U.S. Treasury Exceeds Debt Limit by $39 Billion with Accounting Trick

U.S. federal debt has been stuck at $16,699,396,000,000.00 for four months and that amount is exactly $25 million less than the legal borrowing limit of $16,699,421,000,000.00 set on May 18, 2013. But that's only part of the story.

A closer look at the latest numbers actually shows the U.S. Treasury has already overshot the federal legal borrowing limit, with the help of accounting tricks.

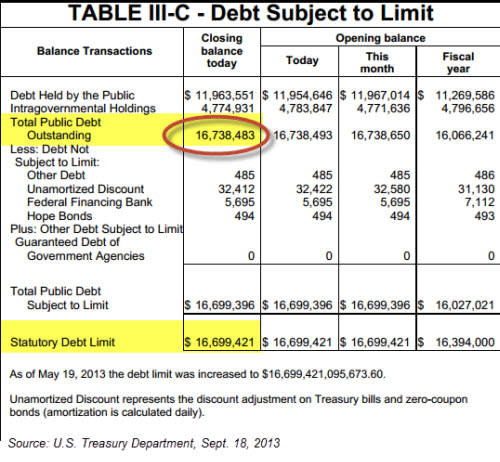

The table below shows how "Total Public Debt Outstanding" is now $38.48 billion above the statuary debt ceiling and currently at $16,738,483,000,000.00. You'll also notice, how the Treasury has itemized this $39.08 billion as "not subject to the debt limit." This technique is known as "creative accounting."

The yield on 10-year U.S. Treasuries (^TNX) has surged 49% year-to-date and that move has taken the 10-year yield from 1.83% to 2.72%. And bond investors, especially owners of long-term debt, are bleeding.

AUDIO: Should you buy floating rate bonds?

The Federal Reserve has joined the chorus of bond losers, courtesy of its massive Treasury holdings (TLT - News). For every 0.01% rise in interest rates, the Fed suffers paper losses of approximately $3 billion. The Fed's Sept.18 decision to continue with massive monetary stimulus or "QE" isn't just about helping the economy, as it alleges. It's also about salvaging its bond portfolio.

When bond yields rise, as they have been, bond values fall. And we've advised our readers to capitalize on this trend.

Leveraged short Treasury ETFs like the ProShares UltraShort US Treasury 20+ Bond ETF (TBT - News) and the Direxion Shares US Treasury 20+ 3x Bear Shares (TMV - News) have jumped between 15% to 21% over the past six months. TBT and TMV aim for double and triple daily opposite performance to long-term Treasury bond prices. Meanwhile, the total U.S. bond market (AGG - News) has lost around 3.25% while long-term U.S. Treasuries have fallen 10% over that same time frame.

If the U.S. Treasury has already subversively exceed its legally mandated borrowing limit, then the upcoming debt debate is nothing more than a dog and pony show.

The ETF Profit Strategy Newsletter uses a combination of fundamental/technical analysis, market sentiment, history, and common sense to be on the right side of the market. Since the beginning of the year, 78% of our ETF picks have turned a profit and 525% was our biggest gainer. (through 6/30/13)

Follow us on Twitter @ ETFguide

P.S. Our just released October 2013 newsletter covers the falling precious metals market, our mega investment theme report, and our popular global equity map.

More From ETFguide.com