U.S. Silica (SLCA) Q3 Earnings Beat Estimates, Revenues Lag

U.S. Silica Holdings, Inc. SLCA logged earnings of 34 cents per share in third-quarter 2023, down from 41 cents in the prior-year quarter.

Adjusted earnings in the reported quarter were 38 cents per share, down from 43 cents in the year-ago quarter. It topped the Zacks Consensus Estimate of 36 cents.

U.S. Silica recorded revenues of $367 million, down around 12% year over year. The metric missed the Zacks Consensus Estimate of $383.8 million.

The company was able to maintain high margin levels in the Oil and Gas segment due to cost savings and favorable prices, notwithstanding reduced demand for products and services. Its Industrial & Specialty Products division benefited from ongoing structural cost reductions, a better product mix resulting from sales in new markets and applications, and price increases.

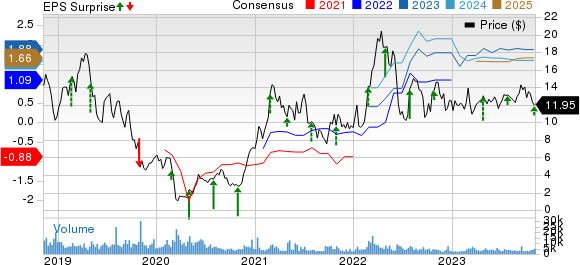

U.S. Silica Holdings, Inc. Price, Consensus and EPS Surprise

U.S. Silica Holdings, Inc. price-consensus-eps-surprise-chart | U.S. Silica Holdings, Inc. Quote

Segmental Highlights

Revenues in the Oil & Gas division amounted to $231.4 million in the reported quarter, down 13% year over year. It was below our estimate of $249.1 million. Sales volume fell 11% year over year to 3.122 million tons. Oil & Gas contribution margin fell 3% year over year to $82.9 million. The figure, however, topped our estimate of $80.8 million.

Revenues in the Industrial & Specialty Products division were $135.5 million in the quarter, down 10% year over year. It was below our estimate of $138.2 million. Sales volume declined 11% year over year to 0.999 million tons. The segment’s contribution margin was $46.3 million in the quarter, flat year over year. It lagged our estimate of $48.6 million.

Financials

At the end of the quarter, the company’s cash and cash equivalents were $222.4 million, down around 17% year over year. Long-term debt declined nearly 22% year over year to $847.8 million.

The company generated $76.7 million in cash flow from operations during the reported quarter.

Outlook

For the fourth quarter of 2023, U.S. Silica noted that its two business segments are well-placed in their respective markets. It has a strong portfolio of Industrial and Specialty Products that serve several essential, high-growth and attractive end markets, backed by a strong pipeline of products under development. It also expects growth in its underlying base business along with pricing hikes.

The oil and gas industry is experiencing a multi-year growth phase and favorable, consistent commodity prices are expected to sustain an active, well-completed environment in the coming years. The company secured solid contractual commitments for its sand production capacity for the rest of the current year and into the next.

The company’s primary focus remains on generating operational cash flow and reducing its debt burden. In 2023, it anticipates a substantial inflow of operating cash and plans to invest at the upper range of the capital expenditure guidance, ranging between $60 million and $65 million for the year.

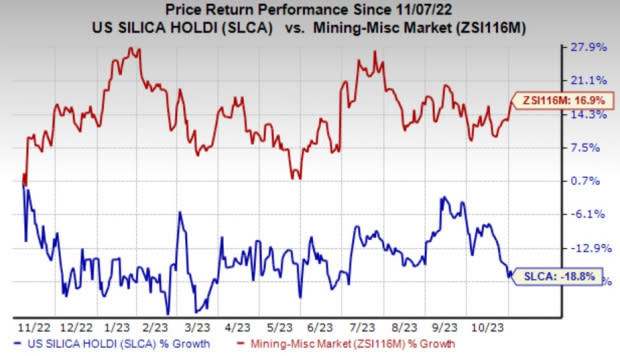

Price Performance

Shares of U.S. Silica are down 18.8% in the past year compared with a 16.9% rise of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Other Key Picks

U.S. Silica currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the Basic Materials space are The Andersons Inc. ANDE and Carpenter Technology Corporation CRS, each sporting a Zacks Rank #1 (Strong Buy) and Linde plc LIN, carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for ANDE’s current-year earnings has been revised 3.3% upward in the past 60 days. Andersons beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 64.4% on average. ANDE shares have rallied around 37.8% in a year.

The consensus estimate for CRS’s current fiscal year earnings is pegged at $3.57, indicating year-over-year growth of 213.2%. CRS beat the Zacks Consensus Estimate in all of the last four quarters, with the average earnings surprise being 14.3%. The company’s shares have surged 68.9% in the past year.

The consensus estimate for Linde’s current fiscal year earnings is pegged at $14.08, indicating a year-over-year growth of 14.6%. LIN beat the Zacks Consensus Estimate in all of the last four quarters, with the average earnings surprise being 5.7%. The company’s shares have rallied 25.2% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Andersons, Inc. (ANDE) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

U.S. Silica Holdings, Inc. (SLCA) : Free Stock Analysis Report

Linde PLC (LIN) : Free Stock Analysis Report