Take-Two Interactive Software Inc (TTWO) Reports Mixed Fiscal Q3 2024 Results Amidst Strategic ...

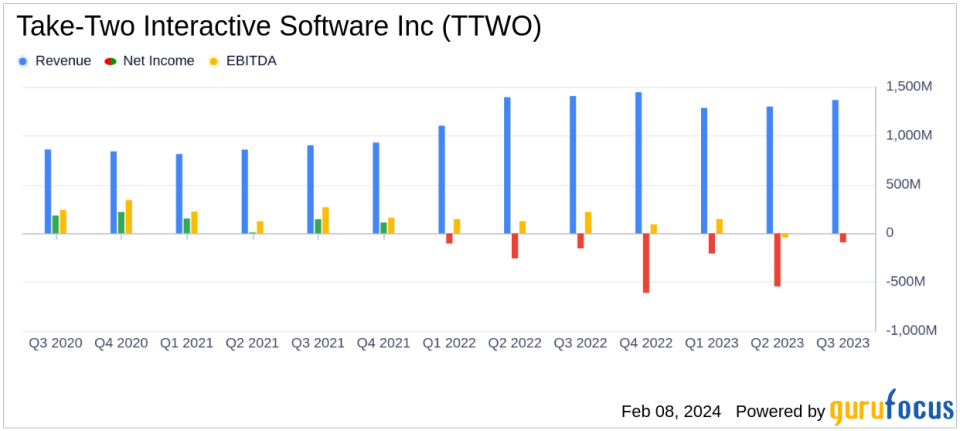

Net Bookings: Reported at $1.34 billion, a slight decrease from the previous year's $1.38 billion.

GAAP Net Revenue: Decreased by 3% year-over-year to $1.37 billion.

GAAP Net Loss: Improved to $91.6 million from a loss of $153.4 million in the same quarter last year.

Recurrent Consumer Spending: Dropped by 7% and represented 75% of total Net Bookings.

Outlook for Fiscal 2024: Revised Net Bookings forecast to $5.25 to $5.3 billion.

Cost Reduction Program: Take-Two is implementing significant cost reduction measures to maximize margins.

On February 8, 2024, Take-Two Interactive Software Inc (NASDAQ:TTWO) released its 8-K filing, detailing the financial outcomes for the third quarter of fiscal year 2024, which ended on December 31, 2023. The company, known for its high-profile gaming franchises like "Grand Theft Auto" and "NBA 2K," experienced a slight dip in Net Bookings compared to the same period last year, with a 3% decrease to $1.34 billion. Despite this, the company saw an improvement in its GAAP net loss, which was $91.6 million, or $0.54 per share, an improvement from the previous year's loss of $153.4 million, or $0.91 per share.

Take-Two Interactive Software Inc (NASDAQ:TTWO), founded in 1993, operates under three wholly owned labels: Rockstar Games, 2K, and Zynga. As one of the world's largest independent video game publishers, Take-Two boasts a portfolio of iconic titles across various platforms, including consoles, PCs, smartphones, and tablets. The company's performance is particularly significant in the interactive media industry, where recurrent consumer spending and digital sales are increasingly important revenue streams.

Financial Performance and Challenges

The company's financial achievements, such as the solid performance of "Grand Theft Auto V" and "Grand Theft Auto Online," along with the "Red Dead Redemption" series and Zynga's "Toon Blast," were offset by softer mobile advertising and sales for "NBA 2K24." The revised outlook for fiscal 2024 reflects these mixed results, as well as a planned release moving out of the fourth quarter and increased marketing for Zynga's new mobile game "Match Factory!." The company's strategic focus on cost reduction aims to maximize margins while still investing in growth, indicating a commitment to operational efficiency and long-term value creation.

Take-Two's Chairman and CEO, Strauss Zelnick, commented on the results:

"We achieved solid third quarter results, including Net Bookings of $1.3 billion. Grand Theft Auto V and Grand Theft Auto Online, the Red Dead Redemption series, and Zyngas in-app purchases, led by Toon Blast, exceeded our expectations... We are reducing our outlook for the year to reflect these factors... Our strategy is anchored in creativity, innovation, and efficiency. We are currently working on a significant cost reduction program across our entire business to maximize our margins, while still investing for growth."

Key Financial Metrics

Important metrics from the income statement, balance sheet, and cash flow statement include:

GAAP net revenue of $1.37 billion, a 3% decrease year-over-year.

GAAP net loss improved to $91.6 million, compared to last year's $153.4 million.

Recurrent consumer spending, a key driver of profitability in the gaming industry, accounted for 76% of total GAAP net revenue, despite a 7% decrease.

The company's GAAP results included an impairment charge of $53.4 million related to intangible assets.

These metrics are crucial as they provide insights into the company's ability to generate revenue from its core business activities and manage costs effectively. Recurrent consumer spending is particularly important for Take-Two, as it indicates the ongoing engagement of players with the company's games and services.

Analysis of Company's Performance

Take-Two's performance in the third quarter of fiscal 2024 reflects the challenges and opportunities within the interactive media industry. While the company has seen success with its flagship titles and in-app purchases, it faces headwinds in mobile advertising and certain game sales. The focus on cost reduction and operational efficiency is a strategic move to improve margins and position the company for future growth. With a robust pipeline of releases and a commitment to creativity and innovation, Take-Two aims to enhance its profitability and deliver value to shareholders in the long term.

For a more detailed analysis of Take-Two Interactive Software Inc (NASDAQ:TTWO)'s financial results and strategic initiatives, investors and interested parties are encouraged to review the full earnings release and accompanying financial tables.

Explore the complete 8-K earnings release (here) from Take-Two Interactive Software Inc for further details.

This article first appeared on GuruFocus.