U.S. Cellular (USM) Q2 Earnings Miss Estimates, Revenues Fall

United States Cellular Corporation USM reported soft second-quarter 2023 results, with the top and the bottom line missing the respective Zacks Consensus Estimate. The Chicago-based leading full-service wireless carrier reported lower revenues year over year due to declining equipment sales and service revenues.

However, healthy traction in the fixed wireless portfolio and 10% year-over-year growth in tower revenues partially cushioned the top line. The company’s ongoing efforts of cost optimization that enable it to mitigate inflationary pressure and continuous 5G investments are some other positive factors.

Net Income

The company registered a net income of $5 million or 5 cents per share compared with $21 million or 25 cents per share in the prior-year quarter. The bottom line fell short of the Zacks Consensus Estimate by 16 cents. The decline was primarily attributed to a top-line contraction year over year.

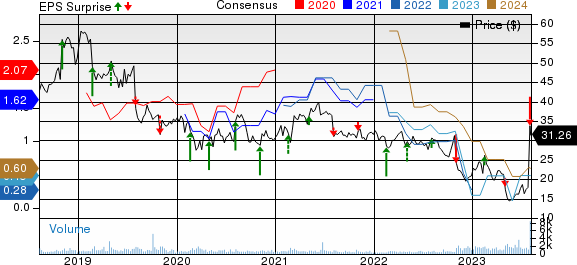

United States Cellular Corporation Price, Consensus and EPS Surprise

United States Cellular Corporation price-consensus-eps-surprise-chart | United States Cellular Corporation Quote

Revenues

Quarterly operating revenues totaled $957 million compared with $1,027 million in the prior-year quarter. Declining total postpaid and prepaid retail connections hindered net sales during the quarter. The top line missed the Zacks Consensus Estimate by $39 million.

Revenues from Service declined to $760 million from $783 million in the year-earlier quarter. Equipment sales contributed $197 million to revenues compared with $244 million in the prior-year quarter.

Handset connections fell to 83,000 from 94,000 in the year-ago quarter. However, lower postpaid handset churn is a positive factor. The loss of net prepaid connections was 8,000 compared with a loss of 4,000 in the year-earlier quarter. Fixed wireless subscribers count reached 96,000, up from 58,000 in the year-ago quarter. Tower rental revenues improved to $25.2 million from $22.9 million in the prior-year quarter.

Postpaid average revenues per user (ARPU) rose to $50.64 from $50.07. Postpaid average revenues per account fell to $130.19 from $130.43 in the year-ago quarter. Postpaid churn rate was 1.21%, down from 1.3%.

Prepaid ARPU was $33.86, down from $35.25 in the prior-year quarter. The prepaid churn rate increased to 4.18% from the prior-year quarter’s 4.07%.

Quarterly Details

Total operating expenses were $923 million, down 7% year over year. Operating income declined to $34 million from $40 million in the year-ago quarter due to lower net sales. Adjusted EBITDA in the quarter was $239 million, down from $261 million in the prior year quarter. Adjusted OIBDA was $198 million, down 10% year over year.

Cash Flow & Liquidity

In the second quarter of 2023, U.S. Cellular generated $349 million of cash in operating activities compared with $267 million cash generated in the prior-year quarter. As of Jun 30, 2023, the company had $186 million in cash and cash equivalents and $3,105 million in long-term debt. It reduced the debt balance by $150 million during the quarter.

Outlook

For 2023, U.S. Cellular lowered its expectations for service revenues to $3,025-3,075 million from the previously estimated range of $3,050-$3150 million. The company raised the lower range of adjusted EBITDA to $925-$1025 million from $875-$1,025 million estimated previously. Management expects capital expenditures in the band of $600-700 million. Adjusted OIBDA is estimated within the range of $750-850 million compared with $725-$875 million expected previously.

Zacks Rank & Stocks to Consider

U.S. Cellular currently carries a Zacks Rank #3 (Hold).

InterDigital, Inc. IDCC, carrying a Zacks Rank #2 (Buy), delivered an earnings surprise of 168.01%, on average, in the trailing four quarters. In the last reported quarter, it pulled off an earnings surprise of 7.44%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

It is a pioneer in advanced mobile technologies that enable wireless communications and capabilities. The company engages in designing and developing a wide range of advanced technology solutions, which are used in digital cellular and wireless 3G, 4G and IEEE 802-related products and networks.

Workday Inc. WDAY, sporting a Zacks Rank #1, delivered an earnings surprise of 13.05%, on average, in the trailing four quarters. In the last reported quarter, it pulled off an earnings surprise of 18.02%.

Workday is a provider of enterprise-level software solutions for financial management and human resource domains. The company’s cloud-based platform combines finance and HR in a single system that makes it easier for organizations to provide analytical insights and decision support.

Meta Platforms Inc. META, carrying a Zacks Rank #2, delivered an earnings surprise of 18.99%, on average, in the trailing four quarters. Meta is the world’s largest social media platform. The company’s portfolio offering evolved from a single Facebook app to multiple apps like the photo and video-sharing app, Instagram, and the WhatsApp messaging app, owing to acquisitions.

Meta is considered to have pioneered the concept of social networking, which is why it enjoys a first-mover advantage in this market. As developed regions mature, Meta undertakes measures to drive penetration in emerging markets of South East Asia, Latin America and Africa.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United States Cellular Corporation (USM) : Free Stock Analysis Report

InterDigital, Inc. (IDCC) : Free Stock Analysis Report

Workday, Inc. (WDAY) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report