UFP Industries (UFPI) Buys Palets Suller Stake, Expands in Spain

UFP Industries, Inc. UFPI is set to make significant strides in the European market with its latest acquisition. Its subsidiary, UFP Global Holdings Ltd., acquired an 80% stake in UFP Palets y Embalajes SL, formerly known as Palets Suller Group. The deal, valued at approximately $52 million, is poised to bolster UFPI's presence in the Spanish market.

Headquartered in Castellón, Spain, Palets Suller Group is the dominant player in machine-built wood pallets, catering primarily to Spain's thriving ceramic tile industry. With a remarkable $38 million in sales over the trailing 12 months that ended in August 2023, Palets Suller Group has solidified its position as a market leader in this sector.

Samuel Suller Oliver, the founder and CEO of Palets Suller Group, will continue to hold a 20% stake in the company, assuming the role of executive director, and will oversee day-to-day operations. Collaborating with him will be UFP veteran Alex Kladt, who will work alongside the Palets Suller leadership team to enhance the business and achieve operational synergies.

Acquisitions: A Major Growth Driver

Acquisitions have been UFP Industries' preferred mode of solidifying its product portfolio and leveraging new business opportunities. UFPI acquired four companies in 2022 and nine in 2021. Acquisitions contributed 2% to unit sales growth in second-quarter 2023. Also, it projects acquisitions to contribute half of its total annual unit sales growth.

The latest strategic acquisition allows UFP Industries to diversify its European portfolio while capitalizing on the thriving Spanish ceramic tile industry, one of the world's largest manufacturing export markets. Furthermore, it provides an excellent foundation for UFP Industries to expand its value-added packaging business throughout Europe.

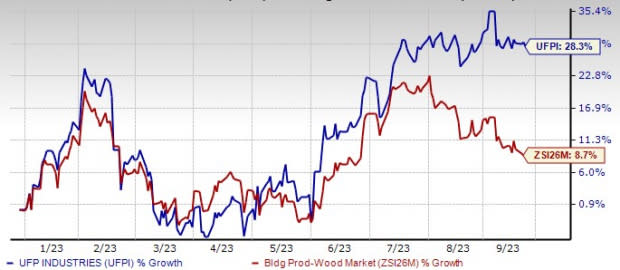

Image Source: Zacks Investment Research

UFP Industries stock jumped 28.3% year to date, strongly outperforming the Zacks Building Products - Wood industry’s rise of 8.7%.

With its sights set on growth and innovation, UFP Industries is clearly positioning itself for success in the European market, solidifying its reputation as a global industry leader.

Zacks Rank & Key Picks

UFP Industries currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Zacks Construction sector are:

EMCOR Group, Inc. EME currently sports a Zacks Rank of 1 (Strong Buy). EME delivered a trailing four-quarter earnings surprise of 17.2%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of EME have risen 45.1% year to date (YTD). The Zacks Consensus Estimate for EME’s 2023 sales and earnings per share (EPS) indicates growth of 11.7% and 36.2%, respectively, from the previous year’s reported levels.

TopBuild Corp. BLD currently sports a Zacks Rank of 1. BLD delivered a trailing four-quarter earnings surprise of 14.1%, on average. Shares of the company have risen 65.7% YTD.

The Zacks Consensus Estimate for BLD’s 2023 sales and EPS indicates growth of 3.3% and 8.4%, respectively, from the previous year’s reported levels.

Fluor Corporation FLR currently sports a Zacks Rank of 1. FLR delivered a trailing four-quarter negative earnings surprise of 5.3%, on average. Shares of the company have gained 8.8% YTD.

The Zacks Consensus Estimate for FLR’s 2023 sales and EPS indicates growth of 11.3% and 141.5%, respectively, from the previous year’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fluor Corporation (FLR) : Free Stock Analysis Report

UFP Industries, Inc. (UFPI) : Free Stock Analysis Report

EMCOR Group, Inc. (EME) : Free Stock Analysis Report

TopBuild Corp. (BLD) : Free Stock Analysis Report