Twilio (NYSE:TWLO) Posts Better-Than-Expected Sales In Q4 But Stock Drops

Cloud communications infrastructure company Twilio (NYSE:TWLO) reported Q4 FY2023 results topping analysts' expectations , with revenue up 5% year on year to $1.08 billion. On the other hand, next quarter's revenue guidance of $1.03 billion was less impressive, coming in 1.9% below analysts' estimates. It made a non-GAAP profit of $0.86 per share, improving from its profit of $0.22 per share in the same quarter last year.

Is now the time to buy Twilio? Find out by accessing our full research report, it's free.

Twilio (TWLO) Q4 FY2023 Highlights:

Revenue: $1.08 billion vs analyst estimates of $1.04 billion (3.2% beat)

EPS (non-GAAP): $0.86 vs analyst estimates of $0.58 (49.5% beat)

Revenue Guidance for Q1 2024 is $1.03 billion at the midpoint, below analyst estimates of $1.05 billion

Free Cash Flow of $213.1 million, similar to the previous quarter

Net Revenue Retention Rate: 102%, in line with the previous quarter

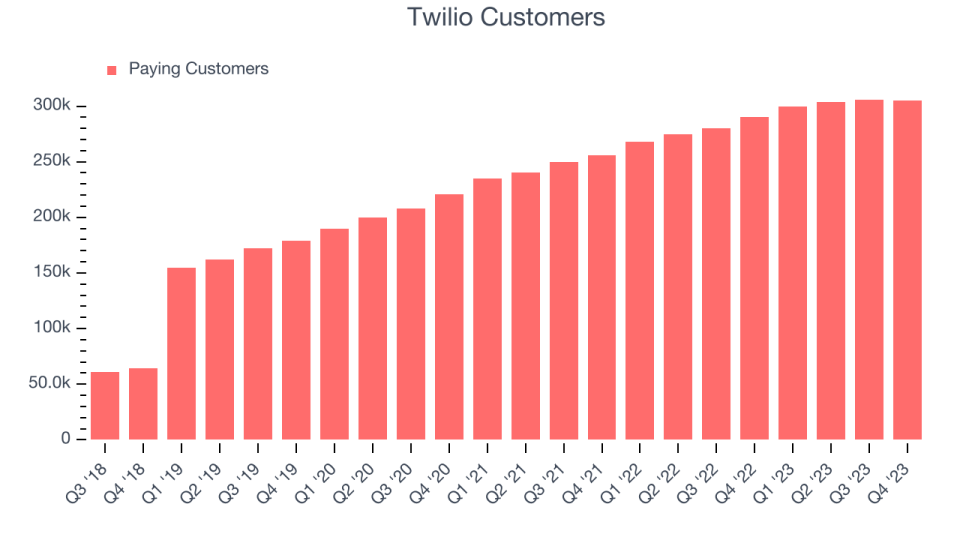

Customers: 305,000, down from 306,000 in the previous quarter

Gross Margin (GAAP): 49.4%, up from 47% in the same quarter last year

Market Capitalization: $12.55 billion

“Twilio had a terrific fourth quarter to close out a strong 2023,” said Khozema Shipchandler, Twilio’s CEO.

Founded in 2008 by Jeff Lawson, a former engineer at Amazon, Twilio (NYSE:TWLO) is a software as a service platform that makes it really easy for software developers to use text messaging, voice calls and other forms of communication in their apps.

Communications Platform

The first shift towards voice communication over the internet (VOIP), rather than traditional phone networks, happened when the enterprises started replacing business phones with the cheaper VOIP technology. Today, the rise of the consumer internet has increased the need for two way audio and video functionality in applications, driving demand for software tools and platforms that enable this utility.

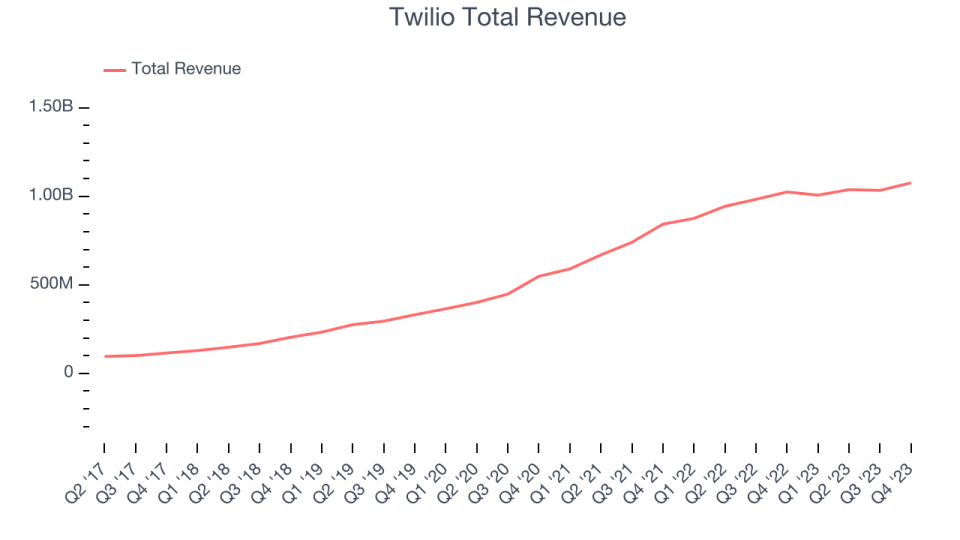

Sales Growth

As you can see below, Twilio's revenue growth has been strong over the last two years, growing from $842.7 million in Q4 FY2021 to $1.08 billion this quarter.

Twilio's quarterly revenue was only up 5% year on year, which might disappoint some shareholders. However, its revenue increased $42.28 million quarter on quarter, a strong improvement from the $4.09 million decrease in Q3 2023. This is a sign of acceleration of growth and very nice to see indeed.

Next quarter's guidance suggests that Twilio is expecting revenue to grow 2.3% year on year to $1.03 billion, slowing down from the 15% year-on-year increase it recorded in the same quarter last year.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Customer Growth

Twilio reported 305,000 customers at the end of the quarter, a decrease of 1,000 from the previous quarter, suggesting that the company's customer acquisition momentum is slowing.

Key Takeaways from Twilio's Q4 Results

It was good to see Twilio beat analysts' revenue expectations this quarter. That stood out as a positive in these results. On the other hand, its revenue guidance for next quarter missed analysts' expectations and its customer growth decelerated. Overall, this was a mixed quarter for Twilio. The company is down 9.9% on the results and currently trades at $65.25 per share.

Twilio may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.