Ulta Beauty Inc (ULTA) Reports Robust Q4 and Full Year Fiscal 2023 Results

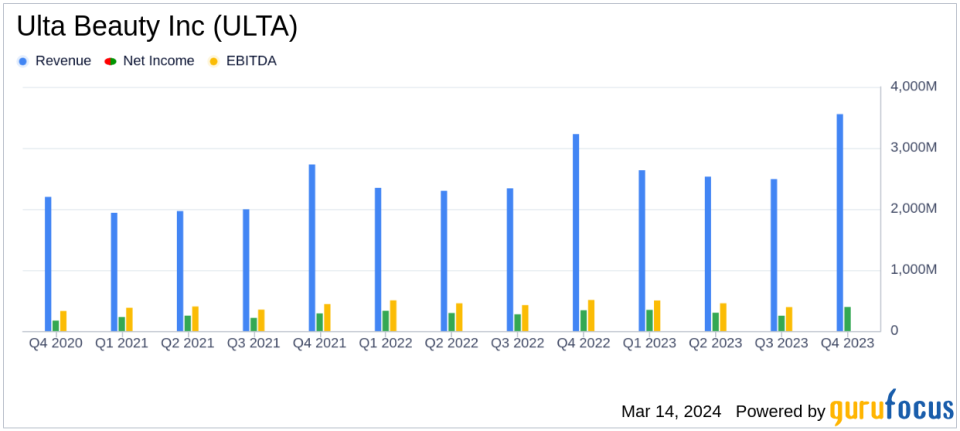

Net Sales: Increased to $3.6 billion in Q4 and $11.2 billion for the full year.

Comparable Sales: Grew by 2.5% in Q4; 5.7% for the full year.

Net Income: Reached $394.4 million in Q4; $1.29 billion for the full year.

Diluted Earnings Per Share (EPS): $8.08 for Q4; $26.03 for the full year.

Store Openings: 30 net new stores in fiscal 2023, with plans for 60-65 more in fiscal 2024.

Share Repurchase Program: $1.0 billion in shares repurchased in fiscal 2023; new $2.0 billion authorization announced.

International Expansion: Joint venture formed to launch Ulta Beauty in Mexico in 2025.

On March 14, 2024, Ulta Beauty Inc (NASDAQ:ULTA) released its 8-K filing, detailing a successful fourth quarter and full fiscal year 2023. The beauty retailer, known for its extensive range of cosmetics, fragrances, skin care, and hair care products, as well as salon services, has reported a significant increase in net sales and net income, reflecting the company's ability to attract and retain customers with its diverse product offerings and in-store experiences.

Financial Highlights and Strategic Achievements

Ulta Beauty's net sales for the fourth quarter reached $3.6 billion, a notable increase from $3.2 billion in the year-ago quarter. The full year saw net sales climb to $11.2 billion from $10.2 billion in the previous year. Comparable sales, a key indicator of the company's health, rose by 2.5% in the fourth quarter and 5.7% for the full year, signaling strong customer engagement and effective merchandising strategies.

Net income for the fourth quarter was reported at $394.4 million, or $8.08 per diluted share, compared to $340.7 million, or $6.68 per diluted share, in the fourth quarter of the previous fiscal year. For the full year, net income increased to $1.29 billion, or $26.03 per diluted share, up from $1.24 billion, or $24.01 per diluted share, in the prior year. These figures underscore Ulta Beauty's profitability and operational efficiency within the competitive retail landscape.

Operational Excellence and Future Outlook

During fiscal 2023, Ulta Beauty opened 30 new stores and ended the year with 1,385 stores, further expanding its physical footprint. The company's share repurchase program remained active, with $1.0 billion worth of shares repurchased during the year. Looking ahead, Ulta Beauty has announced a new $2.0 billion share repurchase authorization, demonstrating confidence in its financial position and commitment to delivering shareholder value.

CEO Dave Kimbell expressed pride in the company's performance and highlighted the strategic investments made to drive future growth. He also announced a joint venture to bring Ulta Beauty to Mexico in 2025, marking a significant step in the company's international expansion efforts.

"We closed out a strong 2023 with better-than-expected fourth quarter financial performance. Our compelling holiday plans and thoughtfully curated assortment resonated with our guests and delivered healthy traffic, record brand awareness, and strong member growth," said Dave Kimbell, chief executive officer.

Financial Stability and Capital Allocation

Ulta Beauty's balance sheet remains robust, with cash and cash equivalents totaling $766.6 million at the end of the fourth quarter. Merchandise inventories increased by 8.6% to support new brand launches and store openings. The company also successfully managed its credit facilities, repaying all amounts borrowed during the third quarter of fiscal 2023.

For fiscal 2024, Ulta Beauty forecasts net sales between $11.7 billion and $11.8 billion, with comparable sales growth of 4% to 5%. The company plans to open 60-65 new stores and undertake 40-45 remodel and relocation projects, with an operating margin of 14.0% to 14.3% and diluted earnings per share between $26.20 and $27.00. Approximately $1 billion is earmarked for share repurchases, reflecting a continued focus on capital return to shareholders.

Ulta Beauty Inc (NASDAQ:ULTA) has demonstrated a strong performance in fiscal 2023, with strategic growth initiatives and a solid financial foundation that positions the company for continued success in the beauty retail industry. Investors and stakeholders can look forward to the company's expansion and sustained profitability in the coming fiscal year.

Explore the complete 8-K earnings release (here) from Ulta Beauty Inc for further details.

This article first appeared on GuruFocus.