Tyson Foods (NYSE:TSN) Reports Q1 In Line With Expectations, Stock Soars

Meat company Tyson Foods (NYSE:TSN) reported results in line with analysts' expectations in Q1 FY2024, with revenue flat year on year at $13.32 billion. It made a non-GAAP profit of $0.69 per share, down from its profit of $0.85 per share in the same quarter last year.

Is now the time to buy Tyson Foods? Find out by accessing our full research report, it's free.

Tyson Foods (TSN) Q1 FY2024 Highlights:

Revenue: $13.32 billion vs analyst estimates of $13.26 billion (small beat)

EPS (non-GAAP): $0.69 vs analyst estimates of $0.42 (63.5% beat)

2024 guidance of flat revenue vs. 2023 and adjusted operating income of $1.25 billion at the midpoint both missed slightly

Free Cash Flow of $946 million is up from -$52 million in the previous quarter

Gross Margin (GAAP): 6.2%, down from 7.1% in the same quarter last year

Market Capitalization: $20.08 billion

"Our team executed well in the quarter and delivered tangible results, including our third sequential quarter of adjusted operating income growth," said Donnie King, President & CEO, Tyson Foods.

Started as a simple trucking business, Tyson Foods (NYSE:TSN) today is one of the world’s largest producers of chicken, beef, and pork.

Packaged Food

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods, prepared meals, or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences.The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

Sales Growth

Tyson Foods is one of the most widely recognized consumer staples companies in the world. Its influence over consumers gives it extremely high negotiating leverage with distributors, enabling it to pick and choose where it sells its products (a luxury many don't have).

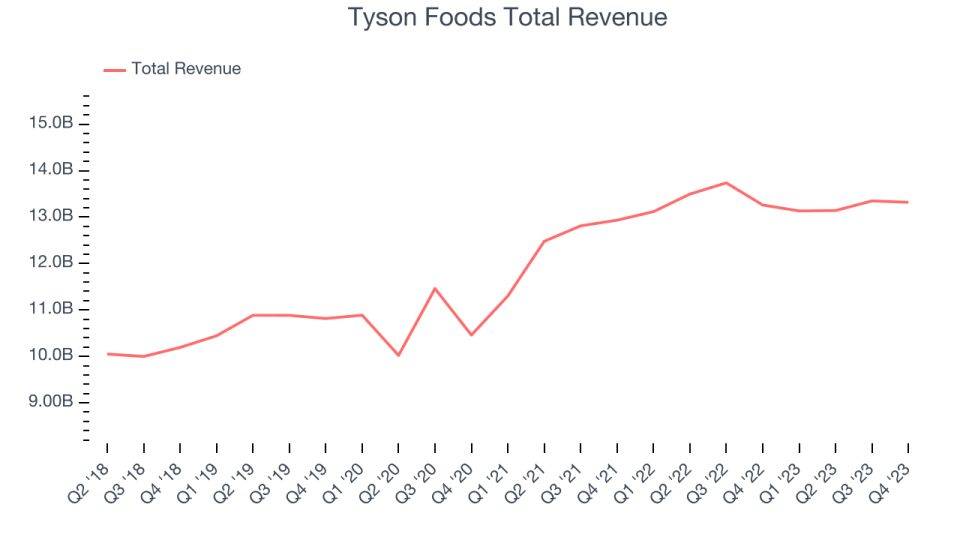

As you can see below, the company's annualized revenue growth rate of 7.3% over the last three years was decent for a consumer staples business.

This quarter, Tyson Foods grew its revenue by 0.4% year on year, and its $13.32 billion in revenue was in line with Wall Street's estimates. Looking ahead, Wall Street expects revenue to remain flat over the next 12 months.

Our recent pick has been a big winner, and the stock is up more than 2,000% since the IPO a decade ago. If you didn’t buy then, you have another chance today. The business is much less risky now than it was in the years after going public. The company is a clear market leader in a huge, growing $200 billion market. Its $7 billion of revenue only scratches the surface. Its products are mission critical. Virtually no customers ever left the company. You can find it on our platform for free.

Key Takeaways from Tyson Foods's Q1 Results

Revenue beat by a small amount while gross margin and EPS beat more convincingly. Guidance for 2024 revenue to be flat and adjusted operating income to be $1.25 billion at the midpoint was slightly below expectations, but the market seemed ok with this. Zooming out, we think this was still a decent, albeit mixed, quarter, showing that the company is staying on track. The stock is up 5.3% after reporting and currently trades at $59.3 per share.

So should you invest in Tyson Foods right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.