Uncertainty Ahead for General Mills Despite Healthy 2nd-Quarter Margins

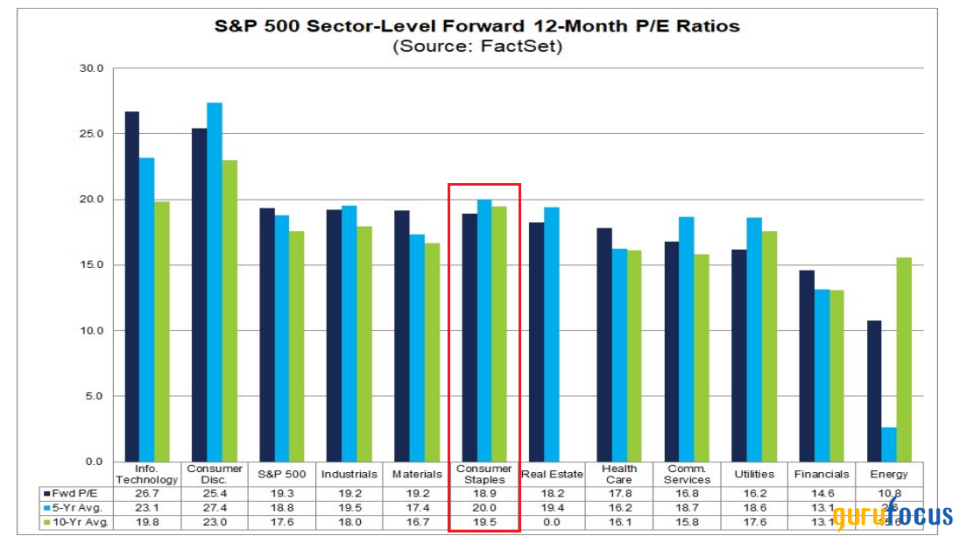

Consumer staples stocks have struggled on a relative basis during the recent broad stock market advance off the October low. Along with utilities and health care, two other defensive value sectors, staples has endured selling pressure as other risk-on, beaten-up niches of the market have sprung back to life. The group's valuation is now below its long-term average price-earnings ratio, according to FactSet.

One household name flashes mixed fundamental and technical signals, however. General Mills Inc.(NYSE:GIS) has a favorable valuation and solid dividend yield, but its momentum is in the bearish camp. If shares can stabilize and the company can thwart competitive and macro risks in 2024, the stock could be a compelling value.

S&P 500 Sector Valuations: Consumer Staples Turns Cheaper in 2023

Source: FactSet

Company description

According to Bank of America Global Research, General Mills is the world's ninth-largest packaged food producer and marketing company. Domestically, it is in the top five. With 13 divisions in more than 20 food categories, supplying products to a range of retailers and consumer outlets, including food distribution facilities, restaurants, bakeries and vending machines, the company generates about $20 billion annually with more than $3 billion in yearly operating profits. It operates through four segments: North America Retail, International, Pet and North America Foodservice.

Key data

With a $37.4 billion market cap, the Minnesota-based packaged foods and meats industry company within the consumer staples sector trades at a low 14.3 forward non-GAAP price-earnings ratio and pays a high 3.7% dividend yield. With second-quarter 2024 earnings now in the rearview mirror, shares trade with a modest 20% implied volatility percentage, and short interest on the stock is low but material at 2.4% as of Dec. 20.

Color on the quarter

Earlier this month, General Mills reported a mixed quarter. Second-quarter non-GAAP earnings of $1.25 per share came in ahead of the $1.16 Wall Street consensus forecast, but $5.1 billion of revenue, a 2% decline from the same period a year ago, missed by a significant $260 million. Volume recovery was weaker than expected, and the company sees consumers continuing to opt for more at-home dining amid moderating input cost inflation. Some share losses were reported across some of its North America Retail areas, though margins were encouraging. Organic net sales are now forecast to be near flat for 2024, and I am concerned that analysts' downgrades could be on the way. Still, free cash flow conversion is projected to be at 95% of adjusted after-tax earnings.

Second-quarter and year-to-date fiscal 2024 performance

Source: General Mills IR

On the call, the tone was upbeat. The management team highlighted margin improvement in the North America Retail segment due to strong holistic margin management, delivery and stabilization of the supply chain environment, though analysts called out the company on current overall volumes. Key risks were detailed, including in categories like wet pet food and the Wilderness brand as the pet boom of the pandemic wears off. Interestingly, General Mills mentioned the possibility of acquisitions to increase shareholder returns that is a possibility given its stable free cash flow.

Risks

Key risks include a continued trade-down effect by consumers to lower-margin brands and private labels, higher commodity and cost inflation, weaker pet food sales and macro weakness across foreign markets.

Valuation

On valuation, analysts at Bank of America see earnings rising at near the rate of inflation in 2024, and per-share profits are then expected to possibly slow further in 2025 before earnings growth rebounds by 2026. The current consensus outlook suggests steady earnings advances over the out years, in the 4% to 5% range, while top-line growth is forecasted to be exceptionally low, in the low single digits percentage range. Thus, operating leverage and efficiency will be key for General Mills' management team.

Dividends, meanwhile, are expected to continue to rise over the coming quarters, potentially leading to a rising dividend yield. At 3.7% using forward numbers, the yield is close to a three-year high. Moreover, General Mills generates a significant amount of free cash flow, helping to support the dividend and share repurchases (the company's 2024 target for buybacks is to reduce the share count by 3%).

If we assume normalized operating earning of $4.50 per share and apply the company's five-year average earnings multiple of 17, the shares should trade near $77. Of course, the unimpressive growth trajectory and higher interest rates today could be significant headwinds. Thus, if we assume a cheaper price-earnings ratio, perhaps 15, then the stock should be near $68. Still, a 6.1% current free cash flow yield is rather appealing.

General Mills: Earnings, valuation, dividend yield and free cash flow forecasts

Source: Bank of America Global Research

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed third-quarter 2024 earnings date of Thursday, March 21. Shares trade ex. a 59 cents quarterly dividend on Tuesday, Jan. 9. No other volatility catalysts are seen on the calendar.

Corporate Event Risk Calendar

The technical take

With shares modestly undervalued and a solid dividend yield, the momentum situation is not the best you will find in today's market. Notice in the chart below that shares broke down below a key support level in the mid-$70s back in the third quarter. With a high of $91 notched earlier this year, the measured move price objective on the pattern is about $58. What's more, the current look is that of a bear flag, given the modest rally off the $60.33 low hit in early October. While a series of higher highs and higher lows is encouraging, the move appears to be merely a consolidation, or corrective snapback, in the broader trend lower that began mid-year. Thus, I am concerned that the 34% bear market may not be over.

Also take a look at the falling 200-day moving average. The long-term trend indicator has turned decidedly negative in its slope, suggesting the bears are in charge. The 200-day moving average also has confluence with the $74 breakdown level. It is not all bearish, however. I see a significant amount of shares traded in the $57 to $70 range, which should offer significant support given the stock is currently near $64. Another feather in the bulls' cap is that the relative strength index momentum oscillator at the bottom of the chart printed a bullish divergence a situation in which RSI hit its low before price did.

Overall, there is ample support in the upper $50s and low $60s with General Mills, but the current chart pattern and broader trend are concerning if you are a bull. Keep your eye on overhead resistance near $75.

Key resistance near $75

The bottom line

General Mills is a mixed bag from an investment perspective. I like the valuation and dividend yield, but near-term growth prospects are troubled and the technical situation is concerning.

This article first appeared on GuruFocus.