Tyson Foods (TSN) Fosters Growth With New Production Facility

Tyson Foods, Inc. TSN has been committed to expanding its production capacity to cater to the rising demand for its products. The meat product behemoth has inaugurated a new fully-cooked food production facility in Danville, VA, worth $300 million.

Spanning 325,000 square feet, the facility marks a major investment in the local community. It is expected to generate around four million pounds of high-quality, fully cooked poultry products weekly to serve the burgeoning demand for the company’s brand products across both retail and foodservice sectors.

This action goes in tandem with Tyson Foods’ strategy to fuel sustained growth, enhance operational efficiency and invest in its poultry space. It marks the company's most automated plants to date, showcasing the implementation of large-scale innovation pilots and prototypes. Also, it has created around 400 new jobs in southeastern Virginia.

This new facility underscores Tyson Foods’ dedication to enhancing the communities it operates in. The Danville facility is not only a testament to this commitment but also a significant stride toward achieving operational excellence through strategic investments in innovative technology and automation.

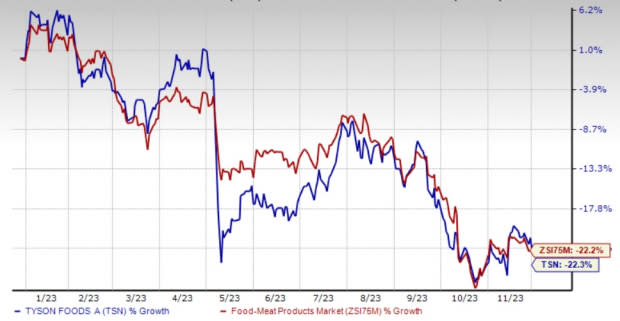

Image Source: Zacks Investment Research

What’s More?

Tyson Foods has been implementing various operational and supply chain efficiency initiatives to strengthen its long-term position. As part of these efforts, the company is making strategic investments in capacity expansion and automation technology. The focus is on advancing digitalization through supply-chain planning and execution processes to elevate customer service.

Management has been optimizing its plant network by incorporating fully cooked capacity, transforming plants for value-added production, implementing plant flexibility measures and refining the portfolio mix. These actions collectively aim to enhance overall operational effectiveness and contribute to the company's sustained growth.

Tyson Foods has been investing heavily in automation. In this regard, the company recently rolled out automated sandwich hand wrap, burrito assembly capabilities and an automated line to serve snacking production. In May 2023, the company acquired Williams Sausage Company, which is likely to solidify Tyson Foods’ product portfolio and manufacturing capacity.

Tyson Foods is actively pursuing an expansion into international markets as part of its strategic growth plan. In July 2022, the company unveiled a strategic partnership with Tanmiah Food Company, a prominent Middle East-based provider of fresh and processed poultry, as well as other processed meat products, animal feed and health products. This collaboration enables Tyson Foods to tap into poultry supplies in Saudi Arabia, positioning the company to meet the increasing demand for protein in the Middle East and other global markets.

Wrapping Up

This Zacks Rank #5 (Strong Sell) company has been seeing hurdles in the Beef segment, wherein volumes fell 6.7% in the fourth quarter of fiscal 2023. For fiscal 2024, the United States Department of Agriculture (“USDA”) projects domestic protein production for beef to decline 5% versus fiscal 2023. Shares of the company have tumbled 22.3% year to date compared with the industry’s decline of 22.2%.

That said, a focus on capacity expansion to meet the growing demand keeps Tyson Foods well-placed for long-term growth.

3 Appetizing Bets

Lamb Weston LW, which offers frozen potato products, sports a Zacks Rank #1 (Strong Buy) at present. LW has a trailing four-quarter earnings surprise of 46.2%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Lamb Weston’s current financial-year sales and earnings suggests growth of 28.3% and 24.8%, respectively, from the year-ago reported numbers.

The Kraft Heinz Company KHC, a food and beverage product company, currently carries a Zacks Rank #2 (Buy). KHC has a trailing four-quarter earnings surprise of 9.9%, on average.

The Zacks Consensus Estimate for Kraft Heinz’s current fiscal-year sales suggests growth of 1.2% from the corresponding year-ago reported figure.

Vital Farms Inc. VITL offers a range of produced pasture-raised foods. It currently has a Zacks Rank #2. VITL has a trailing four-quarter earnings surprise of 145%, on average.

The Zacks Consensus Estimate for Vital Farms’ current financial-year sales suggests growth of 29.4% from the year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tyson Foods, Inc. (TSN) : Free Stock Analysis Report

Kraft Heinz Company (KHC) : Free Stock Analysis Report

Lamb Weston (LW) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report