U.S. Steel's (X) Q3 Earnings and Revenues Top Estimates

United States Steel Corporation X logged a profit of $299 million or $1.20 per share for third-quarter 2023, down around 39% from a profit of $490 million or $1.85 per share in the year-ago quarter.

Barring one-time items, adjusted earnings per share were $1.40 per share, down from $1.98 a year ago. The figure, however, topped the Zacks Consensus Estimate of $1.15.

Revenues fell around 15% year over year to $4,431 million in the reported quarter but beat the Zacks Consensus Estimate of $4,386.5 million.

The company reported a total shipment of 3,782,000 tons for the reported quarter, up around 2% year over year. It was ahead of our estimate of 3,779,000 ton.

U.S. Steel benefited from diverse order book, flat-rolled product portfolio and cost actions in the reported quarter.

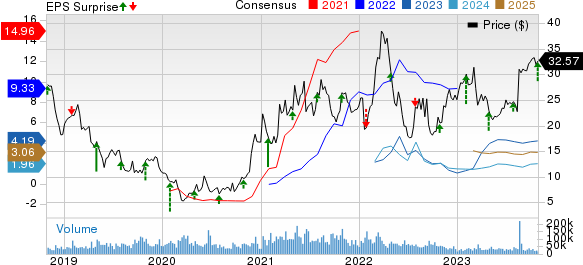

United States Steel Corporation Price, Consensus and EPS Surprise

United States Steel Corporation price-consensus-eps-surprise-chart | United States Steel Corporation Quote

Segment Highlights

Flat-Rolled: The segment recorded an EBIT of $225 million in the reported quarter, down from $518 million a year ago.

Steel shipments in the segment went down roughly 0.8% year over year to 2,159,000 tons. Average realized price per ton in the unit was $1,036, down around 16% year over year. It also lagged our estimate of $1,060.

Mini Mill: The segment recorded a profit of $42 million in the quarter, up from a profit of $1 million in the year-ago quarter. Shipments were 561,000 tons, up around 6% year over year. Average realized price per ton was $901, down around 18% year over year. It also lagged our estimate of $939.

U.S. Steel Europe: The segment posted a loss of $13 million compared with a loss of $32 million in the year-ago quarter. Shipments in the segment rose around 10% year over year to 958,000 tons. Average realized price per ton for the unit was $852, down around 17% year over year. It was in line with our estimate of $852.

Tubular: The segment posted a profit of $87 million in the reported quarter, down from a profit of $155 million a year ago. Shipments fell roughly 17% year over year to 104,000 tons. Average realized price per ton for the unit was $2,927, down roughly 9% year over year. It lagged our estimate of $2,966.

Financials

At the end of the quarter, the company's cash and cash equivalents were $3,222 million, up around 3% from the previous quarter. Long-term debt was $4,129 million, down around 0.6% sequentially.

During the quarter, the company generated $817 million in cash from its operations. Additionally, it had free cash flow of $232 million.

Outlook

The company noted that it remains focused on running its business safely and executing on its ongoing strategic investments. It is seeing strong performance in each of these areas. U.S. Steel is making progress on a competitive strategic alternatives review process to increase stockholder value.

Price Performance

The company’s shares have rallied 58.8% in the past year compared with the industry’s 20% rise.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

U.S. Steel currently has a Zacks Rank #2 (Buy).

Other top-ranked stocks worth a look in the basic materials space include Koppers Holdings Inc. KOP, WestRock Company WRK and The Andersons Inc. ANDE.

Koppers has a projected earnings growth rate of 7.5% for the current year. It currently carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Koppers has a trailing four-quarter earnings surprise of roughly 21.7%, on average. KOP shares have surged around 42% in a year.

In the past 60 days, the Zacks Consensus Estimate for WestRock’s current fiscal year has been revised upward by 5.2%. WRK beat the Zacks Consensus Estimate in three of the last four quarters while missing in one quarter, with the average earnings surprise being 30.7%. The company’s shares have gained 3% in the past year.

Andersons currently carries a Zacks Rank #2. The Zacks Consensus Estimate for ANDE's current-year earnings has been revised 3.3% upward over the past 60 days.

Andersons beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 64.4%, on average. ANDE shares have rallied around 42% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Andersons, Inc. (ANDE) : Free Stock Analysis Report

United States Steel Corporation (X) : Free Stock Analysis Report

Koppers Holdings Inc. (KOP) : Free Stock Analysis Report

WestRock Company (WRK) : Free Stock Analysis Report