The UK’s Recession Arrives: What’s Next for the Pound

However, cable didn’t show a strong decline, with sterling actually bouncing back as a recession had been expected and other data including inflation seem to be cautiously optimistic. This article summarises the latest releases affecting sentiment on the pound sterling and looks briefly at the charts of GBPUSD and GBPJPY.

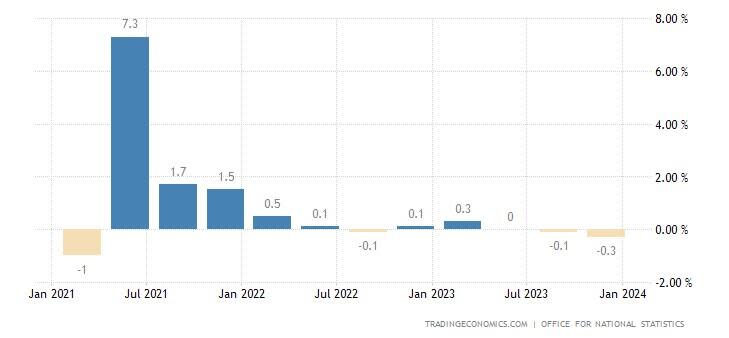

The UK’s preliminary GDP for the fourth quarter came in at negative 0.3%, 0.2% lower than expected, signalling a technical recession:

Growth clearly started to slow down around the end of 2021 and has remained negligible since then, with the last two quarters of recessionary figures still not diverging much from the average over the last two years. The significance of Thursday morning’s data isn’t just a technical recession but also GDP per capita. Seven quarters of declining GDP per capita is the longest run since records began in 1955.

However, this has been a very long time coming. Ever since sentiment started to weaken in 2021 and central banks started to hike rates furiously in early 2022, many participants had called a deep recession or an imminent one. That it’s come now for the UK, much later than initially expected, as inflation has dropped significantly from peaks above 10% and being negligible in size so far, ‘sell the rumour, buy the news’ might be applicable.

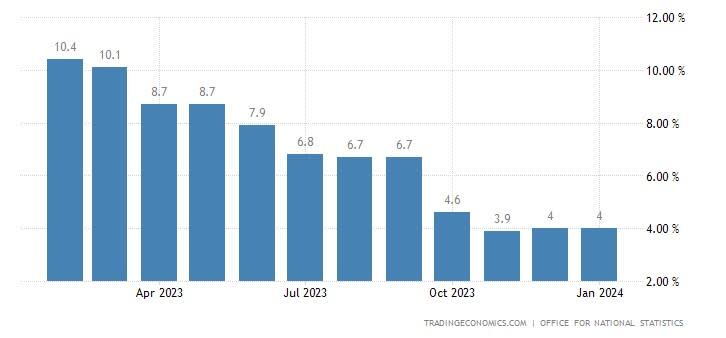

Overall, Tuesday’s job report from the UK was mixed. While claimants in January were up more than expected at 14,100, December’s unemployment went the opposite way from expectations at 3.8% and headline average earnings beat the consensus at 6.2%. Annual headline inflation was steady last month:

While 4% is still double the target of about 2%, the overall decline since this time last year has been very large despite continued growth in wages. That the rate didn’t increase in January was a positive surprise at least for the Bank of England (‘BoE’). Core inflation also held steady at 5.1% in January.

The Governor of the BoE, Andrew Bailey, was optimistic in comments to the Lords’ committee on economic affairs. He ruled out an imminent cut to the bank rate but markets now seem to be pricing one in for June. Dr Bailey’s comments on wanting to see lower growth in earnings means the focus is likely to remain on job reports over the next several months to see how the 60% chance of a cut before the end of the second quarter changes.

Cable, Daily

Both the USA and the UK seem to have bumpy paths ahead of them before inflation reaches 2%, so the general scheme of monetary policy is about as uncertain in both countries for the time being. That’s reflected on the chart as a fairly clear symmetrical channel since the end of last year. $1.253 is the area of the double bottom, so assuming there’s no close below $1.25 over the next couple of days that zone is likely to hold as a support.

The price near the bottom of the channel with some buying pressure remaining and a relatively weak reaction to the news of a recession might suggest a move back up to the upper part of the channel, above the 50 SMA from Bands around $1.267. The ratio here for a potential buyer isn’t bad. Continuation and a breakout lower would probably need a significant catalyst – possibly from the FOMC’s minutes next week – so doesn’t seem favourable immediately.

Pound-yen, Daily

With both the UK and Japan now in technical recessions but inflation never having picked up in the latter, fundamentals continue to point strongly to gains for GBPJPY. However, the yen has lost a lot of value since 2020 against most other major currencies and Japan’s finance minister has hinted again at a possible intervention.

The technical situation makes at least a consolidation likely in the short term if not a significant retracement. There’s a clear overbought signal from the slow stochastic, volume has declined and the formation of a possible head and shoulders is about halfway complete. Japanese inflation a week on Monday is a key release for all pairs with the yen. In the meantime, the area around ¥188 could be an important technical reference.

The opinions in this article are personal to the writer. They do not reflect those of Exness or FX Empire.

This article was originally posted on FX Empire