Turning Point Brands (NYSE:TPB) Is Increasing Its Dividend To $0.07

Turning Point Brands, Inc.'s (NYSE:TPB) dividend will be increasing from last year's payment of the same period to $0.07 on 12th of April. Although the dividend is now higher, the yield is only 1.0%, which is below the industry average.

View our latest analysis for Turning Point Brands

Turning Point Brands' Payment Has Solid Earnings Coverage

The dividend yield is a little bit low, but sustainability of the payments is also an important part of evaluating an income stock. However, Turning Point Brands' earnings easily cover the dividend. This means that most of its earnings are being retained to grow the business.

The next year is set to see EPS grow by 14.5%. If the dividend continues along recent trends, we estimate the payout ratio will be 12%, which is in the range that makes us comfortable with the sustainability of the dividend.

Turning Point Brands Doesn't Have A Long Payment History

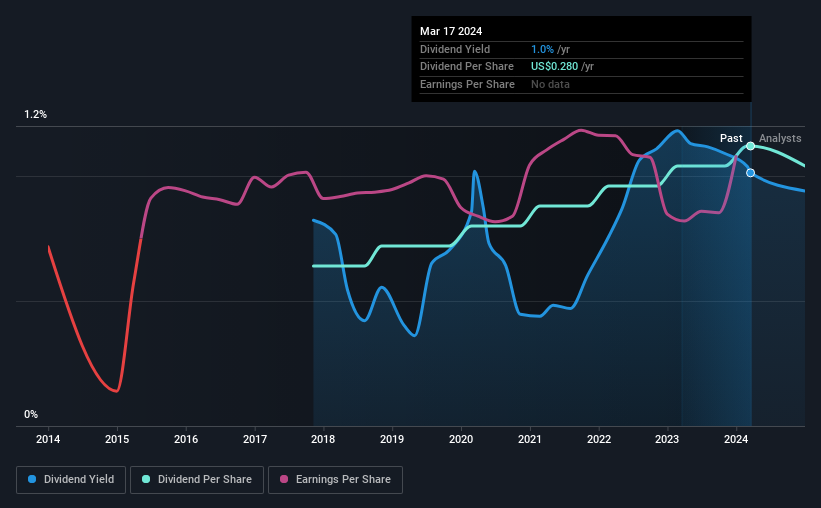

Even though the company has been paying a consistent dividend for a while, we would like to see a few more years before we feel comfortable relying on it. Since 2018, the annual payment back then was $0.16, compared to the most recent full-year payment of $0.28. This means that it has been growing its distributions at 9.8% per annum over that time. Turning Point Brands has been growing its dividend at a decent rate, and the payments have been stable. However, the payment history is very short, so there is no evidence yet that the dividend can be sustained over a full economic cycle.

The Dividend Looks Likely To Grow

The company's investors will be pleased to have been receiving dividend income for some time. Turning Point Brands has impressed us by growing EPS at 11% per year over the past five years. Growth in EPS bodes well for the dividend, as does the low payout ratio that the company is currently reporting.

Turning Point Brands Looks Like A Great Dividend Stock

In summary, it is always positive to see the dividend being increased, and we are particularly pleased with its overall sustainability. Earnings are easily covering distributions, and the company is generating plenty of cash. Taking this all into consideration, this looks like it could be a good dividend opportunity.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. Taking the debate a bit further, we've identified 1 warning sign for Turning Point Brands that investors need to be conscious of moving forward. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.