Tutor Perini Corp (TPC) Reports Mixed 2023 Financial Results with Strong Backlog Growth

Operating Cash Flow: Achieved a record $308.5 million in 2023, a 49% increase from 2022.

Backlog: Grew by 28% year-over-year to $10.2 billion, signaling potential for future revenue growth.

Revenue: Slight increase in 2023 to $3.9 billion, primarily driven by growth in Civil and Building segments.

Net Loss: Reduced net loss to $171.2 million in 2023 from $210.0 million in 2022.

Debt Reduction: Additional $91 million paydown of Term Loan B in February 2024, earlier than required.

EPS Guidance: Established for 2024 in the range of $0.85 to $1.10, anticipating a return to positive earnings.

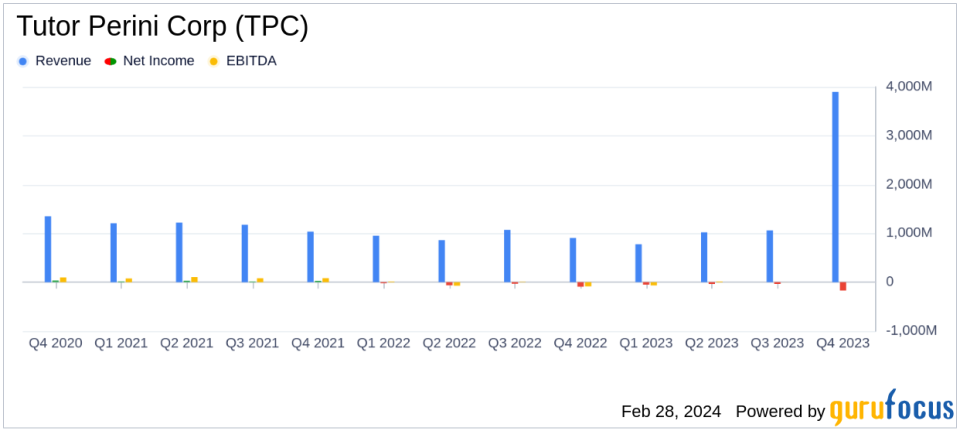

On February 28, 2024, Tutor Perini Corp (NYSE:TPC), a prominent player in the construction industry, released its 8-K filing, disclosing its financial performance for the fourth quarter and full year of 2023. The company, known for its general contracting, construction management, and design-build services, has reported a slight increase in annual revenue to $3.9 billion, up from $3.79 billion in 2022. This growth was primarily attributed to the Civil and Building segments, which saw revenue growth of 9% and 5%, respectively. However, the Specialty Contractors segment experienced a 15% decline in revenue due to reduced project execution activities.

Financial Performance and Challenges

The company's loss from construction operations decreased to $114.6 million in 2023 from $204.8 million in 2022, reflecting more favorable settlement activities and litigation outcomes. Despite this improvement, Tutor Perini reported a net loss attributable to the company of $171.2 million, or a $3.30 diluted loss per share, an improvement from the net loss of $210.0 million, or a $4.09 diluted loss per share, in the previous year.

The record operating cash flow of $308.5 million in 2023, a 49% increase from 2022, underscores the company's ability to generate cash from its operations. This performance is particularly significant for a construction company like Tutor Perini, where cash flow management is critical for sustaining operations and funding new projects.

Backlog and Future Outlook

The company's backlog increased significantly to $10.2 billion, up 28% from the previous year, providing visibility for strong revenue growth. This backlog is expected to continue growing in 2024 and 2025, with Tutor Perini tracking more than $32 billion of near-term opportunities. The substantial backlog is a positive indicator for the construction industry, as it suggests a healthy pipeline of future work and potential revenue.

Tutor Perini's Chairman and CEO, Ronald Tutor, commented on the results:

"We delivered a second consecutive year of record operating cash flow and grew our backlog substantially in 2023... We anticipate double-digit revenue growth and a return to positive earnings in 2024, with substantially stronger earnings expected in 2025 and 2026."

The company's outlook remains optimistic, with expectations of double-digit revenue growth and a return to positive earnings in 2024. The initial EPS guidance for 2024 is set between $0.85 and $1.10. Tutor Perini also expects to continue generating strong operating cash flow over the next several years, which will be well in excess of net income for each year.

Debt Management and Capital Allocation

In terms of capital management, Tutor Perini has made strides in reducing its debt, paying down an additional $91 million of its Term Loan B earlier than required. The company is also in the process of refinancing its Senior Notes, with the transaction expected to be completed by the end of April 2024. These actions demonstrate the company's commitment to strengthening its balance sheet and improving its financial flexibility.

Value investors and potential GuruFocus.com members may find Tutor Perini's strong backlog and improved cash flow management as indicators of the company's resilience and potential for future growth. While the company faces challenges, such as returning to profitability, its strategic focus on resolving disputes, reducing debt, and capturing a share of the burgeoning infrastructure market positions it for potential success in the coming years.

For more detailed information, interested parties can access the full earnings report and participate in the conference call scheduled for 2:00 PM Pacific Time on February 28, 2024.

Explore the complete 8-K earnings release (here) from Tutor Perini Corp for further details.

This article first appeared on GuruFocus.