U.S. Bancorp (USB) Navigates Economic Headwinds with Mixed Q4 Results

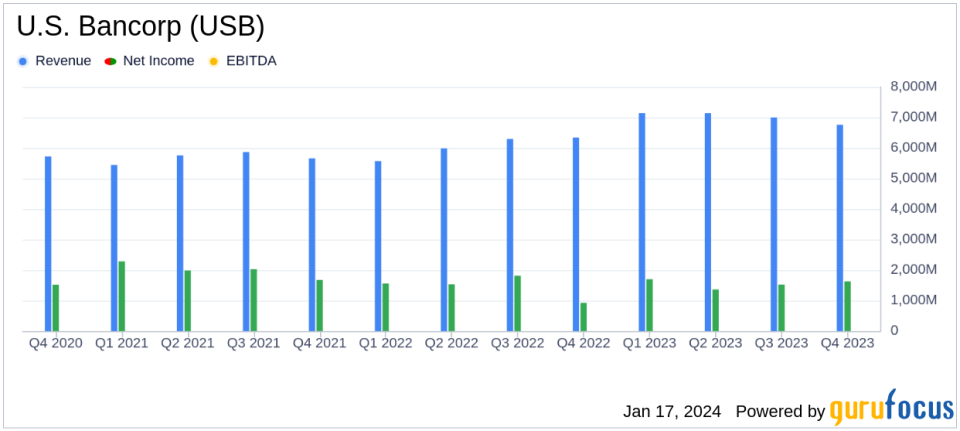

Net Revenue: Q4 net revenue stood at $6.8 billion, adjusted for notable items, with a full-year record of $28.3 billion.

Net Income: Q4 net income was $1.6 billion, adjusted for notable items, with a full-year total of $5.4 billion.

Diluted Earnings Per Share: Adjusted diluted EPS for Q4 reached $0.99, while the full-year adjusted EPS was $4.31.

Loan and Deposit Growth: Year-over-year average total loan growth was 3.6%, with deposit growth at 4.3%.

Capital Ratios: The CET1 capital ratio improved to 9.9% as of December 31, 2023.

Efficiency Ratio: The adjusted efficiency ratio for Q4 was 61.1%, reflecting operational efficiency.

Notable Items: The quarter included several notable charges, such as $734 million FDIC special assessment and $171 million related to MUB merger integration.

On January 17, 2024, U.S. Bancorp (NYSE:USB) released its 8-K filing, detailing the financial results for the fourth quarter and full year of 2023. The diversified financial-services provider, which operates across 26 states and offers a range of services from retail to commercial banking, faced a challenging economic environment but managed to post solid fee revenue growth and maintain strong capital levels.

Financial Performance and Challenges

U.S. Bancorp's Q4 performance was marked by a mix of achievements and challenges. The company reported a net revenue of $6.8 billion when adjusted for notable items, with net interest income on a taxable-equivalent basis at $4.1 billion. However, the reported net income of $847 million and diluted earnings per share (EPS) of $0.49 were impacted by notable items totaling $1.1 billion. Adjusting for these items, the net income applicable to common shareholders was $1.6 billion, with an adjusted diluted EPS of $0.99.

The bank's profitability metrics, such as return on average assets and return on average common equity, were affected by various charges, including merger and integration-related charges and a significant FDIC special assessment. Despite these headwinds, U.S. Bancorp's full-year net revenue reached a record high of $28.3 billion, adjusted for notable items, and the CET1 capital ratio improved to 9.9%, showcasing the bank's resilience and strong capital position.

Key Financial Metrics

Important metrics for U.S. Bancorp include the net interest margin, which decreased to 2.78% in Q4 from 3.01% in the same quarter of the previous year, reflecting the impact of higher interest rates on deposit mix and pricing. The efficiency ratio, a measure of the bank's operational efficiency, stood at an adjusted 61.1% for the quarter. The bank also reported average total loan growth of 3.6% year-over-year, although there was a slight decrease on a linked quarter basis.

"In the fourth quarter, we reported diluted earnings per share of $0.99, excluding $(0.50) of notable items. This quarter we generated net revenue of $6.8 billion and increased our tangible book value per share to $22.30, an increase of 7% linked quarter. Full year results showcased solid fee revenue growth, prudent expense management, and the accretion of common equity tier 1 capital of 150 basis points, giving us a CET1 ratio of 9.9% as of December 31, 2023. We also met our goal this year of achieving full run-rate cost synergies of $900 million with the Union Bank acquisition. Looking ahead, we are making good progress on revenue growth opportunities with Union Bank and effectively managing the balance sheet for continued capital-efficient growth as we maintain our disciplined, through-the-cycle approach to credit risk management. In many ways, both fourth quarter and full year results highlighted the benefits of our well-diversified business model, enhanced scale, and operational resiliency, as we remained focused on delivering shareholder value," said Andy Cecere, Chairman, President, and CEO of U.S. Bancorp.

Analysis and Outlook

U.S. Bancorp's performance in the fourth quarter, while impacted by notable items, still reflects the underlying strength of its diversified business model and its ability to manage expenses and grow fee revenue. The bank's focus on achieving cost synergies from the Union Bank acquisition and its prudent approach to credit risk management positions it well for future growth. However, the economic outlook and the potential for increased credit losses present ongoing challenges that the bank will need to navigate.

Investors and stakeholders will be watching closely to see how U.S. Bancorp continues to leverage its scale and operational efficiency to deliver value in a changing economic landscape.

For further details and to access the full earnings report, please visit the U.S. Bancorp website or contact their investor relations team.

Explore the complete 8-K earnings release (here) from U.S. Bancorp for further details.

This article first appeared on GuruFocus.