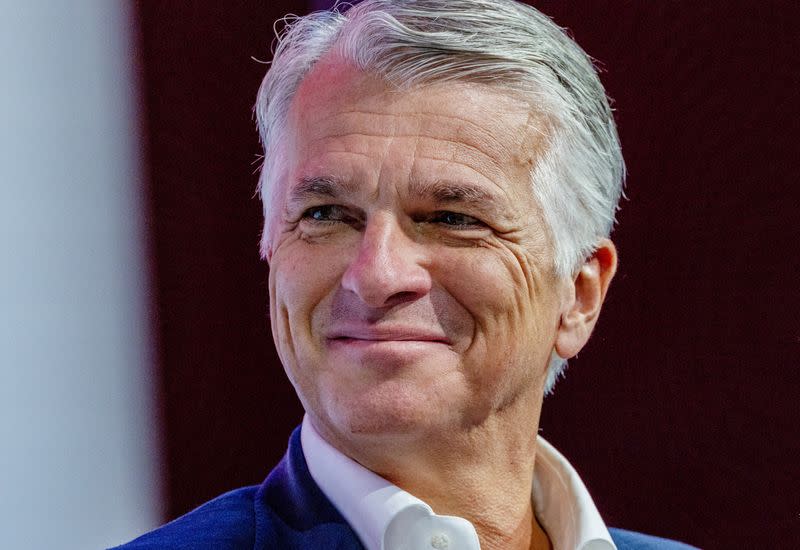

UBS makes Ermotti Europe's best-paid bank boss with $16 million package

By Noele Illien

ZURICH (Reuters) -UBS Chief Executive Sergio Ermotti earned 14.4 million Swiss francs ($15.90 million) in 2023, making him the best paid boss among leading European banks last year.

UBS reported Ermotti's pay in its annual report on Thursday, with the Swiss bank also saying it had shrunk the overall employee bonus pool for 2023.

Ermotti returned to lead UBS on April 5 after it acquired Credit Suisse in an emergency takeover and is still in the process of navigating the wealth manager through the tricky integration of its former rival.

"Sergio has committed to stay at least until the completion of the integration process, if not longer," the annual report said.

UBS also said that findings drawn up by Swiss authorities looking into the 2023 collapse of Credit Suisse could result in more stringent regulation in future, and that the result of a parliamentary inquiry committee expected later this year could include "significant recommendations".

The bank is still reviewing potential mis-statements in Credit Suisse's financial reports and talks with regulators to address the issue are ongoing, UBS said.

"UBS expects to adopt and implement further controls and procedures following the completion of such review and discussions with regulators," it said.

The Ermotti pay package - which included 12.2 million francs in variable pay - makes him one of the best-paid executives among Swiss-listed companies but he was still behind Novartis boss Vas Narasimhan, who took home more than 16 million francs.

Reuters has reviewed pay packages of Europe's 10 largest banks by market capitalisation and Ermotti's pay has come out on top, ahead of HSBC CEO Noel Quinn, with $10.6 million, and Santander Executive Chair Ana Botin, with $13.2 million, according to the banks.

Ermotti's predecessor as CEO, Ralph Hamers, earned 12.6 million francs in 2022.

In total, UBS's executive board received compensation of 140.3 million francs in 2023, up from 106.9 million francs in 2022.

But overall bonuses for the combined banks fell 14% to $4.5 billion, the majority of which was paid in cash.

MORE RISK TAKERS

UBS said that the number of "key risk takers", which includes employees whose total compensation exceeds $2.5 million or 2.5 million Swiss francs, jumped 48% to 1,038 following the Credit Suisse acquisition.

Total compensation for this group increased by 39% to $1.8 billion, meaning UBS paid more than 1,000 people an average of $1.7 million last year.

The bank has committed to reduce its risk profile and to shrink much of the investment banking operations it inherited from Credit Suisse, a bank accused of having a free-wheeling culture.

Some shareholders have raised concerns about the cultural fit of the two organisations, but Chairman Colm Kelleher said in January that "a lot of bad actors had gone".

($1 = 0.9059 Swiss francs)

(Reporting by Noele IllienAdditional reporting by Stefania SpezzatiEditing by Tommy Reggiori Wilkes, David Goodman and Tomasz Janowski)