Is Twist Bioscience (TWST) Too Good to Be True? A Comprehensive Analysis of a Potential Value Trap

Value investors are perpetually seeking stocks priced below their intrinsic value. One stock that currently piques interest is Twist Bioscience Corp (NASDAQ:TWST). Despite a daily loss of 2.99%, the stock has seen a 3-month increase of 21.68%. However, its fair valuation, as indicated by its GF Value, is $81.08, significantly higher than its current price of $22.36.

Understanding the GF Value

The GF Value is a unique valuation model that estimates the intrinsic value of a stock. It considers historical multiples, GuruFocus adjustment factor, and future business performance estimates. If a stock price is significantly above the GF Value Line, it is overvalued, and vice versa.

Despite the apparent undervaluation of Twist Bioscience (NASDAQ:TWST), a closer look at its financial health reveals potential risks. With a low Piotroski F-score of 2, the company might be a value trap. This complexity underscores the necessity of thorough due diligence before investing.

The Piotroski F-Score: A Measure of Financial Health

The Piotroski F-score is a nine-criteria scoring system used to assess a company's financial health. A high score indicates robust financials, while a low score, like Twist Bioscience's current F-Score of 2, flags potential risks for investors.

Twist Bioscience: A Company Overview

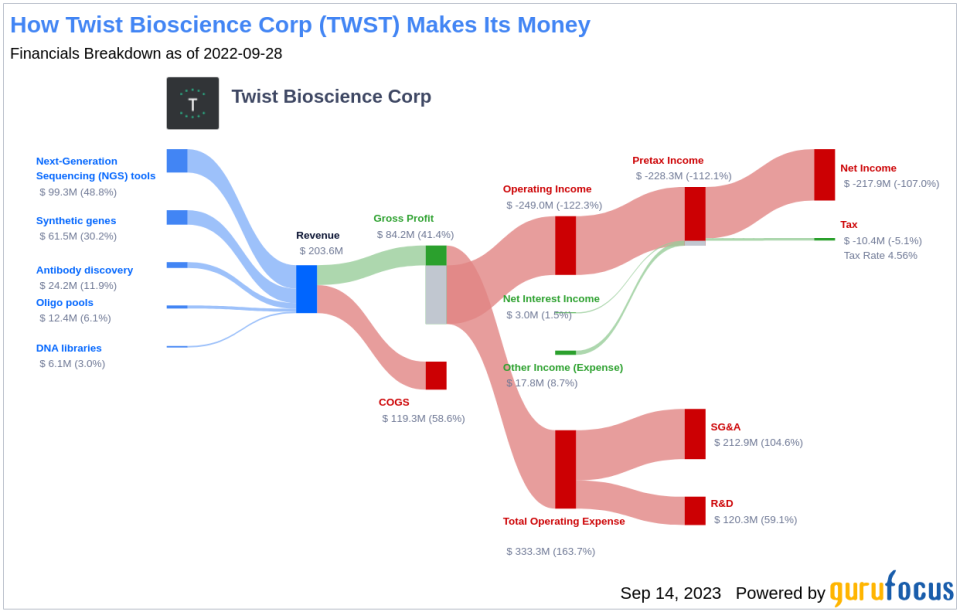

Twist Bioscience Corp is a synthetic biology company that develops a disruptive DNA synthesis platform. This platform synthesizes DNA on silicon, enabling high-quality synthetic DNA production faster and more affordably. Despite its innovative approach, the company's financials reveal potential concerns.

Analyzing Twist Bioscience's Profitability

Twist Bioscience's ROA reveals a concerning trend of negative returns, indicating the company's inability to generate profit from its assets. Furthermore, the discrepancy between the cash flow from operations ($-123.04 million) and the net income (-$209.49 million) over the trailing twelve months (TTM) further raises red flags about the company's earnings quality and financial stability.

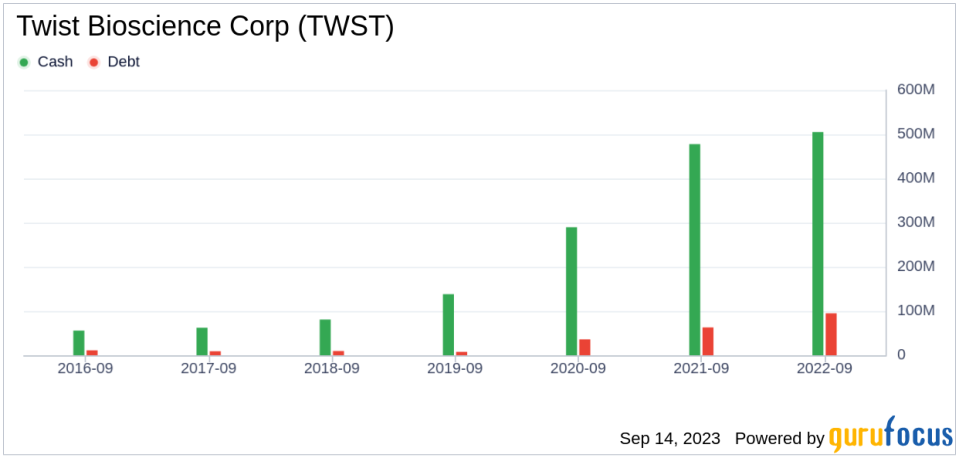

Leverage, Liquidity, and Source of Funds: A Worrying Trend

Twist Bioscience's debt-to-total assets ratio has been increasing over the past three years, suggesting escalating financial risk. Additionally, the company's declining current ratio suggests deteriorating liquidity and capability to manage immediate financial obligations.

Operating Efficiency: A Darker Picture

Twist Bioscience's increasing Diluted Average Shares Outstanding and declining asset turnover over the past three years suggest potential issues with shareholder value and operational efficiency. These trends, combined with the company's low Piotroski F-score, suggest that Twist Bioscience might indeed be a potential value trap.

Conclusion: A Potential Value Trap

Despite its seemingly attractive valuation, Twist Bioscience's financial health raises significant concerns. Its low Piotroski F-score, negative ROA, and increasing debt ratio suggest potential risks that investors should carefully consider. Therefore, despite its current undervaluation, Twist Bioscience might indeed be a value trap.

GuruFocus Premium members can find stocks with high Piotroski F-score using the following Screener: Piotroski F-score screener .

This article first appeared on GuruFocus.