Tyler Technologies Inc (TYL) Posts Strong SaaS Growth in Q4 2023 Earnings

Revenue Growth: Q4 total revenues increased by 6.3% to $480.9 million, with organic growth of 6.1%.

SaaS Revenue Surge: SaaS revenues soared by 21.7% to $141.0 million, marking the 12th consecutive quarter of over 20% growth.

Earnings Per Share: GAAP net income per diluted share rose by 25.2% to $0.91, while non-GAAP net income per diluted share increased by 15.6% to $1.89.

Free Cash Flow: Free cash flow for the quarter was up by 17.1%, reaching $134.4 million.

Strategic Acquisitions: Completed acquisitions of ResourceX and ARInspect for a combined purchase price of approximately $37 million.

Annual Guidance for 2024: Projected total revenues between $2.095 billion and $2.135 billion, with GAAP diluted EPS between $5.17 and $5.37.

On February 14, 2024, Tyler Technologies Inc (NYSE:TYL) released its 8-K filing, announcing its financial results for the fourth quarter ended December 31, 2023. The company, known for its comprehensive suite of software solutions and services for public sector entities, reported a solid increase in revenues and earnings, driven by robust growth in its SaaS offerings.

Fiscal Performance Highlights

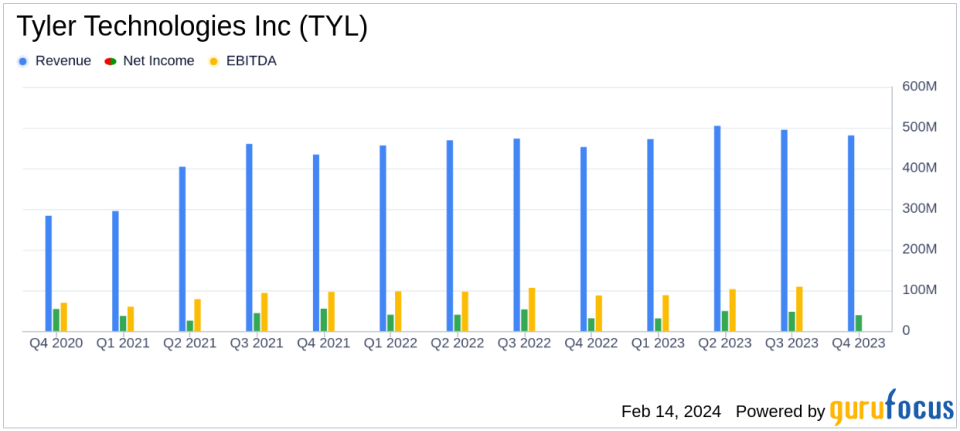

Tyler Technologies' total revenues for the fourth quarter rose to $480.9 million, a 6.3% increase compared to the same period last year. This growth was largely fueled by a 7.9% increase in recurring revenues, which now represent 83.9% of the company's total revenues. The standout performer was the company's SaaS revenues, which surged by 21.7% to $141.0 million, contributing significantly to the annualized recurring revenue (ARR) of $1.61 billion, up by 7.9%.

GAAP operating income for the quarter increased by 17.3% to $47.7 million, while non-GAAP operating income grew by 9.7% to $107.4 million. GAAP net income saw a substantial rise of 25.2% to $38.9 million, or $0.91 per diluted share. Non-GAAP net income also saw a healthy increase, up by 15.6% to $81.4 million, or $1.89 per diluted share. Adjusted EBITDA improved by 7.4%, reaching $117.9 million.

Strategic Growth and Financial Health

During the quarter, Tyler Technologies completed strategic acquisitions of ResourceX and ARInspect, enhancing its product offerings and technological capabilities. The company's balance sheet remains strong, with aggressive debt reduction leading to a net leverage of under one times proforma EBITDA by year-end.

President and CEO Lynn Moore highlighted the company's successful year in cloud transition and operating margin expansion, stating:

"Our fourth quarter results reflected a strong finish to a pivotal year in our cloud transition and a return to year-over-year operating margin expansion. We achieved our key objectives for the year and both earnings and cash flow surpassed our expectations."

Moore also expressed optimism for 2024, citing a healthy public sector market and ongoing strategic initiatives, including cloud migration and data center exits.

Looking Ahead

For the full year 2024, Tyler Technologies anticipates total revenues to be in the range of $2.095 billion to $2.135 billion. GAAP diluted earnings per share are expected to range from $5.17 to $5.37, with non-GAAP diluted earnings per share projected between $8.90 and $9.10. The company also expects a free cash flow margin between 17% and 19%.

This earnings report underscores Tyler Technologies' continued growth trajectory and its commitment to expanding its SaaS offerings, which are crucial for the software industry. The company's strategic acquisitions and focus on recurring revenue streams position it well for sustained financial health and operational efficiency.

Investors and stakeholders can look forward to Tyler Technologies' conference call on February 15, 2024, for further discussion of the company's results and future outlook.

Explore the complete 8-K earnings release (here) from Tyler Technologies Inc for further details.

This article first appeared on GuruFocus.