Twist Bioscience Corp Reports Strong Revenue Growth in Q1 Fiscal 2024

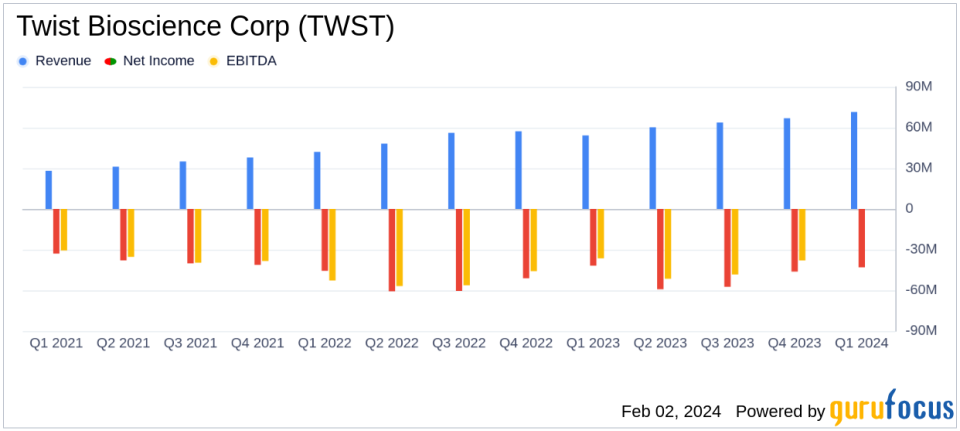

Revenue: Increased to $71.5 million in Q1 FY24, up 32% from $54.2 million in Q1 FY23.

Orders: Rose to $77.5 million in Q1 FY24, marking a 19% increase from the previous year.

Net Loss: Reported at $43.0 million, or $0.75 per share, slightly higher than $41.8 million, or $0.74 per share in Q1 FY23.

Gross Margin: Improved guidance to approximately 40% to 41% for FY24.

Cash Position: Ended the quarter with $311.1 million in cash, cash equivalents, and short-term investments.

Customer Growth: Shipped products to 2,140 customers, up from 2,060 in the same quarter last year.

On February 2, 2024, Twist Bioscience Corp (NASDAQ:TWST) released its 8-K filing, announcing its financial results for the first quarter of fiscal year 2024. The synthetic biology company, which specializes in the production of high-quality synthetic DNA using a proprietary silicon platform, reported a significant increase in revenue and orders, alongside a modest increase in net loss compared to the same period last year.

Twist Bioscience's revenue growth is a critical indicator of the company's expanding market presence and the increasing demand for its synthetic DNA products. The company's improved revenue guidance suggests confidence in its continued growth trajectory, which is particularly important in the competitive Medical Diagnostics & Research industry. The increased gross margin guidance also indicates improving efficiency and potential for higher profitability in the future.

Financial Performance and Challenges

Twist Bioscience's financial performance in the first quarter of fiscal 2024 reflects a robust increase in revenue across its main segments. Synbio revenue, which includes synthetic genes, oligo pools, and DNA libraries, grew to $26.8 million. NGS revenue saw a significant jump to $39.4 million, while Biopharma revenue was reported at $5.2 million. Despite these increases, the company faced a net loss of $43.0 million, or $0.75 per share, which is slightly higher than the net loss of $41.8 million, or $0.74 per share, in the first quarter of fiscal 2023. This net loss is an important consideration as it reflects ongoing challenges in achieving profitability.

Twist Bioscience's CEO, Emily M. Leproust, Ph.D., commented on the company's performance, stating:

"We're starting fiscal 2024 off strong with record revenue of $71.5 million for the first fiscal quarter, coming in above our projection, with a gross margin of 40.5%. In SynBio, after a limited launch of Express Genes in November, we expanded the offering to include midi and Maxi preps at Express speed and over time, we expect this offering will allow us to both expand our share of market and convert the Maker's Market of researchers who make their own genes into DNA buyers."

Key Financial Metrics

Twist Bioscience's financial achievements are underscored by the following key metrics:

Cost of revenues increased to $42.5 million in Q1 FY24 from $29.4 million in Q1 FY23, reflecting the company's investment in scaling operations.

Research and Development expenses decreased to $23.1 million from $31.2 million, indicating a more focused approach to innovation spending.

Selling, General and Administrative expenses rose to $52.8 million from $42.3 million, aligning with the company's growth strategy.

These metrics are important as they provide insight into the company's operational efficiency and its ability to manage costs while scaling its business.

Financial Analysis

Twist Bioscience's performance in the first quarter of fiscal 2024 demonstrates a strong start to the year, with significant revenue growth and a solid increase in orders. The company's strategic focus on expanding its product offerings, such as the Express Genes service, and its ability to attract a larger customer base are key drivers of this growth. However, the company must continue to manage its expenses and work towards profitability, as indicated by the net loss figures.

The company's balance sheet remains healthy, with a strong cash position of $311.1 million, providing it with the financial flexibility to invest in growth initiatives and navigate market challenges. The updated fiscal 2024 guidance reflects management's optimism about the company's future performance, with anticipated revenue growth and improved gross margins.

Twist Bioscience's advancements in the synthetic biology space and its commitment to financial discipline position it as a noteworthy player in the industry, with potential for long-term growth and value creation for its stakeholders.

For more detailed information on Twist Bioscience Corp's financial results, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Twist Bioscience Corp for further details.

This article first appeared on GuruFocus.