Turtle Beach Corp (HEAR) Reports Mixed 2023 Financial Results Amidst Market Challenges

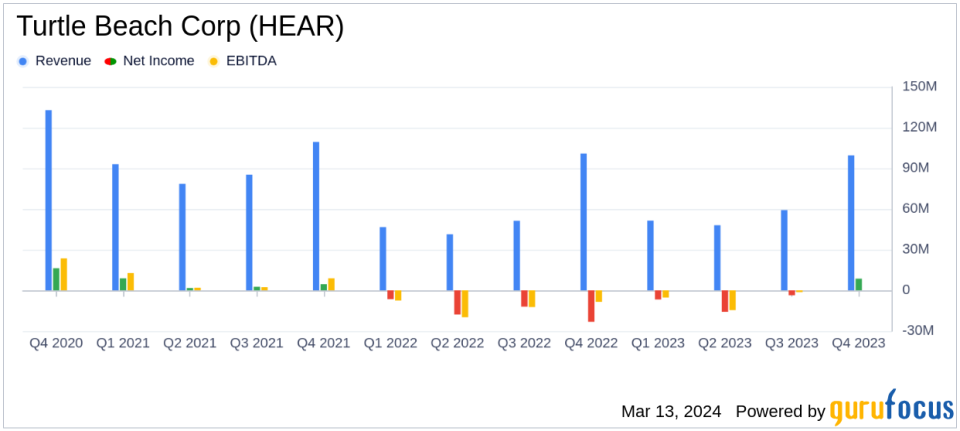

Net Revenue: Annual increase of 7.5% to $258.1 million, despite a 1.3% decrease in Q4.

Net Income: Q4 net income of $8.6 million, a substantial improvement from a net loss of $23.2 million in the same quarter last year.

Adjusted EBITDA: Improved to $14.0 million in Q4 from $1.0 million a year ago; annual adjusted EBITDA turned positive to $6.5 million from a loss of $29.9 million.

Gross Margin: Increased to 32.0% in Q4, the highest in seven quarters, driven by lower freight costs and promotional spend.

Operating Expenses: Decreased by 12.6% in Q4 due to proactive expense management.

Cash Flow: Operating cash flow improved by $68.9 million year over year.

Outlook: 2024 net revenues expected to be between $370 million to $380 million, with adjusted EBITDA between $51 million and $54 million.

On March 13, 2024, Turtle Beach Corp (NASDAQ:HEAR) released its 8-K filing, disclosing its financial performance for the fourth quarter and full year ended December 31, 2023. The company, a leading gaming accessories brand, experienced a slight dip in net revenue for the fourth quarter, reporting $99.5 million, a 1.3% decrease compared to the same period last year. However, the full-year results were more positive, with a 7.5% increase in net revenue to $258.1 million.

Financial Performance and Strategic Developments

Turtle Beach's net income for the fourth quarter was a notable $8.6 million, or $0.47 per diluted share, a significant turnaround from the net loss of $23.2 million, or $1.40 per diluted share, in the prior year's quarter. This improvement was attributed to an increase in gross margin to 32.0% and a reduction in operating expenses by 12.6%. Adjusted EBITDA also saw a remarkable improvement, reaching $14.0 million compared to just $1.0 million a year ago.

CEO Cris Keirn highlighted the company's resilience and adaptability, which have strengthened its leadership position in gaming accessories. Keirn pointed to strategic pillars and cost management initiatives that have driven margin improvements and are expected to fully impact in 2024. The company anticipates significant improvements in business performance due to these initiatives and a portfolio that will feature groundbreaking product launches.

"We are incredibly optimistic about our 2024 prospects given our progress against optimizing the business for the future, our growth prospects in all our gaming categories driven by fantastic new product launches, and our focus on significantly increasing profitability," said Cris Keirn, CEO of Turtle Beach Corp.

The company also announced the acquisition of PDP, which is expected to diversify Turtle Beach's leadership in gaming accessories, strengthen profitability, and enhance scale. This strategic move is anticipated to transform the company's financial profile and growth prospects.

Financial Health and Outlook

Turtle Beach's balance sheet reflects a stronger position with $18.7 million in cash and no outstanding borrowings on its revolver, compared to $11.4 million in cash and $19.1 million outstanding at the end of the previous year. Inventories decreased to $44.0 million from $71.3 million, indicating improved inventory management. The company's cash flow from operations for the year ended December 31, 2023, was a positive $27.0 million, a substantial improvement from the previous year.

Looking ahead, Turtle Beach expects net revenues for 2024 to be in the range of $370 million to $380 million, with adjusted EBITDA between $51 million and $54 million. These projections are driven by the acquisition of PDP and anticipated outperformance in specific gaming categories.

The company's long-term goals include a 10%+ revenue compound annual growth rate (CAGR), a mid-30s gross margin percentage, and a focus on low to mid-teens percentage for adjusted EBITDA margins.

For value investors and potential GuruFocus.com members, Turtle Beach's latest financial report indicates a company navigating market challenges with strategic acquisitions and cost management initiatives that are expected to yield significant improvements in profitability and market position. The company's focus on innovation and expansion into new product categories, coupled with a solid financial foundation, positions it for potential value creation in the years ahead.

Investors and analysts are encouraged to review the full earnings report and join the conference call for further insights into Turtle Beach's financial performance and strategic direction.

Explore the complete 8-K earnings release (here) from Turtle Beach Corp for further details.

This article first appeared on GuruFocus.