Uber (NYSE:UBER) Q4 Earnings: Leading The Gig Economy Pack

Earnings results often give us a good indication of what direction a company will take in the months ahead. With Q4 now behind us, let’s have a look at Uber (NYSE:UBER) and its peers.

The iPhone changed the world, ushering in the era of the “always-on” internet and “on-demand” services - anything someone could want is just a few taps away. Likewise, the gig economy sprang up in a similar fashion, with a proliferation of tech-enabled freelance labor marketplaces, which work hand and hand with many on demand services. Individuals can now work on demand too. What began with tech enabled platforms that aggregated riders and drivers has expanded over the past decade to include food delivery, groceries, and now even a plumber or graphic designer are all just a few taps away.

The 4 gig economy stocks we track reported a weak Q4; on average, revenues were in line with analyst consensus estimates while next quarter's revenue guidance was 5% below consensus. Stocks have faced challenges as investors prioritize near-term cash flows, but gig economy stocks held their ground better than others, with the share prices up 17.4% on average since the previous earnings results.

Best Q4: Uber (NYSE:UBER)

Born out of a winter night thought: "What if you could request a ride from your phone?" Uber (NYSE: UBER) operates a global network of on demand services, most prominently ride hailing and food delivery, and freight.

Uber reported revenues of $9.94 billion, up 15.4% year on year, topping analyst expectations by 1.8%. It was a decent quarter for the company, with strong growth in its user base. Its revenue, EBITDA, and EPS also outperformed Wall Street's estimates. The topline was driven by not only user growth but also better-than-expected gross bookings in both its mobility ($19.3 billion vs estimates of $19.1 billion) and delivery ($17.0 billion vs estimates of $16.7 billion) segments.

Uber pulled off the biggest analyst estimates beat and fastest revenue growth of the whole group. The company reported 150 million users, up 14.5% year on year. The stock is up 13.7% since the results and currently trades at $80.09.

Is now the time to buy Uber? Access our full analysis of the earnings results here, it's free.

Lyft (NASDAQ:LYFT)

Founded by Logan Green and John Zimmer as a long-distance intercity carpooling company Zimride, Lyft (NASDAQ: LYFT) operates a ridesharing network in the US and Canada.

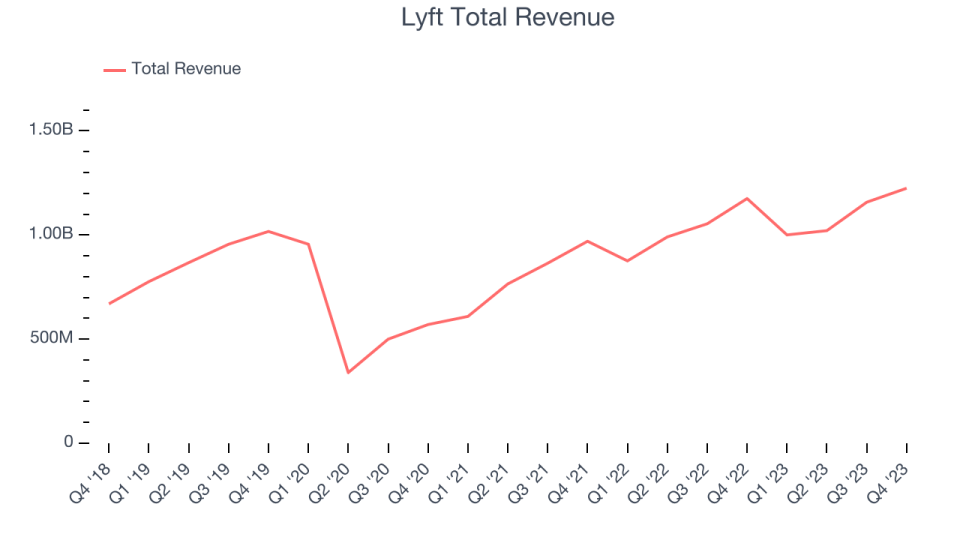

Lyft reported revenues of $1.22 billion, up 4.2% year on year, in line with analyst expectations. It was a mixed quarter for the company, with solid growth in its user base but slow revenue growth. Furthermore, in a potential milestone event, the company expects to generate positive free cash flow for the full year 2024, converting roughly half its forecasted full-year EBITDA into cash.

The stock is up 62.5% since the results and currently trades at $19.74.

Is now the time to buy Lyft? Access our full analysis of the earnings results here, it's free.

Slowest Q4: Angi (NASDAQ:ANGI)

Created by IAC’s mergers of Angie’s List and HomeAdvisor, ANGI (NASDAQ: ANGI) operates the largest online marketplace for home services in the US.

Angi reported revenues of $300.4 million, down 27.3% year on year, falling short of analyst expectations by 2.8%. It was a weak quarter for the company, with a decline in its user base and slow revenue growth.

Angi had the weakest performance against analyst estimates and slowest revenue growth in the group. The company reported 4.32 million service requests, down 28.2% year on year. The stock is up 9.7% since the results and currently trades at $2.66.

Read our full analysis of Angi's results here.

Fiverr (NYSE:FVRR)

Based in Tel Aviv, Fiverr (NYSE:FVRR) operates a fixed price global freelance marketplace for digital services.

Fiverr reported revenues of $91.5 million, up 10.1% year on year, falling short of analyst expectations by 1.1%. It was a weak quarter for the company, with full-year revenue guidance missing analysts' expectations.

The company reported 4.1 million active buyers, down 4.7% year on year. The stock is down 16.5% since the results and currently trades at $21.62.

Read our full, actionable report on Fiverr here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.