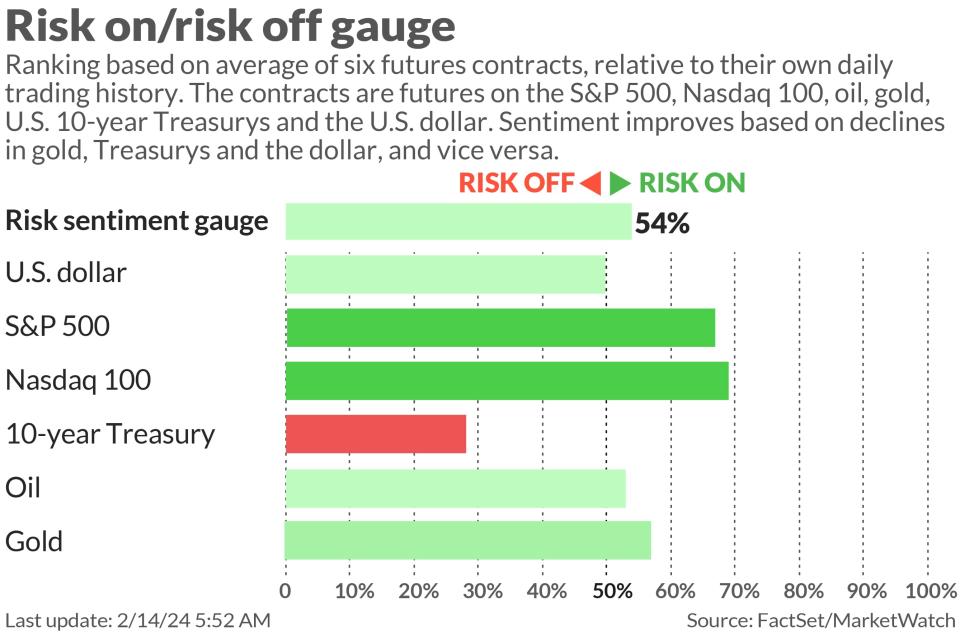

Stocks DJIA SPX COMP have opened sharply higher, as Treasury yields BX:TMUBMUSD10Y BX:TMUBMUSD02Y ease back from Tuesday’s massive surge. Gold GC00 continues to weaken and the dollar shot above 150 yen USDJPY, prompting a top Japan official to warn of intervention if needed.

Key asset performance | Last | 5d | 1m | YTD | 1y |

S&P 500 | 4,953.17 | -0.02% | 3.93% | 3.84% | 19.75% |

Nasdaq Composite | 15,655.60 | -0.64% | 5.39% | 4.29% | 29.70% |

10 year Treasury | 4.292 | 16.87 | 18.31 | 41.08 | 48.49 |

Gold | 2,004.60 | -2.26% | -0.21% | -3.24% | 8.56% |

Oil | 77.91 | 5.17% | 6.96% | 9.22% | -0.76% |

Data: MarketWatch. Treasury yields change expressed in basis points | |||||

The buzz

Uber UBER stock is up after the ride-share group announced its first share buyback program, with plans to buy back up to $7 billion worth. Elsewhere, its drivers and those of Lyft are planning mass Valentine’s Day strikes.

Rival Lyft LYFT is up 16% after topping expectations — though shares are off the 60% surge seen in late trade Tuesday that some linked to an earnings typo the company later corrected.

Opinion: Lyft’s gargantuan earnings error proves Wall Street should cut the jargon

Airbnb stock ABNB soared, then fell after forecast-beating results and guidance.

Amazon AMZN founder Jeff Bezos sold another $2 billion , or 12 million shares. Nvidia NVDA, meanwhile, Tuesday closed with a market cap above the e-commerce giant’s for the first time since 2002.

A bitcoin ETF has added to crypto demand , says Robinhood Markets HOOD CFO Jason Warnick. That could be good news for Coinbase COIN too.

Chicago Fed President Austan Goolsbee will speak at 9:30 a.m., followed by Fed Vice Chair for Supervision Michael Barr at 4 p.m.

Best of the web

Do you need to know how much money your partner makes?

Forget passwords and badges: Your body is your next security key .

The curse of Valentine’s Day: The internet has killed off romance.

The chart

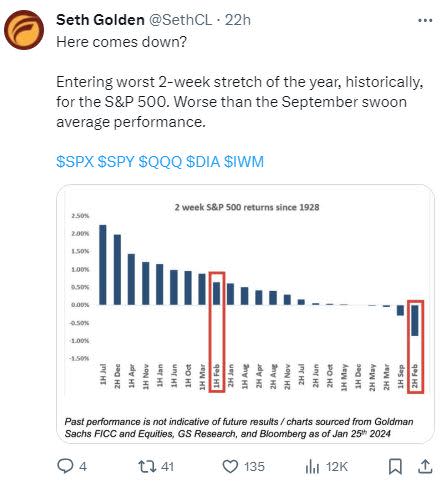

Maybe Tuesday’s selloff was just the beginning, judging by this chart from Finom Group ’s chief market strategist, Seth Golden, who says the roughest patch of the year is dead ahead:

Top tickers

These were the top-searched tickers on MarketWatch as of 6 a.m.:

Ticker | Security name |

TSLA | Tesla |

NVDA | Nvidia |

ARM | Arm Holdings |

MARA | Marathon Digital |

MSFT | Microsoft |

PLTR | Palantir Technologies |

AMC | AMC Entertainment |

NIO | NIO |

AMD | Advanced Micro Devices |

AAPL | Apple |

Random reads

Rewind. Cassette tapes are back .

Worker goes viral after boss rudely cancels his vake.

That’s no black bear! Taiwan zoo workers under scrutiny.

Travis Kelce is already making Hollywood movies .

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Check out On Watch by MarketWatch , a weekly podcast about the financial news we’re all watching – and how that’s affecting the economy and your wallet.