UFP Industries Inc (UFPI) Reports Dip in Net Sales and Earnings for Q4 and Fiscal Year 2023

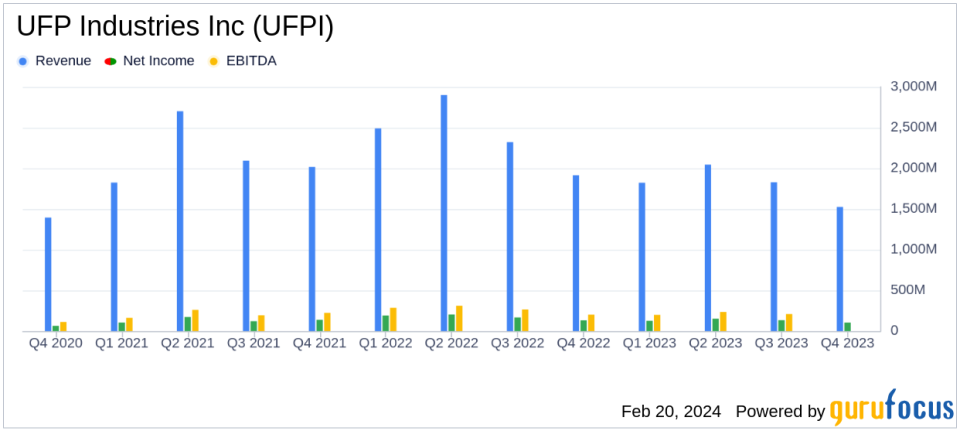

Net Sales: $1.5 billion in Q4 and $7.2 billion for fiscal 2023, reflecting a year-over-year decrease.

Net Earnings: $103 million for Q4 and $514 million for fiscal 2023, with a decline from the previous year.

Earnings Per Share: $1.62 diluted in Q4 and $8.07 for fiscal 2023, down from $2.10 and $10.97 respectively in the prior year.

Balance Sheet: Strong with $841.9 million in net surplus cash at year-end 2023.

Segment Performance: Declines in net sales across UFP Retail Solutions, UFP Packaging, and UFP Construction segments.

Market Outlook: Challenging conditions expected in H1 2024, with improvements in H2.

Long-Term Goals: Raised, reflecting confidence in future growth and profitability.

On February 20, 2024, UFP Industries Inc (NASDAQ:UFPI), a leading supplier of lumber and a multibillion-dollar holding company serving retail, packaging, and construction markets globally, released its 8-K filing. The report detailed the company's financial results for the fourth quarter and the fiscal year ended December 2023, which showed a decrease in net sales and earnings compared to the previous year. This performance reflects the impact of one less week of operating activity in 2023 and broader market challenges.

Despite the downturn, UFPI's Chairman and CEO, Matthew J. Missad, expressed confidence in the company's ability to grow and enhance its value-added product offering. "Our operating margins and robust cash flow continue to surpass historic levels and allow us to remain on offense," said Missad. The company's strong balance sheet, with significant liquidity and net surplus cash, supports its return-focused approach to capital allocation, enabling continued investments in growth and acquisitions.

Financial Performance and Challenges

For the fourth quarter of 2023, UFPI reported net sales of $1.5 billion and net earnings attributable to controlling interest of $103 million, resulting in earnings per diluted share of $1.62. For the full fiscal year, net sales reached $7.2 billion with earnings per diluted share of $8.07. These figures represent a decline from the previous year, with net sales and earnings per diluted share in Q4 2022 at $1.9 billion and $2.10, respectively, and $9.6 billion and $10.97 for fiscal 2022.

The company's performance is significant as it indicates the resilience and adaptability of UFPI in a challenging economic environment. The decline in net sales and earnings is attributed to a combination of lower selling prices and a decrease in organic unit sales across its business segments. The construction segment experienced the most significant drop, with full-year net sales down 31 percent from the previous year.

Segment Breakdown and Market Outlook

Each of UFPI's business segments faced declines in net sales, with UFP Retail Solutions, UFP Packaging, and UFP Construction reporting decreases of 27%, 21%, and 16% respectively in the fourth quarter. The full-year figures also saw reductions across the board. The company anticipates lumber prices to remain at lower levels and expects demand for its packaging segment to be slightly down, with construction and retail segments ranging from slightly up to slightly down in 2024.

Looking ahead, UFPI expects market conditions to remain challenging in the first half of 2024, with improvements anticipated in the second half. The company remains committed to enhancing business efficiency, reducing costs, and innovating products and services.

Long-Term Goals and Investor Confidence

Despite the short-term challenges, UFPI has raised its long-term financial goals, signaling confidence in its strategic direction and growth prospects. The company's robust cash flow and strong balance sheet position it well to pursue its objectives and deliver value to shareholders.

For value investors and potential GuruFocus.com members, UFPI's latest earnings report presents a nuanced picture of a company navigating industry headwinds while laying the groundwork for future success. The company's proactive approach to capital allocation and strategic investments, coupled with its raised long-term targets, make it a noteworthy consideration for those looking for resilient players in the Forest Products industry.

For more detailed financial analysis and insights into UFP Industries Inc (NASDAQ:UFPI), visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from UFP Industries Inc for further details.

This article first appeared on GuruFocus.