Ultragenyx (RARE) Q3 Earnings and Revenues Miss Estimates

Ultragenyx Pharmaceutical Inc. RARE incurred a loss of $2.23 per share in third-quarter 2023, wider than the Zacks Consensus Estimate of a loss of $2.08. The company reported a loss of $3.50 per share in the year-ago quarter.

Ultragenyx’s total revenues amounted to $98 million in the reported quarter, up 8% year over year. The top line missed the Zacks Consensus Estimate of $108 million.

The company markets four drugs, namely Crysvita, Mepsevii, Dojolvi and Evkeeza. Crysvita is approved for treating X-linked hypophosphatemia, an inherited disorder and tumor-induced osteomalacia, an ultra-rare disease. Mepsevii is approved to treat Mucopolysaccharidosis VII, also known as Sly syndrome. Dojolvi was approved in June 2020 for all forms of long-chain fatty acid oxidation disorders.

In January 2022, Ultragenyx announced a license and collaboration agreement with Regeneron Pharmaceuticals REGN. Per the deal, RARE has obtained the rights to develop, commercialize and distribute Evkeeza (evinacumab) outside the United States. The regions include the European Economic Area. The collaboration with Regeneron for Evkeeza gives Ultragenyx a fourth-approved product that adds to the top line. However, REGN will continue to solely commercialize Evkeeza in the United States.

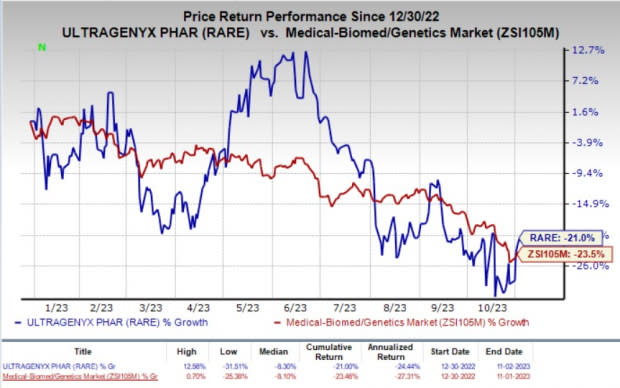

Shares of RARE have lost 21% in the year-to-date period compared with the industry’s decline of 23.5%.

Image Source: Zacks Investment Research

Quarter in Detail

Crysvita’s total revenues were $75 million, up 7% year over year, driven by increased demand for approved indications. Crysvita’s net product revenues in third-quarter 2023 were primarily driven by sales of the drug in the Latin America region, which were $19.2 million, representing 46% year-over-year growth. Revenues from North America were $50 million in the reported quarter and $6 million from the European region. Ultragenyx sold its Crysvita rights in the European territory to Royalty Pharma in December 2019. In April 2023, RARE entered into a licensing agreement withKyowa Kirin to transition commercialization responsibilities for Crysvita in North America to its partner.

Per RARE, the third quarter Crysvita revenues were partially offset by a one-time decrease in channel inventory related to Kyowa Kirin's change from Ultragenyx-labeled products to Kyowa-Kirin-labeled products, as part of the transition of North America commercialization responsibilities.

Mepsevii product revenues were $5.6 million in the third quarter, down 47% from the year-ago quarter. Dojolvi product revenues were $16.6 million, up 25% from the year-ago quarter, driven by strong new patient demand. Evkeeza recorded sales of $0.96 million in the reported quarter.

Operating expenses decreased 23% to $243.1 million in the third quarter. Operating expenses for the reported quarter include research and development expenses of $157.2 million (down 34%) and selling, general and administrative expenses of $74.9 million (up 7%).

Cash, cash equivalents and marketable debt securities amounted to $524.2 million as of Sep 30, 2023 compared with $618.4 million as of Jun 30.

2023 Guidance Reaffirmed

Ultragenyx expects total revenues in 2023 between $425 million and $450 million. Crysvita revenues are expected in the range of $325-$340 million (including all regions where Ultragenyx will recognize revenues, including the royalties in Europe, which have been ongoing and the royalties in North America, which began in April 2023). Dojolvi revenues are expected between $65 million and $75 million.

Ultragenyx expects net cash used in operations to be around $425 million for the full year 2023.

Other Updates

Earlier, Ultragenyx and its partner, Mereo BioPharma MREO, announced positive data from the mid-stage portion of the ORBIT study of setrusumab for patients with OI.

Per Ultragenyx’s ongoing collaboration agreement with Mereo to co-develop UX143, RARE was tasked with leading the future global development of UX143 in both pediatric and adult patients with OI. Under this deal, Mereo received an upfront payment of $50 million from Ultragenyx. MREO also remains eligible to receive up to $254 million upon achieving certain regulatory and sales-based milestones.

In return, Mereo granted Ultragenyx an exclusive license to develop and commercialize setrusumab in the United States, Turkey and the rest of the world. However, MREO retained its commercial rights in the European Economic Area, the U.K. and Switzerland, also known as the Mereo Territory. Furthermore, RARE is responsible for bearing global development costs as well as making tiered royalty payments to Mereo based on net sales in its territory. Mereo is also liable to pay Ultrageyx a fixed royalty on net sales in the Mereo Territory.

Also, during the quarter, RARE began dosing the second dose-escalation cohort in its pivotal phase I/II/III Cyprus2+ study evaluating UX701 gene therapy to treat Wilson Disease. The dosing in the second cohort was initiated following a thorough review of findings from the first cohort.

The company expects to report initial data from Stage 1 of the Cyprus2+ study in the first half of 2024.

Ultragenyx Pharmaceutical Inc. Price and Consensus

Ultragenyx Pharmaceutical Inc. price-consensus-chart | Ultragenyx Pharmaceutical Inc. Quote

Zacks Rank & Stock to Consider

Ultragenyx currently has a Zacks Rank #3 (Hold).

A better-ranked stock in the same industry is Apellis Pharmaceuticals APLS, carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 30 days, the Zacks Consensus Estimate for Apellis’ 2023 loss per share has narrowed from $4.89 to $4.32. During the same time frame, the estimate for Apellis’ 2024 loss per share has narrowed from $2.77 to $2.15. Year to date, shares of APLS have lost 4.6%.

APLS beat estimates in two of the trailing four quarters, missing the mark on the other two occasions, delivering an average negative earnings surprise of 3.91%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regeneron Pharmaceuticals, Inc. (REGN) : Free Stock Analysis Report

Ultragenyx Pharmaceutical Inc. (RARE) : Free Stock Analysis Report

Apellis Pharmaceuticals, Inc. (APLS) : Free Stock Analysis Report

MEREO BIOPHARMA (MREO) : Free Stock Analysis Report