Twilio (TWLO) to Report Q4 Earnings: What's in the Offing?

Twilio Inc. TWLO is slated to report fourth-quarter 2023 results on Feb 14.

For the fourth quarter, the company anticipates revenues between $1.03 billion and $1.04 billion. The Zacks Consensus Estimate for fiscal fourth-quarter revenues stands at $1.04 billion, indicating a marginal improvement of 1.5% from the year-ago quarter’s revenues of $1.02 billion.

Twilio anticipates non-GAAP earnings between 53 cents and 57 cents per share. The consensus mark for earnings is pegged at 57 cents per share, suggesting a strong 159.1% improvement from the year-ago quarter’s earnings of 22 cents per share.

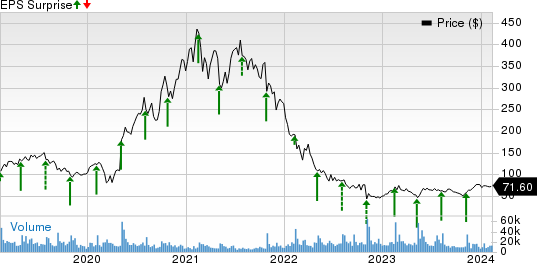

Twilio’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 157.8%.

Let’s see how things are shaping up for this announcement.

Twilio Inc. Price and EPS Surprise

Twilio Inc. price-eps-surprise | Twilio Inc. Quote

Factors at Play

Twilio’s fourth-quarter results are likely to reflect gains from continued digital transformation initiatives as organizations continue to reconfigure their setup for a hybrid operational environment. The strong uptake of Segment, the growing adoption of Twilio Flex and an increasing clientele base are likely to have favored the fourth-quarter performance.

In the last reported quarter, Twilio added around 2,000 new clients, taking the total active customer count to 306,000 as of Sep 30, 2023. In the fourth quarter, the company’s increasing scope among leading enterprises is likely to have acted as a key tailwind.

Solutions like Twilio Conversations, SendGrid Ads and SendGrid’s Email Validation application programming interface are likely to have contributed to the fourth-quarter performance. The company’s efforts to fortify its global footprint are likely to be reflected in the to-be-reported quarter's results.

However, softening IT spending as customers are pushing or postponing their large IT investment plans in the ongoing uncertain macroeconomic environment and geopolitical issues are likely to have weighed on the to-be-reported quarter’s top line.

Nonetheless, Twilio’s bottom line is likely to have benefited from its cost-saving initiatives, which include headcount reduction and the closure of several offices. The company ended the third quarter with 5,905 employees, down from the previous quarter’s 6,428 staff and the year-ago quarter’s 8,992 personnel.

What Our Model Says

Our proven model does not conclusively predict an earnings beat for Twilio this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. However, that’s not the case here.

Though TWLO currently carries a Zacks Rank of 2, it has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks With the Favorable Combination

Per our model, NVIDIA NVDA, Akamai Technologies AKAM and Block SQ have the right combination of elements to post an earnings beat in their upcoming releases.

NVIDIA carries a Zacks Rank #2 and has an Earnings ESP of +5.26%. The company is scheduled to report fourth-quarter 2023 results on Feb 21. Its earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 19%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for NVIDIA’s fourth-quarter earnings is pegged at $4.51 per share, indicating a year-over-year increase of 412.5%. The consensus mark for revenues stands at $20.18 billion, calling for a year-over-year rise of 233.5%.

Akamai is slated to report fourth-quarter 2023 results on Feb 13. The company has a Zacks Rank #3 and an Earnings ESP of +1.61% at present. Akamai’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 6.9%.

The Zacks Consensus Estimate for fourth-quarter earnings is pegged at $1.59 per share, suggesting an increase of 16.1% from the year-ago quarter’s earnings of $1.37. Akamai’s quarterly revenues are estimated to improve 7.5% to $997.6 million.

Block carries a Zacks Rank #3 and has an Earnings ESP of +1.05%. The company is scheduled to report fourth-quarter 2023 results on Feb 22. Its earnings beat the Zacks Consensus Estimate thrice in the preceding four quarters while missing on one occasion, with the average surprise being 11%.

The Zacks Consensus Estimate for Block’s fourth-quarter earnings stands at 60 cents per share, indicating a year-over-year improvement of 172.7%. It is estimated to report revenues of $5.69 billion, which suggests an increase of approximately 22.3% from the year-ago quarter.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Akamai Technologies, Inc. (AKAM) : Free Stock Analysis Report

Block, Inc. (SQ) : Free Stock Analysis Report

Twilio Inc. (TWLO) : Free Stock Analysis Report