U.S. Steel's (X) Earnings and Revenues Top Estimates in Q4

United States Steel Corporation X slipped to a loss of $80 million or 36 cents per share for fourth-quarter 2023, against a profit of $174 million or 68 cents per share in the year-ago quarter.

Barring one-time items, adjusted earnings per share were 67 cents, down from 89 cents a year ago. The figure, however, topped the Zacks Consensus Estimate of 25 cents.

Revenues fell around 4.5% year over year to $4,144 million in the reported quarter but beat the Zacks Consensus Estimate of $3,702.1 million.

The company reported a total shipment of 3,807,000 tons for the reported quarter, up around 13% year over year. It was ahead of our estimate of 3,697,000 tons.

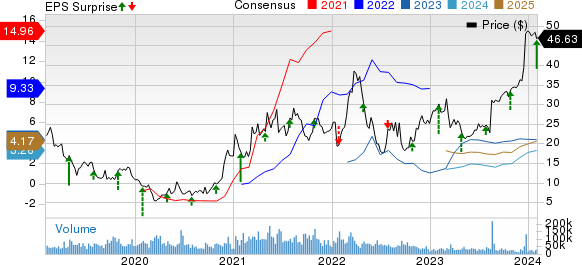

United States Steel Corporation Price, Consensus and EPS Surprise

United States Steel Corporation price-consensus-eps-surprise-chart | United States Steel Corporation Quote

Segment Highlights

Flat-Rolled: The segment recorded a loss of $31 million in the reported quarter, down from a profit of $171 million a year ago.

Steel shipments in the segment went up roughly 8% year over year to 2,034,000 tons. The average realized price per ton in the unit was $978, down around 10% year over year. It beat our estimate of $951.

Mini Mill: The segment recorded a profit of $29 million in the quarter, up from a loss of $68 million in the year-ago quarter. Shipments were 617,000 tons, down around 3% year over year. The average realized price per ton was $807, up around 3% year over year. It also beat our estimate of $788.

U.S. Steel Europe: The segment posted a loss of $21 million in the reported quarter, narrower than a loss of $68 million a year ago. Shipments rose roughly 43% year over year to 1,024,000 tons. The average realized price per ton for the unit was $716, down around 24% year over year. It lagged our estimate of $813.

Tubular: The segment posted a profit of $113 million in the reported quarter, down from a profit of $205 million a year ago. Shipments remained flat at 132,000 tons. The average realized price per ton for the unit was $2,390, down nearly 34% year over year. It lagged our estimate of $2,448.

Financials

At the end of the quarter, the company's cash and cash equivalents were $2,948 million, down around 9% from the previous quarter’s levels. The long-term debt was $4,080 million, down around 1.1% sequentially.

For full-year 2023, the company generated $2,100 million in cash from its operations. Additionally, it had a negative free cash flow of $468 million for the full year.

FY23 Results

In 2023, the full-year net earnings amounted to $895 million, or $3.56 per share. Adjusted net earnings for the same period stood at $1,195 million, or $4.73 per share. This contrasts with the figures for 2022, where full-year net earnings were $2,524 million, or $9.16 per share. Adjusted net earnings for 2022 were $2,785 million, or $10.06 per share. Revenues experienced a decline of approximately 14% year over year, dropping from $21,065 million in 2022 to $18,053 million in 2023.

Outlook

The company anticipates robust performance driven by its commitment to safety and the forthcoming merger with Nippon Steel Corporation, which promises fresh avenues for growth. Despite challenges like supply chain disruptions and inflationary pressures, the focus stays on executing strategic initiatives efficiently.

Strategic investments, including the direct reduced-grade pellets production and upcoming projects like the dual galvalume/galvanized coating line in Arkansas and the Big River 2 mini mill, underscore its dedication to sustainability and competitiveness. The additional capital allocated for Big River 2 reflects confidence in its successful completion, with the total estimated capital spend reaching approximately $3.2 billion.

Price Performance

The company’s shares have rallied 54.1% in the past year compared with the industry’s 5.6% rise.

Image Source: Zacks Investment Research

Zacks Rank & Other Key Picks

U.S. Steel currently sports a Zacks Rank #1 (Strong Buy).

Some other top-ranked stocks in the Basic Materials space are Cameco Corporation CCJ and Carpenter Technology Corporation CRS, both sporting a Zacks Rank #1, and Air Products and Chemicals, Inc. APD, carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Cameco has a projected earnings growth rate of 188% for the current year. The Zacks Consensus Estimate for CCJ’s current-year earnings has been revised upward by 12.5% in the past 60 days. The stock is up around 77.6% in a year.

The consensus estimate for CRS’s current fiscal year earnings is pegged at $3.97, indicating a year-over-year surge of 248.3%. CRS beat the Zacks Consensus Estimate in all of the last four quarters, with the average earnings surprise being 14.3%. The company’s shares have rallied 19.7% in the past year.

The consensus estimate for APD’s current fiscal year earnings is pegged at $13, indicating a year-over-year rise of 13%. APD beat the Zacks Consensus Estimate in three of the last four quarters and missed one, with the average earnings surprise being 1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Air Products and Chemicals, Inc. (APD) : Free Stock Analysis Report

United States Steel Corporation (X) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Cameco Corporation (CCJ) : Free Stock Analysis Report