U.S. Silica (SLCA) Concludes $25 Million Loan Repurchase

U.S. Silica Holdings, Inc. SLCA has announced the completion of a $25 million voluntary term loan principal repayment. The debt was paid off on par, utilizing excess cash on hand.

Given its strong business performance and cash flow generation, the company is retiring additional debt and reinforcing its balance sheet. Last year, it paid off $284 million in debt, lowering its overall debt by 24%.

As envisioned, SLCA is investing in additional capacity, new capabilities and innovative new products. As part of its long-term strategy for capitalizing on future growth opportunities and increasing shareholder value, U.S. Silica is committed to improving its leverage profile.

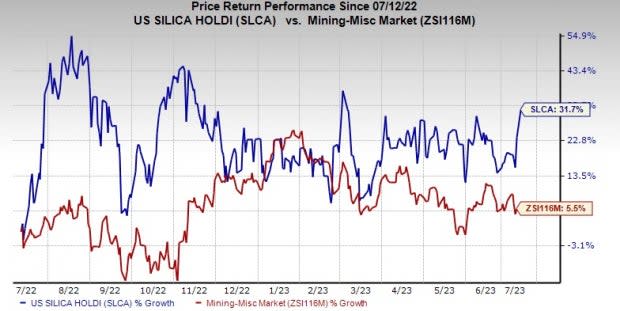

The stock has gained 31.7% over the past year compared with a 5.5% rise of its industry.

Image Source: Zacks Investment Research

U.S. Silica, on its first-quarter call, noted that its two business segments are well-placed in their respective markets for the second quarter. It has a strong portfolio of Industrial and Specialty Products that serve several essential, high-growth and attractive end markets, backed by a strong pipeline of products under development. It also expects growth in its underlying base business, along with pricing hikes and surcharges, to continue combating inflationary impacts.

In the Oil & Gas segment, the company expects a multi-year growth cycle. The strength in WTI crude oil prices supports an active well-completion environment in 2023.

The company is focused on delivering a free cash flow in 2023, deleveraging its balance sheet. It plans to generate significant operating cash flow in the year as well. It forecasts capital expenditure of $50-$60 million for the year.

U.S. Silica Holdings, Inc. Price and Consensus

U.S. Silica Holdings, Inc. price-consensus-chart | U.S. Silica Holdings, Inc. Quote

Zacks Rank & Key Picks

U.S. Silica currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks to consider in the basic materials space include Carpenter Technology Corporation CRS, Silvercorp Metals Inc. SVM and Linde plc LIN.

CRS currently carries a Zacks Rank #1 (Strong Buy). The Zacks Consensus Estimate for current-year earnings for CRS is currently pegged at $1.04, implying year-over-year growth of 6.3%. It has a trailing four-quarter earnings surprise of roughly 198.1%, on average. The stock has gained around 111.9% in a year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Silvercorp Metals currently carries a Zacks Rank #1. The consensus estimate for current fiscal-year earnings for Silvercorp is currently pegged at 27 cents, suggesting year-over-year growth of 28.6%. The stock has jumped roughly 24.6% in the past year.

Linde currently carries a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for LIN’s current-year earnings has been revised 3.8% upward in the past 60 days. Linde beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 6.9% on average. The stock has gained roughly 32.8% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

U.S. Silica Holdings, Inc. (SLCA) : Free Stock Analysis Report

Linde PLC (LIN) : Free Stock Analysis Report

Silvercorp Metals Inc. (SVM) : Free Stock Analysis Report