U.S. Silica (SLCA) Q2 Earnings Beat on Higher Oil & Gas Margin

U.S. Silica Holdings, Inc. SLCA logged second-quarter 2023 earnings of 59 cents per share, up from 29 cents in the prior-year quarter.

Adjusted earnings in the reported quarter were 60 cents per share, up from 32 cents in the year-ago quarter. It topped the Zacks Consensus Estimate of 54 cents.

U.S. Silica recorded revenues of $406.8 million, up around 5% year over year. It missed the Zacks Consensus Estimate of $434.8 million.

The company benefited from expanded contribution margin in the Oil and Gas segment on the back of higher sand prices, reduced operational costs and increased transportation margins for SandBox. Its Industrial & Specialty Products division also benefited from higher prices, improved operational efficiencies, lower costs and increased sales of higher-margin products.

U.S. Silica Holdings, Inc. Price, Consensus and EPS Surprise

U.S. Silica Holdings, Inc. price-consensus-eps-surprise-chart | U.S. Silica Holdings, Inc. Quote

Segmental Highlights

Revenues in the Oil & Gas division amounted to $262.3 million in the reported quarter, up 7% year over year. It was below our estimate of $299.6 million. Sales volume fell 3% year over year to 3.419 million tons. Oil & Gas contribution margin rose 28% year over year to $99.1 million. It, however, fell short of our estimate of $109.7 million.

Revenues in the Industrial & Specialty Products division were to $144.5 million in the quarter, essentially flat year over year. It was above our estimate of $132.4 million. Sales volume declined 7% year over year to 1.040 million tons. The segment’s contribution margin was $51.6 million in the quarter, up 12% year over year. It beat our estimate of $49 million.

Financials

At the end of the quarter, the company’s cash and cash equivalents were $187 million, down around 40% year over year. Long-term debt declined roughly 27% year over year to $871.9 million.

The company generated $92.1 million in cash flow from operations during the reported quarter.

Outlook

For the third quarter of 2023, U.S. Silica noted that its two business segments are well-placed in their respective markets. It has a strong portfolio of Industrial and Specialty Products that serve several essential, high-growth and attractive end markets, backed by a strong pipeline of products under development. It also expects growth in its underlying base business along with pricing hikes.

In the Oil & Gas segment, the company expects a multi-year growth cycle. The strength in crude oil prices supports an active well completion environment over the next few years.

The company is focused on delivering a free cash flow and deleveraging its balance sheet. It plans to generate significant operating cash flow this year. SLCA forecasts capital expenditure of $50-$60 million for 2023.

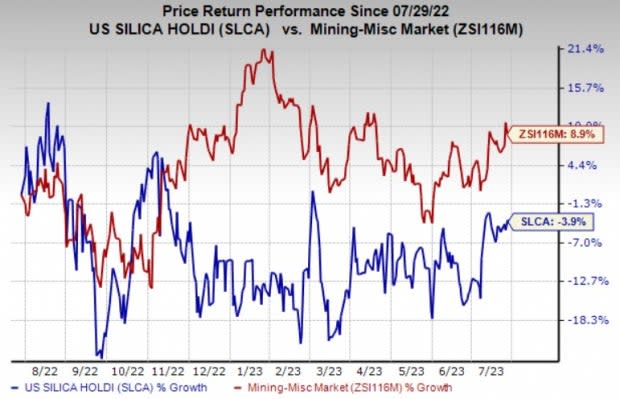

Price Performance

Shares of U.S. Silica are down 3.9% in the past year compared with an 8.9% rise of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Other Key Picks

U.S. Silica currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks worth a look in the basic materials space include PPG Industries, Inc. PPG, Carpenter Technology Corporation CRS and Silvercorp Metals Inc. SVM.

PPG Industries currently carries a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for PPG's current-year earnings has been revised 3% upward over the past 60 days.

PPG Industries’ earnings beat the Zacks Consensus Estimate in three of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 7.3%, on average. PPG shares have gained around 12% in a year.

The Zacks Consensus Estimate for current-year earnings for CRS is currently pegged at $1.04, implying year-over-year growth of 198.1%. Carpenter Technology currently carries a Zacks Rank #1(Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Carpenter Technology has a trailing four-quarter earnings surprise of roughly 30.9%, on average. The stock has rallied around 83% in a year.

Silvercorp Metals currently carries a Zacks Rank #2. The consensus estimate for current fiscal-year earnings for SVM is currently pegged at 26 cents, suggesting year-over-year growth of 23.8%.

Silvercorp Metals has a trailing four-quarter earnings surprise of roughly 12.5%, on average The stock has rallied gained 11% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PPG Industries, Inc. (PPG) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

U.S. Silica Holdings, Inc. (SLCA) : Free Stock Analysis Report

Silvercorp Metals Inc. (SVM) : Free Stock Analysis Report