Tyson Foods Inc (TSN) Reports Mixed Q1 2024 Results Amidst Market Challenges

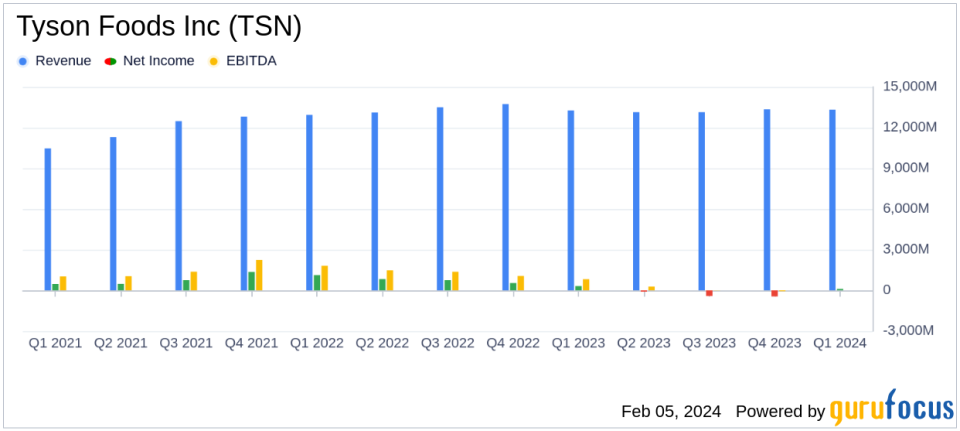

Sales: Marginally increased to $13,319 million, up 0.4% from the previous year.

Operating Income: GAAP operating income plunged by 51% to $231 million.

Adjusted Operating Income: Non-GAAP measure down 9% to $411 million.

Net Income Per Share: GAAP EPS plummeted by 66% to $0.30, while adjusted EPS decreased by 19% to $0.69.

Liquidity: Remained robust at approximately $3.7 billion as of December 30, 2023.

Segment Performance: Beef and Pork segments faced volume declines, while Chicken and Prepared Foods showed mixed results.

On February 5, 2024, Tyson Foods Inc (NYSE:TSN) released its 8-K filing, detailing its financial performance for the first quarter of 2024. The company, a leading protein-focused food producer known for brands like Tyson, Jimmy Dean, and Hillshire Farm, reported a slight increase in sales but faced significant declines in operating income and earnings per share (EPS).

Tyson Foods' diverse protein portfolio includes significant segments in chicken and beef, each accounting for about one-third of U.S. sales, and a prepared foods segment that contributes roughly 20% of sales. Despite its size, the company faces stiff competition in several product categories and is actively seeking growth through acquisitions, particularly in international and food-service markets.

The first quarter results highlighted a challenging environment for Tyson Foods. While sales increased marginally by 0.4% to $13,319 million, GAAP operating income saw a sharp decline of 51% to $231 million compared to the prior year. Adjusted operating income, a non-GAAP financial measure, also decreased by 9% to $411 million. This decline in profitability is significant as it reflects the pressures faced by the company in maintaining its operational efficiency amidst market headwinds.

Net income per share attributable to Tyson was particularly hard hit, with GAAP EPS dropping by 66% to $0.30, and adjusted EPS falling by 19% to $0.69. This stark decrease in earnings highlights the challenges Tyson Foods is facing in translating sales into net income.

The company's liquidity remained strong, with approximately $3.7 billion on hand as of December 30, 2023. This financial health is crucial for Tyson Foods as it navigates the current economic landscape and invests in strategic initiatives.

Segment results were mixed, with the Beef segment experiencing a volume decrease of 4.1% but an average price increase of 10.5%. The Pork segment saw a volume increase of 7.7% but faced a price decrease of 8.5%. The Chicken segment's volume decreased by 1.5%, with a 3.9% drop in average price. Prepared Foods showed a slight volume increase of 2.5% but a price decrease of 2.3%. These figures indicate varying market dynamics across Tyson Foods' diverse product lines.

Looking ahead, Tyson Foods anticipates a slight increase in domestic protein production for fiscal 2024. The company's outlook includes adjusted operating income projections ranging from $1.0 billion to $1.5 billion and sales expected to be relatively flat compared to fiscal 2023. Capital expenditures are projected to be between $1.0 billion and $1.5 billion, focusing on profit improvement and maintenance projects.

Despite the mixed results, President & CEO Donnie King expressed confidence in the company's strategic path, stating,

Our team executed well in the quarter and delivered tangible results, including our third sequential quarter of adjusted operating income growth,"

and emphasizing the company's commitment to delivering long-term shareholder value.

Value investors may find Tyson Foods' current position and future outlook a point of interest, as the company continues to navigate industry challenges while maintaining a strong liquidity position and focusing on operational excellence.

For more detailed information on Tyson Foods Inc (NYSE:TSN)'s financial performance, investors are encouraged to review the full earnings release and financial statements.

Explore the complete 8-K earnings release (here) from Tyson Foods Inc for further details.

This article first appeared on GuruFocus.